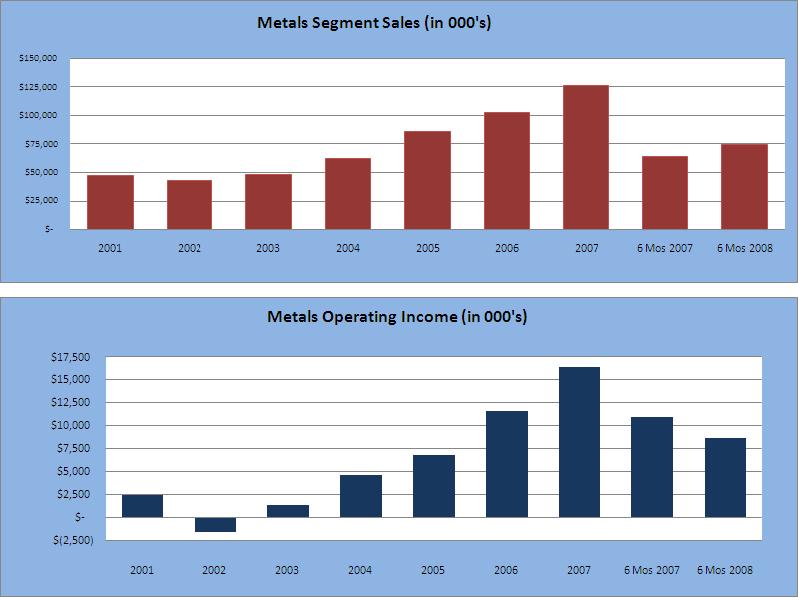

METALS

SEGMENT – BRISTOL METALS

LARGEST

DOMESTIC PRODUCER OF STAINLESS STEEL PIPE

PROVIDER

OF TOTAL PIPING SOLUTIONS FOR GLOBAL INFRASTRUCTURE

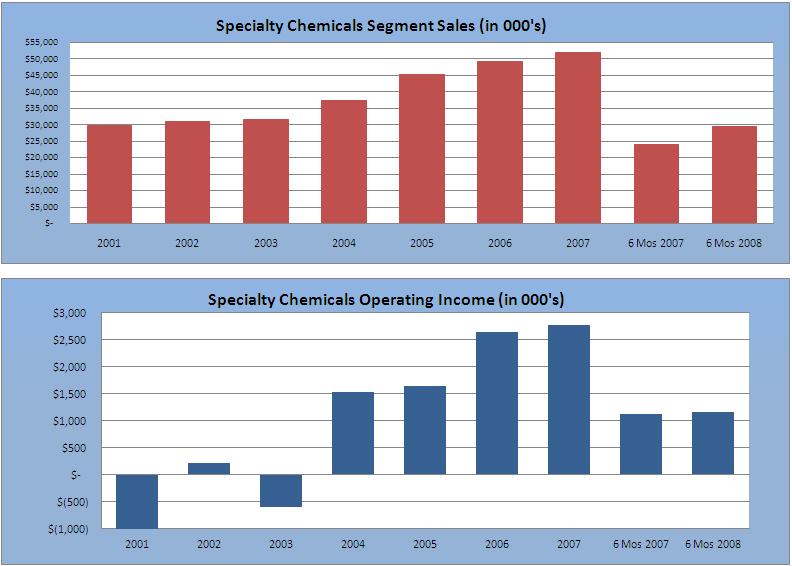

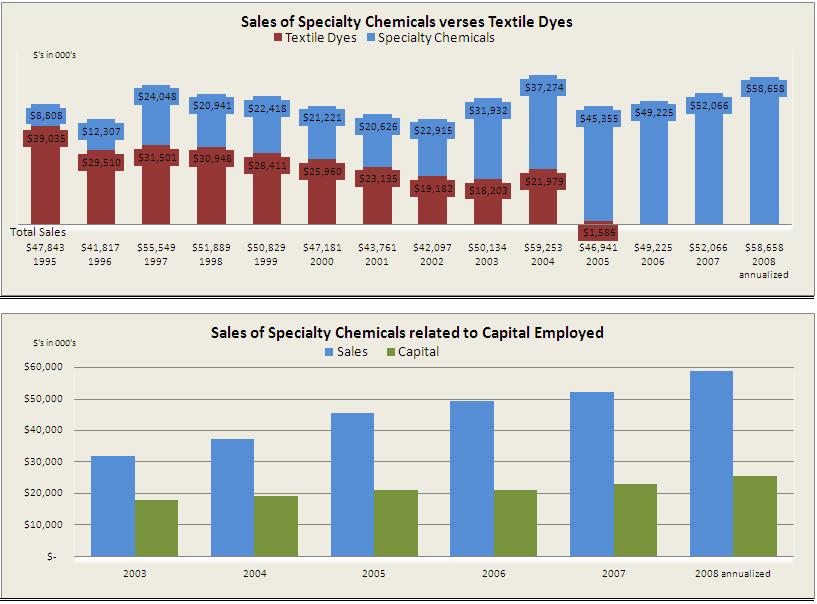

SPECIALTY

CHEMICALS SEGMENT

TRANSITIONED

FROM TEXTILE DYES INTO A HIGH QUALITY PROVIDER OF SPECIALTY CHEMICALS TO

DOMESTIC AND OVERSEAS CUSTOMERS

BRISTOL

METALS

UNIQUE

CHARACTERISTICS OF BRISTOL METALS:

Largest domestic manufacturer of welded

stainless steel pipe

Producer

of all size ranges from ½ inch to 120 inches in diameter, up to 16 inches

utilizing continuous mills, in wall thicknesses of up to 1 ½ inch and in lengths

up to 60 feet

Producer

of all types of austenitic stainless steel and high-nickel alloys with

capabilities that include real time x-ray and hydro-testing

Plant

expansions completed in 2006 and 2007, allow the manufacture of pipe up to 42

inches in diameter utilizing more readily available raw materials at lower

costs, provide improved product handling and additional space for planned

equipment additions.

Piping

systems operation that processes a significant amount of our pipe production

into piping systems that conform to engineered drawings furnished by

customers

Low-cost producer

including purchase of stainless steel

Strategically

located domestically within primary markets utilizing stainless steel

pipe

Management

team that has demonstrated the ability to identify and penetrate new markets,

such as power generation and waste water treatment, for its products

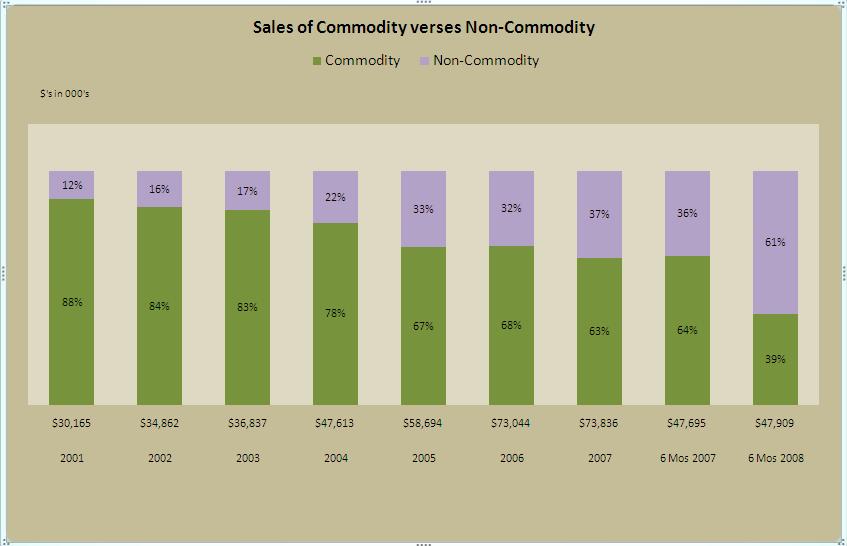

transitioning from a commodity business into a specialty pipe

operation

COMMODITY

PIPE OPERATION

CUSTOMER

BASE

Bristol

Metals sells its commodity pipe primarily through distribution including all of

the major PVF distributor houses:

McJunkin

Redman, Southwest Stainless (HD Supply), Ferguson Enterprises, Warren Alloys,

Robert James Sales, Wilson Supply, Global Stainless

COMMODITY

PRICING

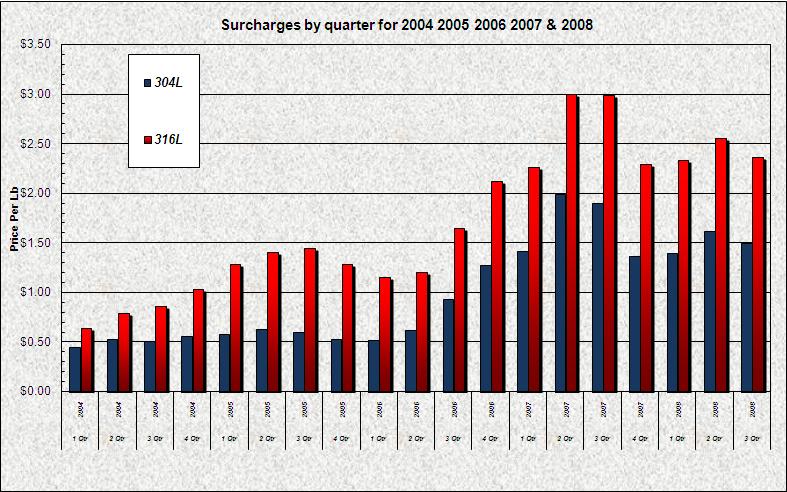

Commodity

prices are significantly influenced by surcharges paid to the steel mills based

primarily on nickel (304 & 316) and molybdenum (316), and to a lesser extent

on chromium. These surcharges, which make up as much as ½ of the selling prices

are routinely passed on to the customer (See attached graph on

surcharges)

Surcharges

are quoted 2 months out and are calculated based on the average of the current

month’s surcharges paid by the steel mills to their suppliers. They are included

as part of the raw material cost based on the date the material is received, and

charged to the customer based on the date the pipe is shipped. Under FIFO

inventory costing, increases in surcharges generally have a positive impact on

profitability while decreases have a negative impact

COMPETITION

There are

3 primary domestic competitors – Outokumpu (Wildwood, FL), Marcegaglia (Munhall,

PA) and Felker Bros (Marshfield, WI) capable of producing most size ranges, and

several smaller domestic producers with limited capabilities.

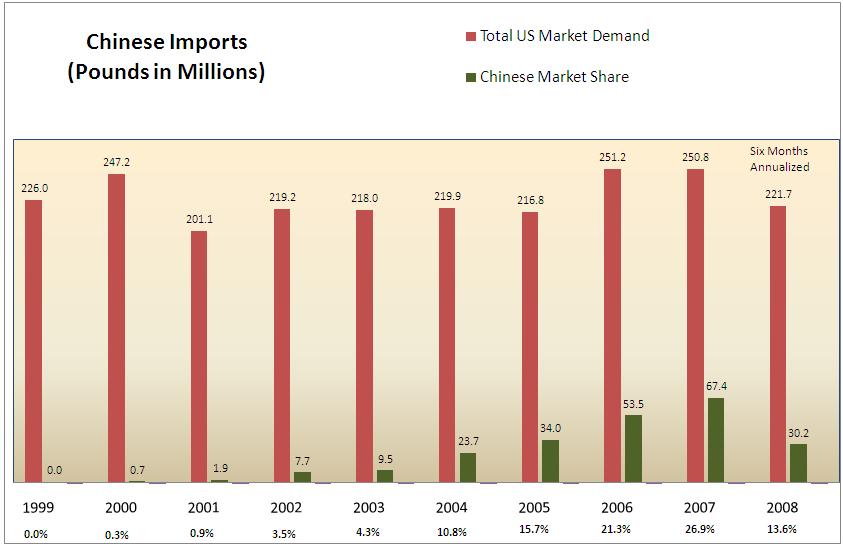

Foreign

imports, primarily Chinese, are significant especially in smaller diameters up

to 8 inches (See attached graph)

A

successful trade case filed in the 1st quarter

of 2008 against Chinese imports appeared to curtail the import growth in 2008.

On August 28, 2008, the Dept. of Commerce announced the preliminary

determination of countervailing and anti-dumping duties ranging from 22% to 128%

on imported stainless steel welded pipe smaller than 16 inch from China which

should continue to positively impact the domestic pipe market over the next

several years

SUPPLIERS

Stainless

steel coils and sheet are purchased primarily from domestic mills such as

Allegheny Ludlum (Allegheny Technologies, sym: ATI), North American Stainless

(Acerinox Group, sym: ACX.MC), and AK Steel (sym: AK), and foreign suppliers in

Europe and Asia such as Arcelor Mittal (sym: MT)

NON-COMMODITY

PIPE OPERATIONS

BUSINESS

DESCRIPTION

Includes

sales of large diameter (18 inch and larger) 304L and 316L pipe, sales of other

alloy pipe, and fabrication of piping systems

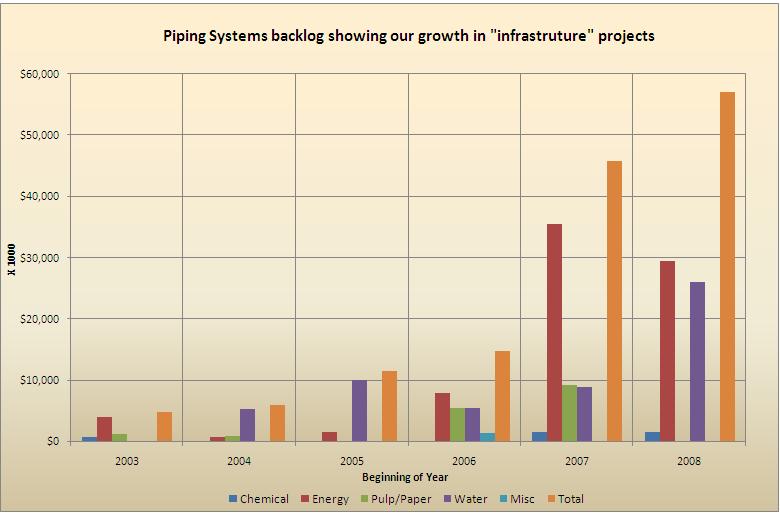

Piping

Systems has transitioned from primarily the pulp and paper and chemical

industries to a focus on infrastructure projects in industries such as liquid

natural gas (LNG), power generation, waste water treatment and water treatment

(See attached backlog graph)

Non-commodity

pipe is sold to order allowing us to lock in material costs minimizing the

surcharge impact

We are

only 1 of 2 domestic producers that makes pipe and further processes it into

piping systems

CUSTOMER

BASE

Piping

Systems has a strong on-going relationship with all of the major engineering,

procurement and construction companies, including: BE&K, Bechtel,

Chicago Bridge & Iron, Fluor, and AMEC

Our

strong customer relationships allow us to participate in current project

activities of our customers most of which currently have historically high

backlogs

Project

business gives us 2 opportunities to book business for each project – 1) to

fabricate the piping systems from our pipe, and 2), if unable to obtain the

award for the fabrication, to supply the loose pipe requirements of the

project

COMPETITION

Domestic

fabrication competitors include Shaw Group (Baton Rouge, LA), Turner IPS (Baton

Rouge, LA), and Team Industries, Inc. (Appleton, WI)

Foreign competitors include Butting

(Germany), Rivit Inoxtech (Italy), and EEW (Germany)

FUTURE

OPPORTUNITIES FOR NON-COMMODITY PIPE IN THE “INFRASTRUCTURE” MARKET

AREAS

LIQUID

NATURAL GAS -

7 new US

LNG Regas terminals proposed to FERC

12 new US

LNG Regas terminals approved by FERC but not yet under construction

3 new

Canadian Regas terminals approved but not yet under construction

1 new

Mexican Regas terminal approved but not yet under construction

4-5 new

Liquefaction projects will proceed in the next 1-3 years in the Middle East,

Asia and Australia

2

Projects proceeding in South America

COAL FIRE

PROJECTS – 4 new coal fire projects by 2011

SCRUBBER

INSTALLATIONS – more than 260 scrubber units to be installed in the United

States

WATER & WASTE WATER

TREATMENT - We are currently tracking 13 WWTP projects with an estimated

bid range of $5-$10MM each

DESALINATION

- - We have participated in the domestic desalination business in the past 3 years

and continue to track potential projects in North America. In

addition, we see a real potential from the large scale facilities planned for

the Middle East

ETHANOL -

While ethanol is slowing, there are still 538 projects in the planned or

approved status.

NUCLEAR –

Although 7 to 10 years away, we have the necessary qualifications, such as an

N-Stamp, and A&E and contractor contacts to participate in this market

successfully

THE

SYNALLOY CHEMICALS GROUP

BUSINESS

DESCRIPTION AND STRATEGIES

The

Synalloy Chemicals Group consists of 3 operations in 2 locations: Manufacturers’

Chemicals (MC) located in Cleveland, TN, and Blackman Uhler Chemicals (BU) and

Organic Pigments (OP) located in Spartanburg, SC.

The Group

produces specialty chemicals, pigments and dyes for the carpet, chemical, paper,

metals, mining, photographic, pharmaceutical, agriculture, fiber, paint,

textile, automotive, petroleum, cosmetics, mattress, furniture, janitorial, and

other industries

Focus on

industries and markets that have good prospects for sustainability in the U.S.

in light of global trends

Rely on

sales to end users through our own sales force, but also sell chemical

intermediates to other chemical companies and distributors

Utilize

close working relationships with a significant number of major chemical

companies that outsource their production for regional manufacture and

distribution to specialty chemical companies of our size to provide contract

production and toll manufacturing

Capitalize

on process & equipment to fully utilize capacity

Broaden

end use markets & sell across company lines by:

Focusing

on fast customer response opportunities

Focusing

on right first time, product consistency and on-time delivery, monitoring

through continuous tracking

Use

renewable feed-stocks wherever possible

Utilize

milling technology to produce chemical dispersions of fine particle

size

Expand

exports through growth of business with strategic partners aimed at paper and

agriculture industries

SALES

TARGETS

To End

Users through Sales Force

Reaction

Intermediates to other Chemical Companies

Contract

or Toll Manufacturing for Large Producers & Marketing Based

Companies

MARKETS

Paper

& Pulp

Water

Treatment The

markets in this group are also served by Bristol Metals

Oil

Refining

Chemical

Intermediates

Mining

Agriculture

Construction

Materials

Latex

& Rubber Products

Textile

& Carpet

Plastics

Automotive

Coatings

Cosmetics

Surgical

Devices

Leather

Metal

Working

Wire

Coating

Mattress

& Upholstery

Graphic

Arts & Ink

Paint

PROCESSES

AND CAPACITIES

|

Manufacturers

Chemicals

|

Blackman

Uhler

|

Organic

Pigments

|

|||||

|

Esterification

|

Hydrogenation

|

Aqueous

Pigment Dispersion

|

|||||

|

Amidation

|

Epoxidation

|

Aqueous

Chemical Dispersion

|

|||||

|

Condensation

|

Methylation

|

Dispersions

in Oils

|

|||||

|

Imidazolines

|

Carboxylation

|

||||||

|

Phosphation

|

Nitration

|

||||||

|

Sulfation

|

Polymerization

|

||||||

|

Quaternization

|

|||||||

|

Hydrophobization

|

Milling

|

||||||

|

Dye

Blending

|

Spray

Drying

|

||||||

|

Homogenization

|

Kosher

Certification

|

||||||

|

Blending

|

ISO

Certification

|

||||||

|

ISO

Certification

|

(in addition to all

items done at MC)

|

||||||