DanChem Technologies, Inc. Financial Report December 31, 2020 Exhibit 99.1

Contents Independent auditor’s report 1 Financial statements Balance sheet 2 Statement of income 3 Statement of changes in stockholders’ equity 4 Statement of cash flows 5 Notes to financial statements 6-12

1 Independent Auditor’s Report Board of Directors DanChem Technologies, Inc. Report on the Financial Statements We have audited the accompanying financial statements of DanChem Technologies, Inc. (the Company), which comprise the balance sheet as of December 31, 2020, the related statements of income, changes in stockholders’ equity and cash flows for the year then ended, and the related notes to the financial statements. Management’s Responsibility for the Financial Statements Management is responsible for the preparation and fair presentation of these financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error. Auditor’s Responsibility Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Opinion In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of DanChem Technologies, Inc. as of December 31, 2020, and the results of its operations and its cash flows for the year then ended in accordance with accounting principles generally accepted in the United States of America. /s/ RSM US LLP Greensboro, North Carolina March 19, 2021

2 DanChem Technologies, Inc. Balance Sheet December 31, 2020 Assets Current assets: Cash 1,504 $ Trade accounts receivable, less allowance for doubtful accounts $314,471 5,730,563 Inventories 1,170,971 Prepaid expenses 346,860 Total current assets 7,249,898 Other assets 138,000 Property and equipment, net 11,467,994 Total assets 18,855,892 $ Liabilities and Stockholders’ Equity Current liabilities: Checks issued in excess of bank balance 489,699 $ Current portion of long-term debt 6,303,524 Accounts payable 1,952,544 Accrued expenses 1,303,010 Total current liabilities 10,048,777 Long-term debt, less current portion 1,316,667 Deferred income taxes 205,792 11,571,236 Stockholders’ equity: Common stock, par value $0.01 per share; authorized, issued 30 and outstanding 3,000 shares Additional paid-in capital 6,797,589 Retained earnings 487,037 Total stockholders’ equity 7,284,656 18,855,892 $ See notes to financial statements

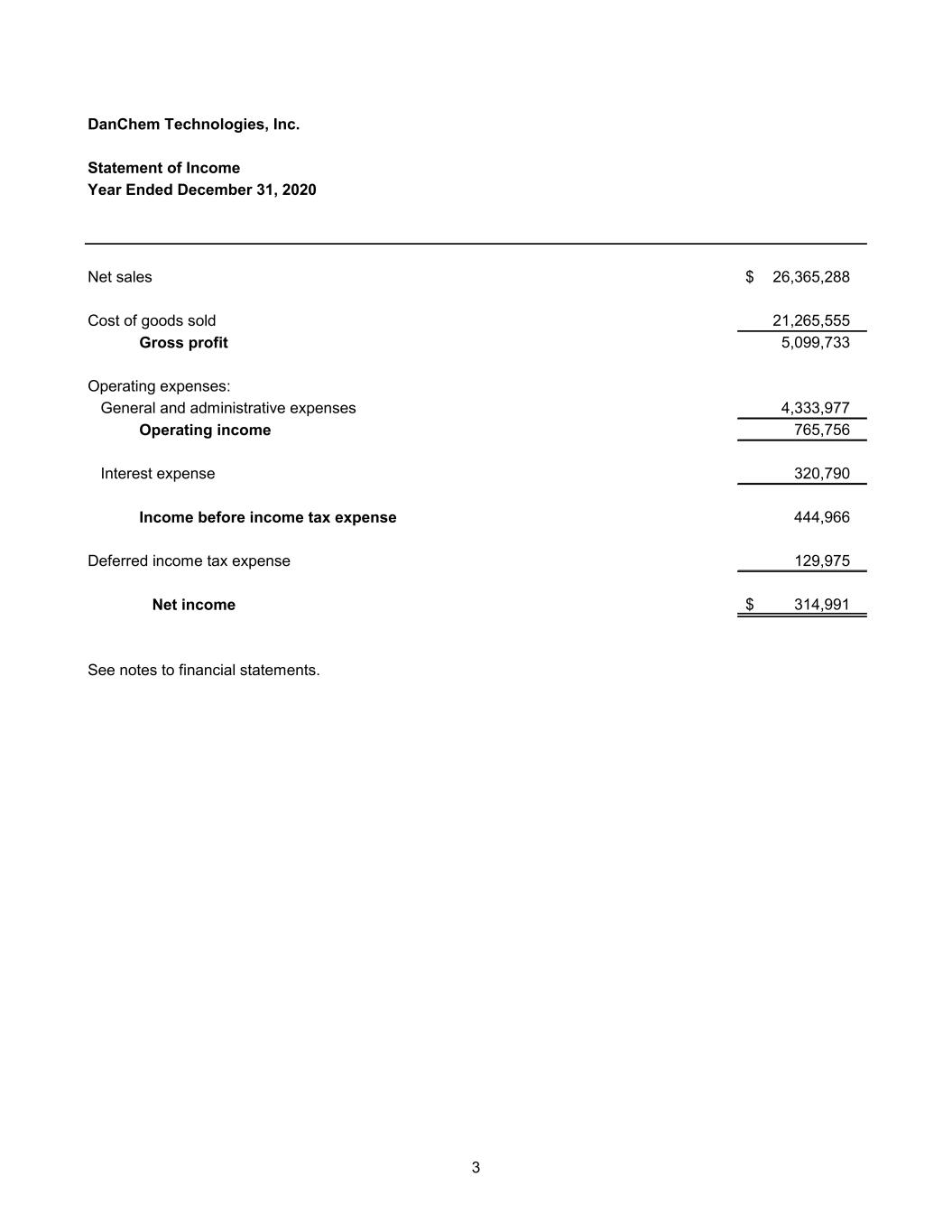

3 DanChem Technologies, Inc. Statement of Income Year Ended December 31, 2020 Net sales 26,365,288 $ Cost of goods sold 21,265,555 Gross profit 5,099,733 Operating expenses: General and administrative expenses 4,333,977 Operating income 765,756 Interest expense 320,790 Income before income tax expense 444,966 Deferred income tax expense 129,975 Net income 314,991 $ See notes to financial statements.

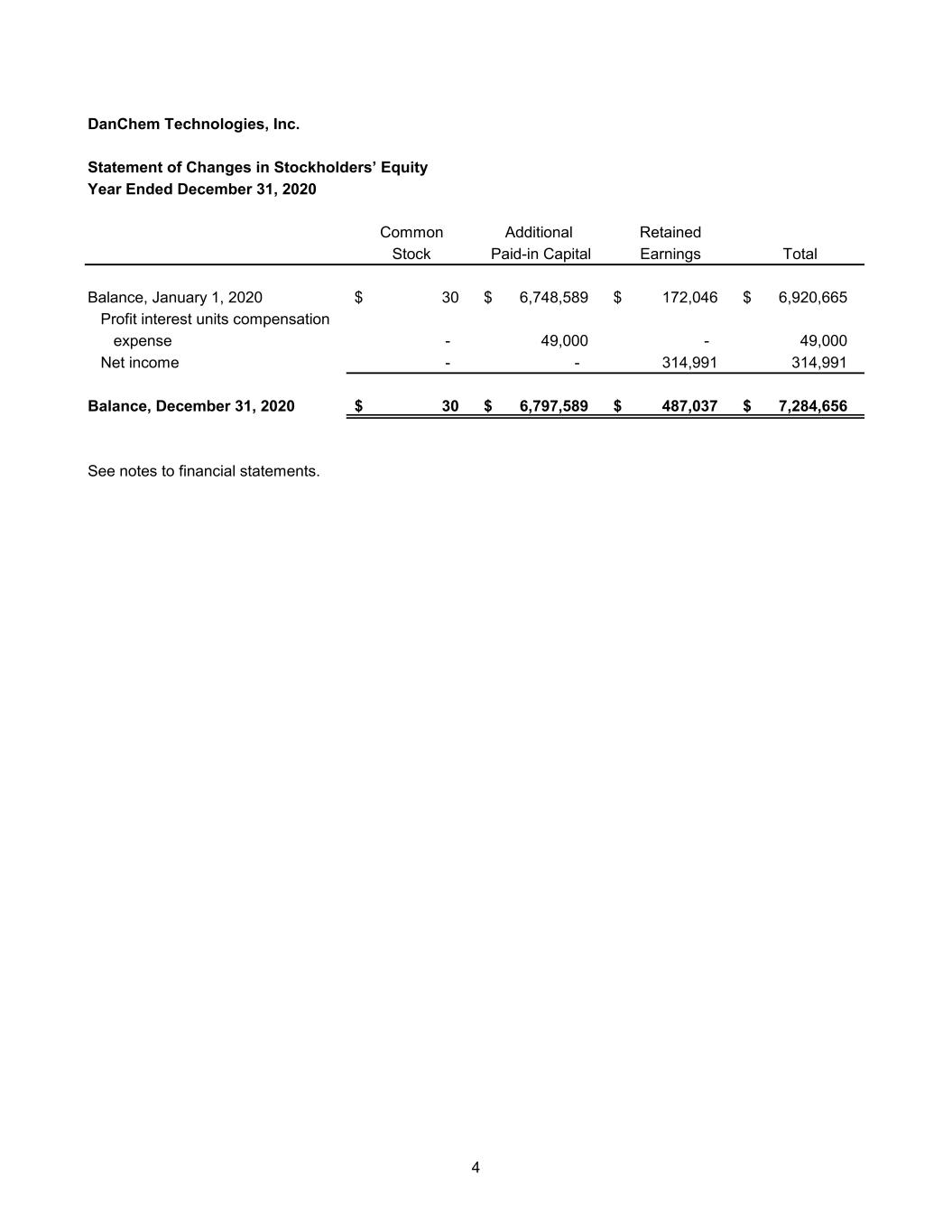

4 DanChem Technologies, Inc. Statement of Changes in Stockholders’ Equity Year Ended December 31, 2020 Common Additional Retained Stock Paid-in Capital Earnings Total Balance, January 1, 2020 30 $ 6,748,589 $ 172,046 $ 6,920,665 $ Profit interest units compensation expense - 49,000 - 49,000 Net income - - 314,991 314,991 Balance, December 31, 2020 30 $ 6,797,589 $ 487,037 $ 7,284,656 $ See notes to financial statements.

5 DanChem Technologies, Inc. Statement of Cash Flows Year Ended December 31, 2020 Cash flows from operating activities: Net income 314,991 $ Adjustments to reconcile net income to net cash provided by operating activities: Depreciation expense 2,369,797 Deferred income tax expense 129,975 Profit interest units compensation expense 49,000 Changes in assets and liabilities: (Increase) in: Trade accounts receivable (1,557,790) Inventories (45,532) Prepaid expenses (66,210) Increase (decrease) in: Accounts payable (584,585) Accrued expenses 573,622 Net cash provided by operating activities 1,183,268 Cash flows used in investing activities: Purchase of property and equipment (615,074) Cash flows from financing activities: Decrease in checks issued in excess of bank balance (130,230) Net proceeds from revolver line of credit (1,672,388) Proceeds from loan 1,975,000 Principal payments of long-term debt (739,752) Net cash used in financing activities (567,370) Net increase in cash and cash equivalents 824 Cash and cash equivalents: Beginning 680 Ending 1,504 $ Supplemental disclosure of cash flow information: Cash payments for Interest 320,790 $ Supplemental disclosure of noncash investing and financing activities: Incurrence of accounts payable for equipment purchases 315,518 $ See notes to financial statements.

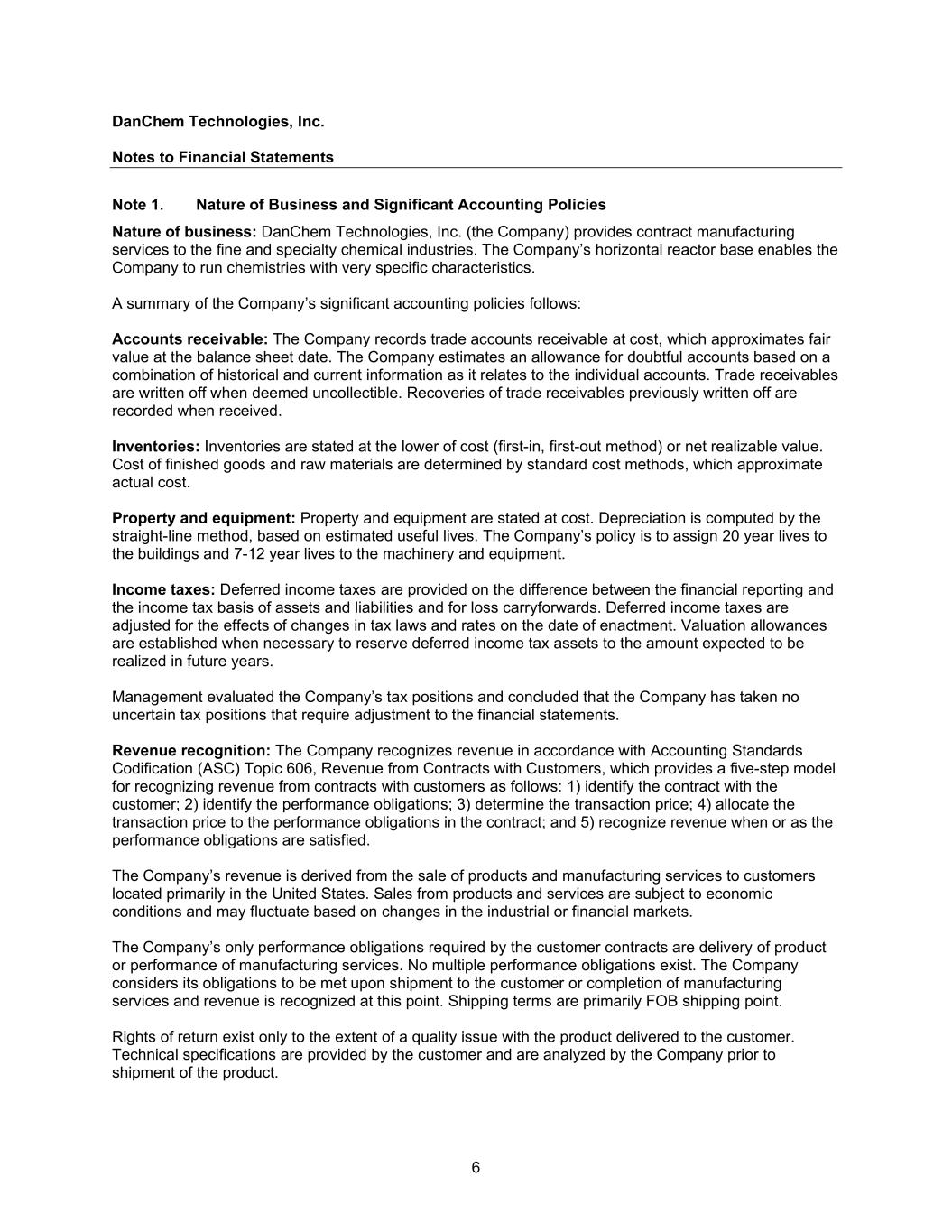

DanChem Technologies, Inc. Notes to Financial Statements 6 Note 1. Nature of Business and Significant Accounting Policies Nature of business: DanChem Technologies, Inc. (the Company) provides contract manufacturing services to the fine and specialty chemical industries. The Company’s horizontal reactor base enables the Company to run chemistries with very specific characteristics. A summary of the Company’s significant accounting policies follows: Accounts receivable: The Company records trade accounts receivable at cost, which approximates fair value at the balance sheet date. The Company estimates an allowance for doubtful accounts based on a combination of historical and current information as it relates to the individual accounts. Trade receivables are written off when deemed uncollectible. Recoveries of trade receivables previously written off are recorded when received. Inventories: Inventories are stated at the lower of cost (first-in, first-out method) or net realizable value. Cost of finished goods and raw materials are determined by standard cost methods, which approximate actual cost. Property and equipment: Property and equipment are stated at cost. Depreciation is computed by the straight-line method, based on estimated useful lives. The Company’s policy is to assign 20 year lives to the buildings and 7-12 year lives to the machinery and equipment. Income taxes: Deferred income taxes are provided on the difference between the financial reporting and the income tax basis of assets and liabilities and for loss carryforwards. Deferred income taxes are adjusted for the effects of changes in tax laws and rates on the date of enactment. Valuation allowances are established when necessary to reserve deferred income tax assets to the amount expected to be realized in future years. Management evaluated the Company’s tax positions and concluded that the Company has taken no uncertain tax positions that require adjustment to the financial statements. Revenue recognition: The Company recognizes revenue in accordance with Accounting Standards Codification (ASC) Topic 606, Revenue from Contracts with Customers, which provides a five-step model for recognizing revenue from contracts with customers as follows: 1) identify the contract with the customer; 2) identify the performance obligations; 3) determine the transaction price; 4) allocate the transaction price to the performance obligations in the contract; and 5) recognize revenue when or as the performance obligations are satisfied. The Company’s revenue is derived from the sale of products and manufacturing services to customers located primarily in the United States. Sales from products and services are subject to economic conditions and may fluctuate based on changes in the industrial or financial markets. The Company’s only performance obligations required by the customer contracts are delivery of product or performance of manufacturing services. No multiple performance obligations exist. The Company considers its obligations to be met upon shipment to the customer or completion of manufacturing services and revenue is recognized at this point. Shipping terms are primarily FOB shipping point. Rights of return exist only to the extent of a quality issue with the product delivered to the customer. Technical specifications are provided by the customer and are analyzed by the Company prior to shipment of the product.

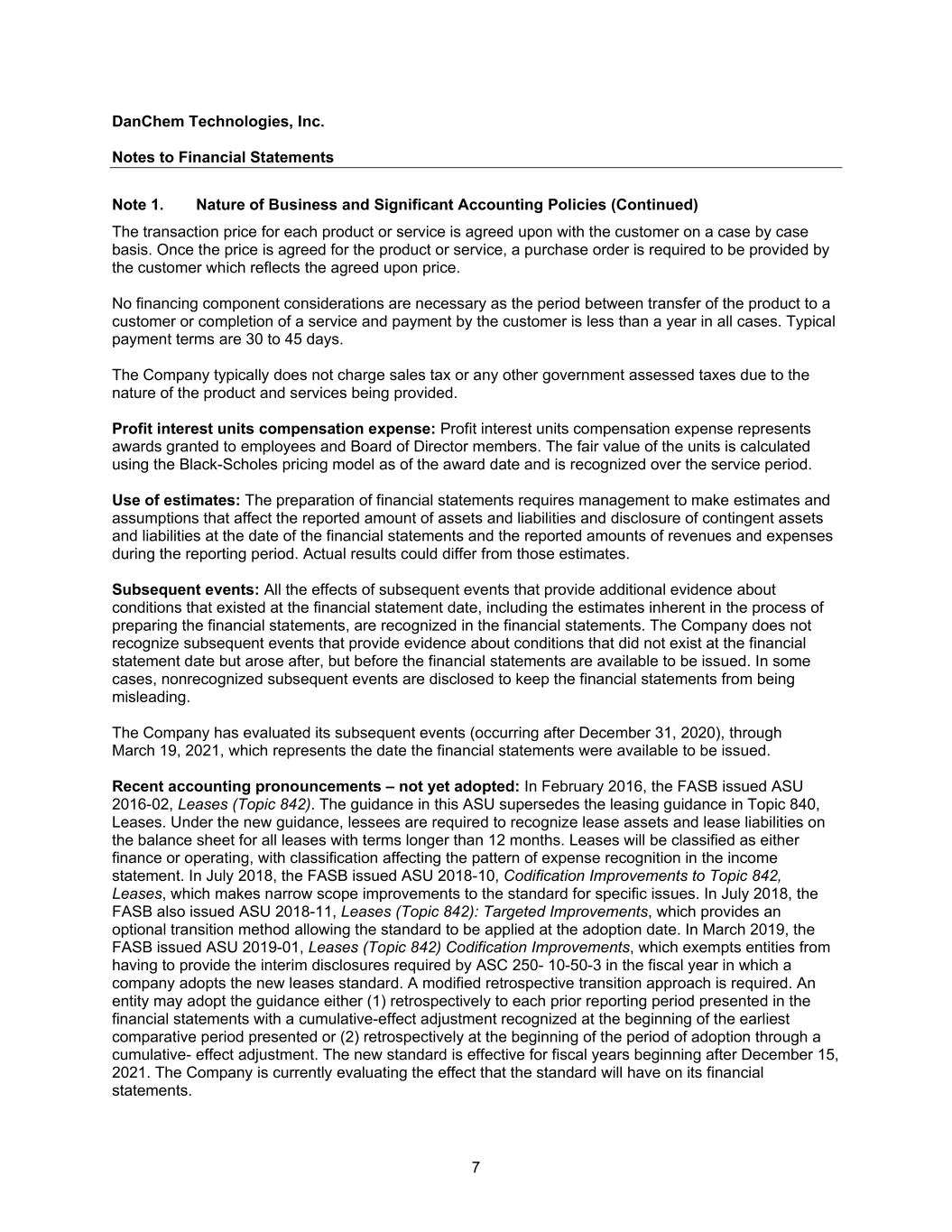

DanChem Technologies, Inc. Notes to Financial Statements 7 Note 1. Nature of Business and Significant Accounting Policies (Continued) The transaction price for each product or service is agreed upon with the customer on a case by case basis. Once the price is agreed for the product or service, a purchase order is required to be provided by the customer which reflects the agreed upon price. No financing component considerations are necessary as the period between transfer of the product to a customer or completion of a service and payment by the customer is less than a year in all cases. Typical payment terms are 30 to 45 days. The Company typically does not charge sales tax or any other government assessed taxes due to the nature of the product and services being provided. Profit interest units compensation expense: Profit interest units compensation expense represents awards granted to employees and Board of Director members. The fair value of the units is calculated using the Black-Scholes pricing model as of the award date and is recognized over the service period. Use of estimates: The preparation of financial statements requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Subsequent events: All the effects of subsequent events that provide additional evidence about conditions that existed at the financial statement date, including the estimates inherent in the process of preparing the financial statements, are recognized in the financial statements. The Company does not recognize subsequent events that provide evidence about conditions that did not exist at the financial statement date but arose after, but before the financial statements are available to be issued. In some cases, nonrecognized subsequent events are disclosed to keep the financial statements from being misleading. The Company has evaluated its subsequent events (occurring after December 31, 2020), through March 19, 2021, which represents the date the financial statements were available to be issued. Recent accounting pronouncements – not yet adopted: In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842). The guidance in this ASU supersedes the leasing guidance in Topic 840, Leases. Under the new guidance, lessees are required to recognize lease assets and lease liabilities on the balance sheet for all leases with terms longer than 12 months. Leases will be classified as either finance or operating, with classification affecting the pattern of expense recognition in the income statement. In July 2018, the FASB issued ASU 2018-10, Codification Improvements to Topic 842, Leases, which makes narrow scope improvements to the standard for specific issues. In July 2018, the FASB also issued ASU 2018-11, Leases (Topic 842): Targeted Improvements, which provides an optional transition method allowing the standard to be applied at the adoption date. In March 2019, the FASB issued ASU 2019-01, Leases (Topic 842) Codification Improvements, which exempts entities from having to provide the interim disclosures required by ASC 250- 10-50-3 in the fiscal year in which a company adopts the new leases standard. A modified retrospective transition approach is required. An entity may adopt the guidance either (1) retrospectively to each prior reporting period presented in the financial statements with a cumulative-effect adjustment recognized at the beginning of the earliest comparative period presented or (2) retrospectively at the beginning of the period of adoption through a cumulative- effect adjustment. The new standard is effective for fiscal years beginning after December 15, 2021. The Company is currently evaluating the effect that the standard will have on its financial statements.

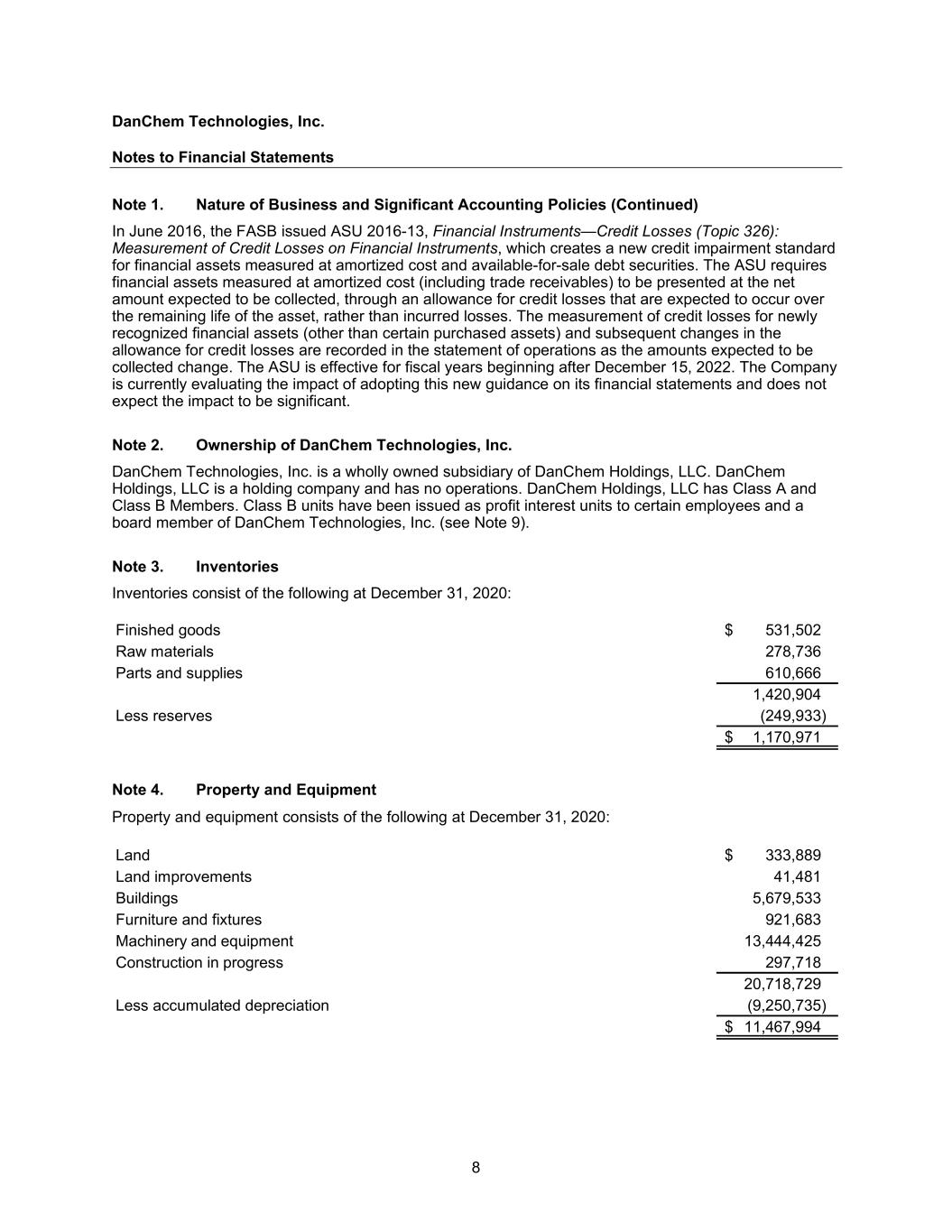

DanChem Technologies, Inc. Notes to Financial Statements 8 Note 1. Nature of Business and Significant Accounting Policies (Continued) In June 2016, the FASB issued ASU 2016-13, Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments, which creates a new credit impairment standard for financial assets measured at amortized cost and available-for-sale debt securities. The ASU requires financial assets measured at amortized cost (including trade receivables) to be presented at the net amount expected to be collected, through an allowance for credit losses that are expected to occur over the remaining life of the asset, rather than incurred losses. The measurement of credit losses for newly recognized financial assets (other than certain purchased assets) and subsequent changes in the allowance for credit losses are recorded in the statement of operations as the amounts expected to be collected change. The ASU is effective for fiscal years beginning after December 15, 2022. The Company is currently evaluating the impact of adopting this new guidance on its financial statements and does not expect the impact to be significant. Note 2. Ownership of DanChem Technologies, Inc. DanChem Technologies, Inc. is a wholly owned subsidiary of DanChem Holdings, LLC. DanChem Holdings, LLC is a holding company and has no operations. DanChem Holdings, LLC has Class A and Class B Members. Class B units have been issued as profit interest units to certain employees and a board member of DanChem Technologies, Inc. (see Note 9). Note 3. Inventories Inventories consist of the following at December 31, 2020: Finished goods 531,502 $ Raw materials 278,736 Parts and supplies 610,666 1,420,904 Less reserves (249,933) 1,170,971 $ Note 4. Property and Equipment Property and equipment consists of the following at December 31, 2020: Land 333,889 $ Land improvements 41,481 Buildings 5,679,533 Furniture and fixtures 921,683 Machinery and equipment 13,444,425 Construction in progress 297,718 20,718,729 Less accumulated depreciation (9,250,735) 11,467,994 $

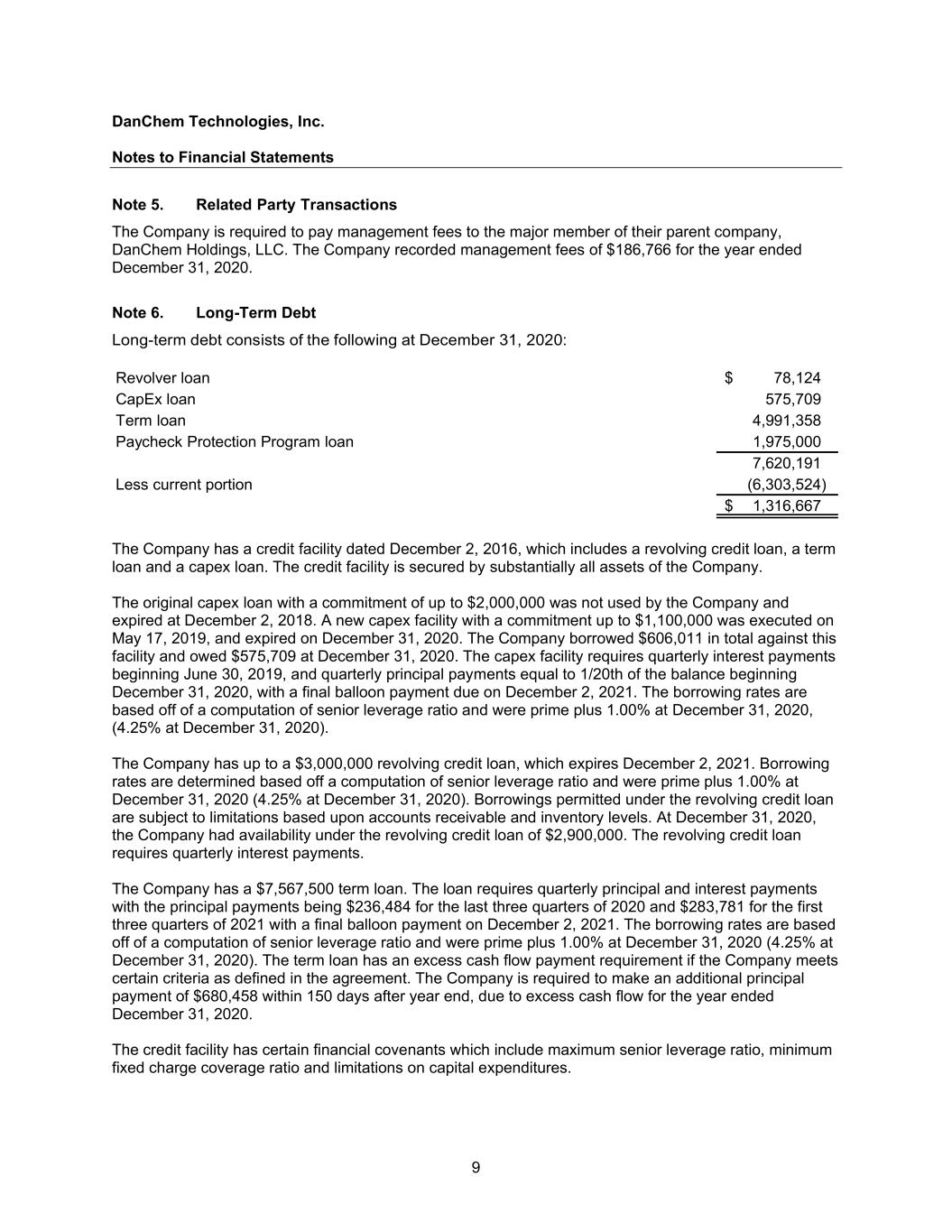

DanChem Technologies, Inc. Notes to Financial Statements 9 Note 5. Related Party Transactions The Company is required to pay management fees to the major member of their parent company, DanChem Holdings, LLC. The Company recorded management fees of $186,766 for the year ended December 31, 2020. Note 6. Long-Term Debt Long-term debt consists of the following at December 31, 2020: Revolver loan 78,124 $ CapEx loan 575,709 Term loan 4,991,358 Paycheck Protection Program loan 1,975,000 7,620,191 Less current portion (6,303,524) 1,316,667 $ The Company has a credit facility dated December 2, 2016, which includes a revolving credit loan, a term loan and a capex loan. The credit facility is secured by substantially all assets of the Company. The original capex loan with a commitment of up to $2,000,000 was not used by the Company and expired at December 2, 2018. A new capex facility with a commitment up to $1,100,000 was executed on May 17, 2019, and expired on December 31, 2020. The Company borrowed $606,011 in total against this facility and owed $575,709 at December 31, 2020. The capex facility requires quarterly interest payments beginning June 30, 2019, and quarterly principal payments equal to 1/20th of the balance beginning December 31, 2020, with a final balloon payment due on December 2, 2021. The borrowing rates are based off of a computation of senior leverage ratio and were prime plus 1.00% at December 31, 2020, (4.25% at December 31, 2020). The Company has up to a $3,000,000 revolving credit loan, which expires December 2, 2021. Borrowing rates are determined based off a computation of senior leverage ratio and were prime plus 1.00% at December 31, 2020 (4.25% at December 31, 2020). Borrowings permitted under the revolving credit loan are subject to limitations based upon accounts receivable and inventory levels. At December 31, 2020, the Company had availability under the revolving credit loan of $2,900,000. The revolving credit loan requires quarterly interest payments. The Company has a $7,567,500 term loan. The loan requires quarterly principal and interest payments with the principal payments being $236,484 for the last three quarters of 2020 and $283,781 for the first three quarters of 2021 with a final balloon payment on December 2, 2021. The borrowing rates are based off of a computation of senior leverage ratio and were prime plus 1.00% at December 31, 2020 (4.25% at December 31, 2020). The term loan has an excess cash flow payment requirement if the Company meets certain criteria as defined in the agreement. The Company is required to make an additional principal payment of $680,458 within 150 days after year end, due to excess cash flow for the year ended December 31, 2020. The credit facility has certain financial covenants which include maximum senior leverage ratio, minimum fixed charge coverage ratio and limitations on capital expenditures.

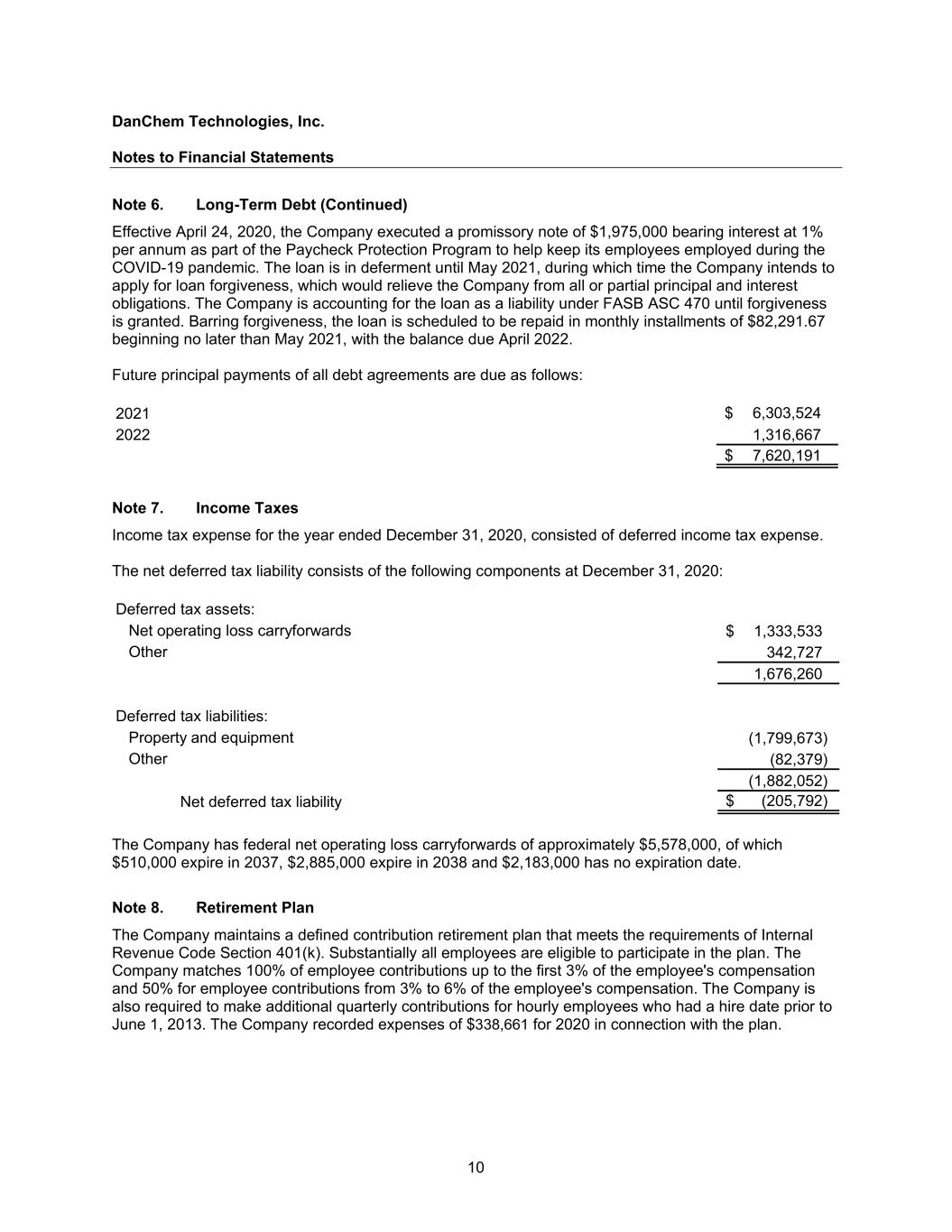

DanChem Technologies, Inc. Notes to Financial Statements 10 Note 6. Long-Term Debt (Continued) Effective April 24, 2020, the Company executed a promissory note of $1,975,000 bearing interest at 1% per annum as part of the Paycheck Protection Program to help keep its employees employed during the COVID-19 pandemic. The loan is in deferment until May 2021, during which time the Company intends to apply for loan forgiveness, which would relieve the Company from all or partial principal and interest obligations. The Company is accounting for the loan as a liability under FASB ASC 470 until forgiveness is granted. Barring forgiveness, the loan is scheduled to be repaid in monthly installments of $82,291.67 beginning no later than May 2021, with the balance due April 2022. Future principal payments of all debt agreements are due as follows: 2021 6,303,524 $ 2022 1,316,667 7,620,191 $ Note 7. Income Taxes Income tax expense for the year ended December 31, 2020, consisted of deferred income tax expense. The net deferred tax liability consists of the following components at December 31, 2020: Deferred tax assets: Net operating loss carryforwards 1,333,533 $ Other 342,727 1,676,260 Deferred tax liabilities: Property and equipment (1,799,673) Other (82,379) (1,882,052) Net deferred tax liability (205,792) $ The Company has federal net operating loss carryforwards of approximately $5,578,000, of which $510,000 expire in 2037, $2,885,000 expire in 2038 and $2,183,000 has no expiration date. Note 8. Retirement Plan The Company maintains a defined contribution retirement plan that meets the requirements of Internal Revenue Code Section 401(k). Substantially all employees are eligible to participate in the plan. The Company matches 100% of employee contributions up to the first 3% of the employee's compensation and 50% for employee contributions from 3% to 6% of the employee's compensation. The Company is also required to make additional quarterly contributions for hourly employees who had a hire date prior to June 1, 2013. The Company recorded expenses of $338,661 for 2020 in connection with the plan.

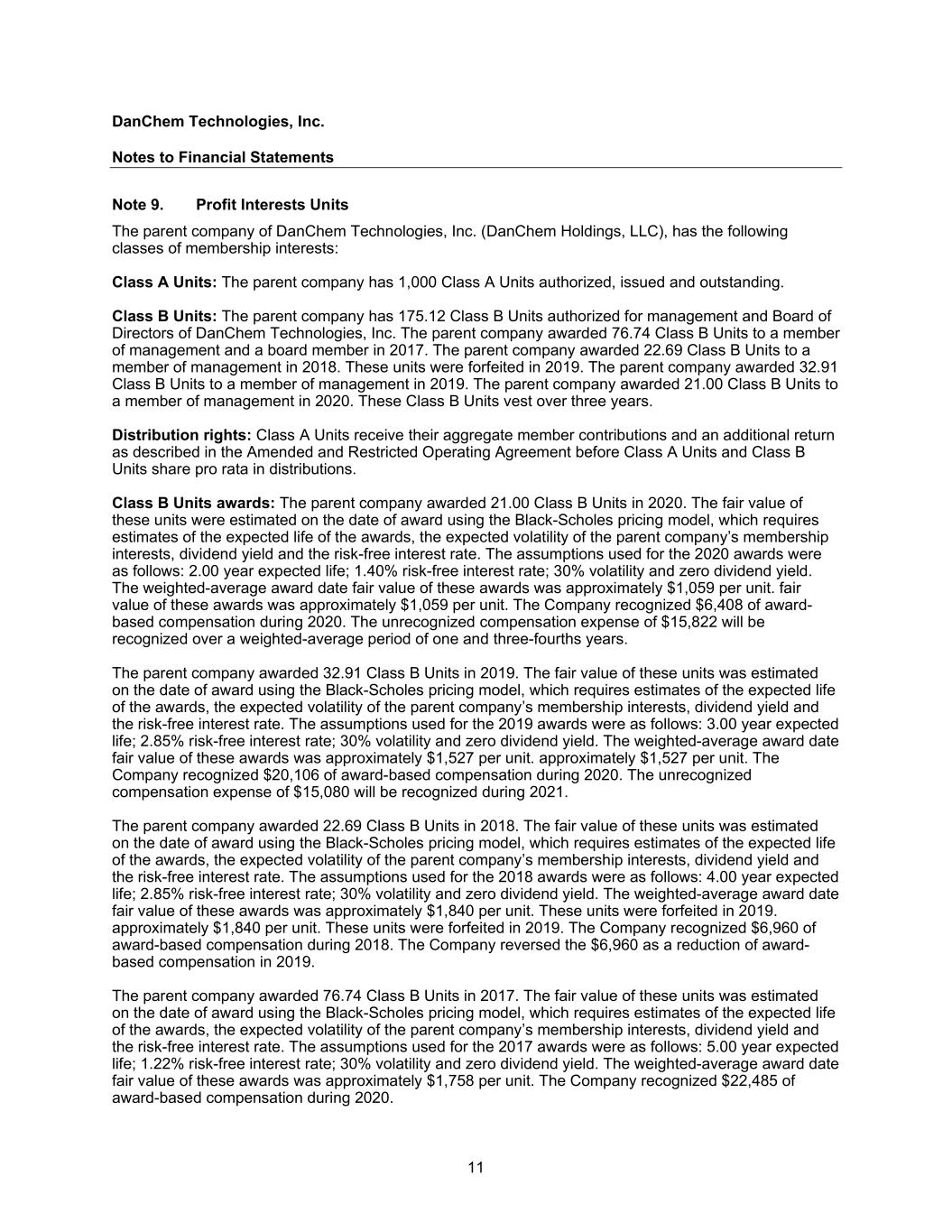

DanChem Technologies, Inc. Notes to Financial Statements 11 Note 9. Profit Interests Units The parent company of DanChem Technologies, Inc. (DanChem Holdings, LLC), has the following classes of membership interests: Class A Units: The parent company has 1,000 Class A Units authorized, issued and outstanding. Class B Units: The parent company has 175.12 Class B Units authorized for management and Board of Directors of DanChem Technologies, Inc. The parent company awarded 76.74 Class B Units to a member of management and a board member in 2017. The parent company awarded 22.69 Class B Units to a member of management in 2018. These units were forfeited in 2019. The parent company awarded 32.91 Class B Units to a member of management in 2019. The parent company awarded 21.00 Class B Units to a member of management in 2020. These Class B Units vest over three years. Distribution rights: Class A Units receive their aggregate member contributions and an additional return as described in the Amended and Restricted Operating Agreement before Class A Units and Class B Units share pro rata in distributions. Class B Units awards: The parent company awarded 21.00 Class B Units in 2020. The fair value of these units were estimated on the date of award using the Black-Scholes pricing model, which requires estimates of the expected life of the awards, the expected volatility of the parent company’s membership interests, dividend yield and the risk-free interest rate. The assumptions used for the 2020 awards were as follows: 2.00 year expected life; 1.40% risk-free interest rate; 30% volatility and zero dividend yield. The weighted-average award date fair value of these awards was approximately $1,059 per unit. fair value of these awards was approximately $1,059 per unit. The Company recognized $6,408 of award- based compensation during 2020. The unrecognized compensation expense of $15,822 will be recognized over a weighted-average period of one and three-fourths years. The parent company awarded 32.91 Class B Units in 2019. The fair value of these units was estimated on the date of award using the Black-Scholes pricing model, which requires estimates of the expected life of the awards, the expected volatility of the parent company’s membership interests, dividend yield and the risk-free interest rate. The assumptions used for the 2019 awards were as follows: 3.00 year expected life; 2.85% risk-free interest rate; 30% volatility and zero dividend yield. The weighted-average award date fair value of these awards was approximately $1,527 per unit. approximately $1,527 per unit. The Company recognized $20,106 of award-based compensation during 2020. The unrecognized compensation expense of $15,080 will be recognized during 2021. The parent company awarded 22.69 Class B Units in 2018. The fair value of these units was estimated on the date of award using the Black-Scholes pricing model, which requires estimates of the expected life of the awards, the expected volatility of the parent company’s membership interests, dividend yield and the risk-free interest rate. The assumptions used for the 2018 awards were as follows: 4.00 year expected life; 2.85% risk-free interest rate; 30% volatility and zero dividend yield. The weighted-average award date fair value of these awards was approximately $1,840 per unit. These units were forfeited in 2019. approximately $1,840 per unit. These units were forfeited in 2019. The Company recognized $6,960 of award-based compensation during 2018. The Company reversed the $6,960 as a reduction of award- based compensation in 2019. The parent company awarded 76.74 Class B Units in 2017. The fair value of these units was estimated on the date of award using the Black-Scholes pricing model, which requires estimates of the expected life of the awards, the expected volatility of the parent company’s membership interests, dividend yield and the risk-free interest rate. The assumptions used for the 2017 awards were as follows: 5.00 year expected life; 1.22% risk-free interest rate; 30% volatility and zero dividend yield. The weighted-average award date fair value of these awards was approximately $1,758 per unit. The Company recognized $22,485 of award-based compensation during 2020.

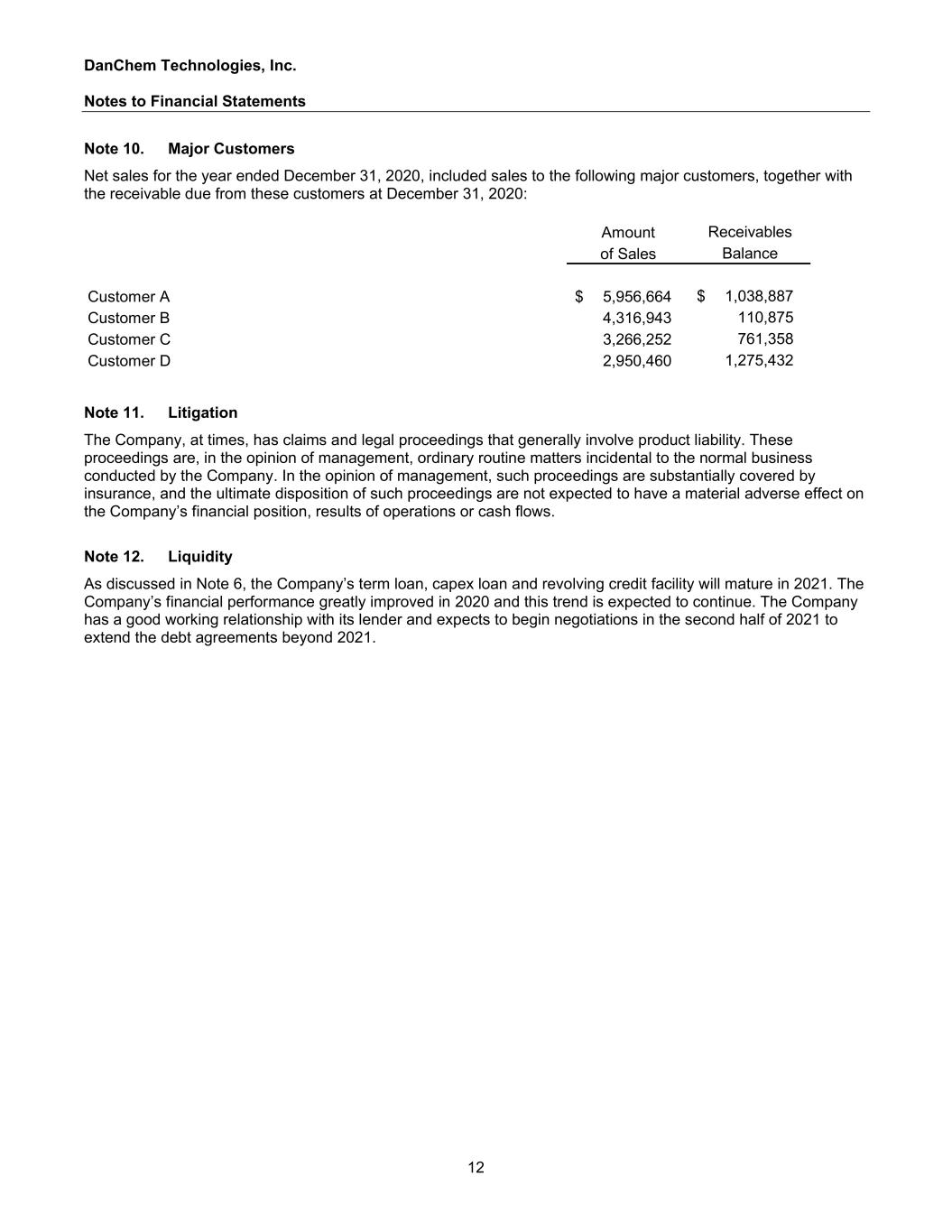

DanChem Technologies, Inc. Notes to Financial Statements 12 Note 10. Major Customers Net sales for the year ended December 31, 2020, included sales to the following major customers, together with the receivable due from these customers at December 31, 2020: Amount Receivables of Sales Balance Customer A 5,956,664 $ 1,038,887 $ Customer B 4,316,943 110,875 Customer C 3,266,252 761,358 Customer D 2,950,460 1,275,432 Note 11. Litigation The Company, at times, has claims and legal proceedings that generally involve product liability. These proceedings are, in the opinion of management, ordinary routine matters incidental to the normal business conducted by the Company. In the opinion of management, such proceedings are substantially covered by insurance, and the ultimate disposition of such proceedings are not expected to have a material adverse effect on the Company’s financial position, results of operations or cash flows. Note 12. Liquidity As discussed in Note 6, the Company’s term loan, capex loan and revolving credit facility will mature in 2021. The Company’s financial performance greatly improved in 2020 and this trend is expected to continue. The Company has a good working relationship with its lender and expects to begin negotiations in the second half of 2021 to extend the debt agreements beyond 2021.