iAccess Alpha Virtual Best Ideas Winter Investment Conference 2025 December 9, 2025 Ascent Industr ies Co. | Nasdaq: ACNT

Forward-Looking Statements This presentation includes "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 and other applicable federal securities laws. All statements that are not historical facts are forward-looking statements. Forward looking statements can be identified through the use of words such as "estimate," "project," "intend," "expect," "believe," "should," "anticipate," "hope," "optimistic," "plan," "outlook," "should," "could," "may" and similar expressions. The forward-looking statements are subject to certain risks and uncertainties, including without limitation those identified below, which could cause actual results to differ materially from historical results or those anticipated. Readers are cautioned not to place undue reliance on these forward-looking statements. The following factors could cause actual results to differ materially from historical results or those anticipated: adverse economic conditions, including risks relating to the impact and spread of and the government’s response to pandemics; inability to weather an economic downturn; the impact of competitive products and pricing; product demand and acceptance risks; raw material and other increased costs, including the impact of tariffs; raw material availability; financial stability of the Company’s customers; customer delays or difficulties in the production of products; loss of consumer or investor confidence; employee relations; ability to maintain workforce by hiring trained employees; labor efficiencies; risks associated with acquisitions; environmental issues; negative or unexpected results from tax law changes; inability to comply with covenants and ratios required by the Company’s debt financing arrangements; and other risks detailed from time-to-time in Ascent Industries Co.'s Securities and Exchange Commission filings, including our Annual Report on Form 10-K, which filings are available from the SEC. Ascent Industries Co. assumes no obligation to update any forward-looking information included in this release. Non-GAAP Financial Information Financial statement information included in this earnings release includes non-GAAP (Generally Accepted Accounting Principles) measures and should be read along with the accompanying tables which provide a reconciliation of non-GAAP measures to GAAP measures. Adjusted EBITDA is a non-GAAP financial measure that the Company believes is useful to investors in evaluating its results to determine the value of a company. An item is excluded in the measure if its periodic value is inconsistent and sufficiently material that not identifying the item would render period comparability less meaningful to the reader or if including the item provides a clearer representation of normalized periodic earnings. The Company excludes in Adjusted EBITDA two categories of items: 1) Base EBITDA components, including: interest expense, income taxes, depreciation and amortization, and 2) Material transaction costs including: goodwill impairment, asset impairment, gain on lease modification, stock-based compensation, non-cash lease cost, acquisition costs and other fees, shelf registration costs, loss on extinguishment of debt, retention costs and restructuring & severance costs from net income. Management believes that these non-GAAP measures are useful because they are key measures used by our management team to evaluate our operating performance, generate future operating plans and make strategic decisions as well as allow readers to compare the financial results between periods. Non-GAAP measures should not be considered as an alternative to any measure of performance or financial condition as promulgated under GAAP, and investors should consider the Company's performance and financial condition as reported under GAAP and all other relevant information when assessing the performance or financial condition of the Company. Non-GAAP measures have limitations as analytical tools, and investors should not consider them in isolation or as a substitute for analysis of the Company's results or financial condition as reported under GAAP. Forward Looking Statement Safe Harbor and Non-GAAP Information 2

Kitchen, Kavalauskas, and many of their management team counterparts have previously worked together, a synergy that has had an undeniable impact on Ascent's operational and financial performance since assuming their roles in early 2024 CEO & CFO Have a Proven Track Record of Making Good Specialty Chemical Companies Great Bryan Kitchen President & Chief Executive Officer Bryan joined Ascent in September 2023 to lead the specialty chemicals segment; promoted to president & CEO in February 2024 Prior to joining Ascent, Bryan led the stabilization, turnaround and successful sale of Clearon Corp to Solenis Previous experience: Ryan Kavalauskas Chief Financial Officer Ryan joined Ascent as CFO in February 2024 Prior to joining Ascent, Ryan was the CFO at Clearon and played an instrumental role in the stabilization, turnaround and successful sale of Clearon Corp to Solenis Previous Experience: Built to deliver durable shareholder value. Led by those who’ve done it before, together. 3

After 75 years, we are going back to our roots as a Specialty Chemical Company Company Founded Blackman Uhler Industries, Inc. was founded in 1945, marking the company’s entry into the specialty chemical market. Bristol Metals Blackman Uhler Industries, Inc. acquired Bristol Metals, initiating the company's expansion into the stainless- steel industry and further diversifying its operations. Synalloy Corporation Blackman Uhler Industries Inc., changes name to Synalloy Corporation. Initial Public Offering Synalloy Corporation launched its initial public offering on the NASDAQ Stock Exchange, trading under the ticker symbol SYNL. Manufacturers Chemicals Synalloy Corporation acquires Manufacturers Chemicals, significantly expanding the company’s footprint in the specialty chemicals sector and diversifying its product offering Rite Industries Synalloy Corporation combined its textile dyes business with Rite Industries to form a new subsidiary, Blackman Uhler Specialties. Palmer of Texas Tanks Synalloy Corporation acquired Palmer of Texas Tanks, a premier manufacturer of fiberglass and stainless storage tanks used primarily in the oil industry. CRI Tolling In line with its long- term commitment to the chemical industry, Synalloy Corporation acquired CRI Tolling, marking its first foray into specialty chemical custom manufacturing. Specialty Pipe & Tube Synalloy Corporation advanced its vertical integration and expanded its metals business by acquiring Specialty Pipe & Tube and the U.S. assets of Marcegaglia in 2014. Marcegaglia USA Further expanding its metal business, in 2016, Synalloy Corporation acquired the stainless-steel pipe and tube assets of Marcegaglia USA. Marcegaglia USA Synalloy Corporation made yet another acquisition acquiring the galvanized pipe and tube assets of Marcegaglia USA. American Stainless Tubing, Inc. Synalloy Corporation further diversified through the acquisition of American Stainless Tubing Inc., a leading manufacturer of ornamental stainless- steel tubing. DanChem Technologies Expanding on its presence in specialty chemicals custom manufacturing, Synalloy Corporation acquired DanChem Technologies in 2021 from Edgewater Capital Partners. Ascent Industries Co. Synalloy Corporation rebranded to Ascent Industries Co., trading on the NASDAQ Stock Exchange under the ticker symbol ACNT. Divestiture of Specialty Pipe & Tube Executing against its strategic plan, Ascent sold the business and related assets of Specialty Pipe & Tube to a Financial Sponsor. Portfolio Optimization Ascent sells substantially all operating assets associated with the Tubular segment 1945 1964 1967 1980 1996 2003 2012 2013 2014 2016 2018 2019 2021 2022 2023 20252024 Management Turnaround Kitchen & Kavalauskas installed as CEO and CFO respectively; high- impact team was assembled to accelerate transformation and unlock shareholder value 3 Domestic Manufacturing Sites 5 Manufacturing Plants ~95% Revenue Supported With Domestic Raw Materials 1945 Founded ~205 Employees 170+ Customers $80.8M 2024 Revenue 4

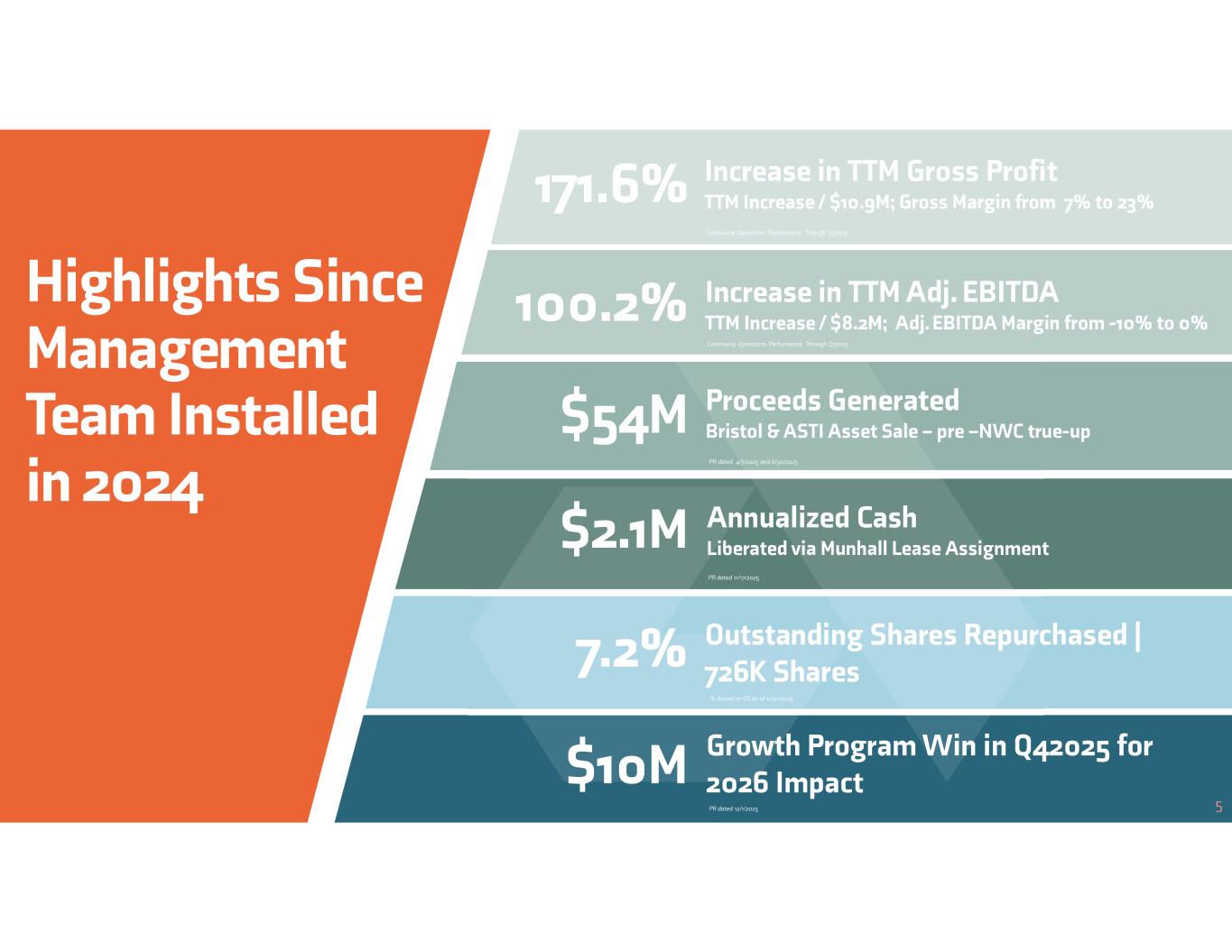

Highlights Since Management Team Installed in 2024 $54M 7.2% Outstanding Shares Repurchased | 726K Shares $2.1M Annualized Cash Liberated via Munhall Lease Assignment Increase in TTM Adj. EBITDA TTM Increase / $8.2M; Adj. EBITDA Margin from -10% to 0%100.2% Continuing Operations Performance Through Q32025 Proceeds Generated Bristol & ASTI Asset Sale – pre –NWC true-up % Based on OS as of 12/31/2024 $10M Growth Program Win in Q42025 for 2026 Impact PR dated 12/1/2025 PR dated 11/17/2025 PR dated 4/7/2025 and 6/30/2025 Increase in TTM Adj. EBITDA TTM Increase / $8.2M100.2% Continuing Operations Performance Through Q32025 171.6 Increase in TTM Gross Profit TTM Increase / $10.9M; Gross Margin from 7% to 23% Continuing Operations Performance Through Q32025 5

Pure-Play Who We Are, What We Do & How We Operate Specialty Chemicals Company

Expand and Elevate our Current Capabilities Maximizing our owned assets to serve high-value segments like Oil & Gas, CASE, HI&I, Water Treatment and Ag with precision & technical support Our Strategy & Operating Model Outcomes over everything. We’re building a platform that solves real problems across the value chain, not just by providing products or capacity, but by offering a full suite of services: formulation development, reaction capabilities, blending, packaging, logistics, regulatory support and reliable delivery. Core levers: 7 Win Across the Moments that Matter Moments where loyalty is earned, and retained: 1. Discovery & Development 2. Commercial & Contracting 3. Manufacturing & Fulfillment 4. Service & Lifecycle Support It’s not a tagline, it’s a strategic roadmap.

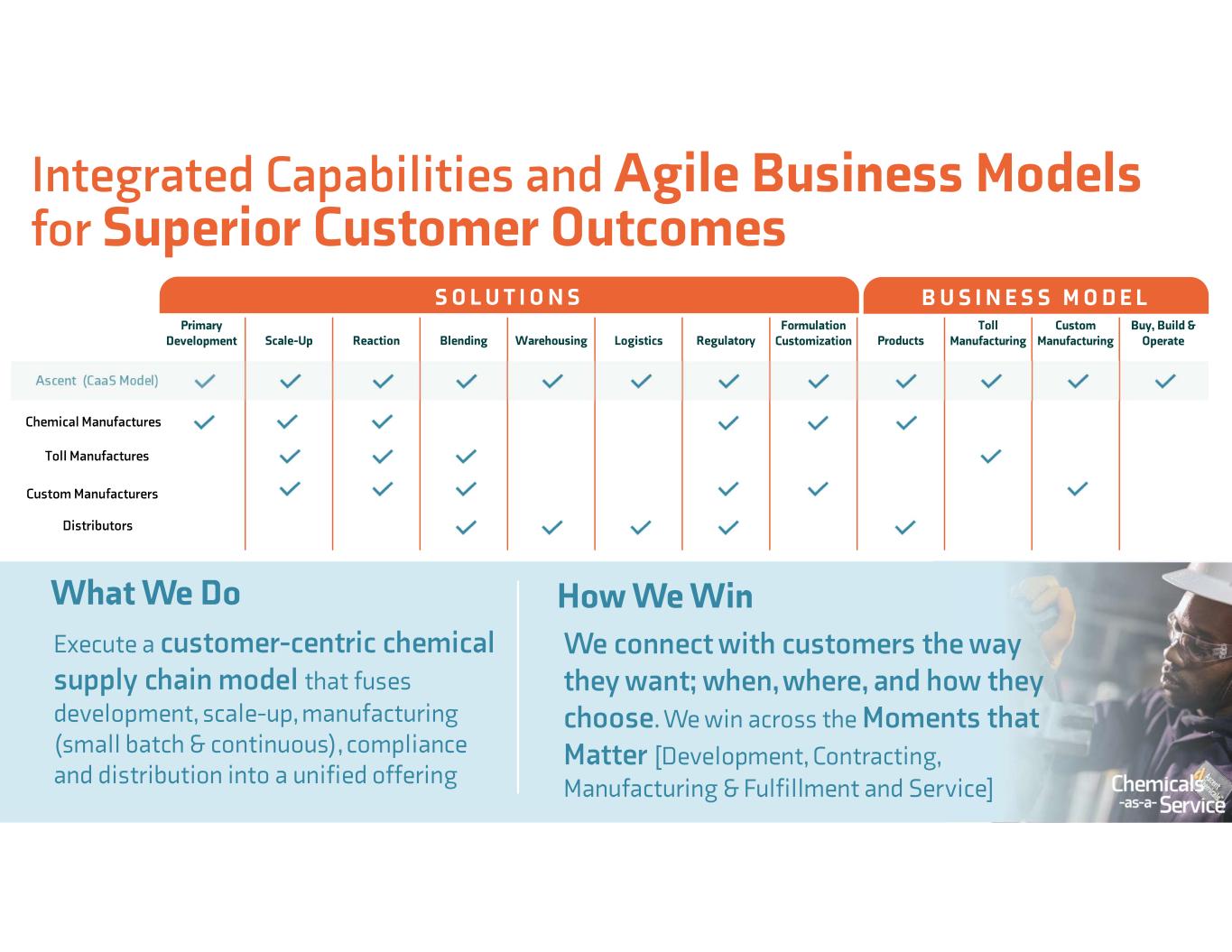

Buy, Build & Operate Custom Manufacturing Toll ManufacturingProducts Formulation CustomizationRegulatoryLogisticsWarehousingBlendingReactionScale-Up Primary Development Ascent (CaaS Model) Toll Manufactures Distributors Custom Manufacturers B U S I N E S S M O D E LS O L U T I O N S Execute a customer-centric chemical supply chain model that fuses development, scale-up, manufacturing (small batch & continuous), compliance and distribution into a unified offering We connect with customers the way they want; when, where, and how they choose. We win across the Moments that Matter [Development, Contracting, Manufacturing & Fulfillment and Service] What We Do How We Win Integrated Capabilities and Agile Business Models for Superior Customer Outcomes Chemical Manufactures

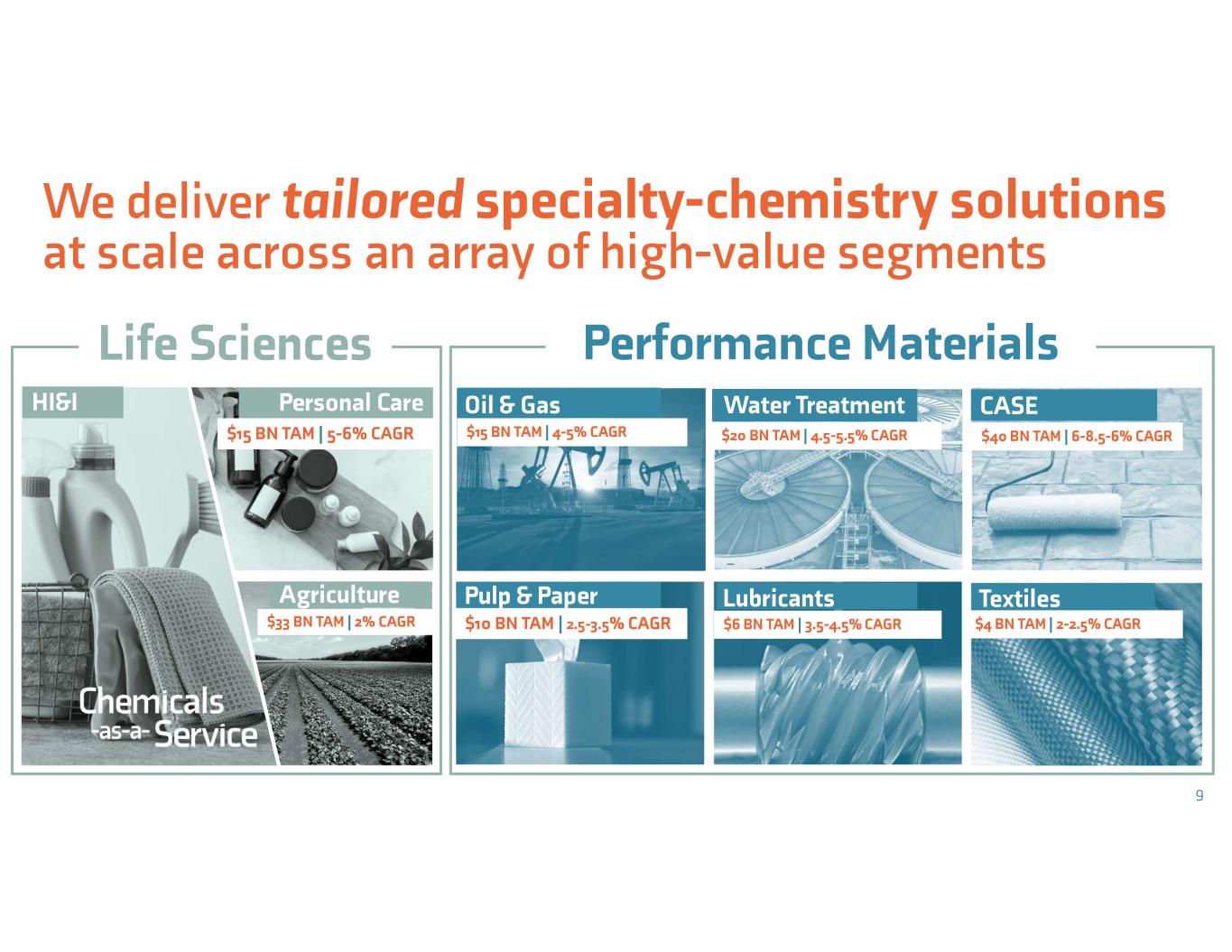

$15 BN TAM | 4-5% CAGR Oil & Gas Water Treatment CASE TextilesLubricantsPulp & Paper $40 BN TAM | 6-8.5-6% CAGR $10 BN TAM | 2.5-3.5% CAGR $20 BN TAM | 4.5-5.5% CAGR $4 BN TAM | 2-2.5% CAGR$6 BN TAM | 3.5-4.5% CAGR Agriculture $33 BN TAM | 2% CAGR We deliver tailored specialty-chemistry solutions at scale across an array of high-value segments 9 Personal Care $15 BN TAM | 5-6% CAGR HI&I Life Sciences Performance Materials

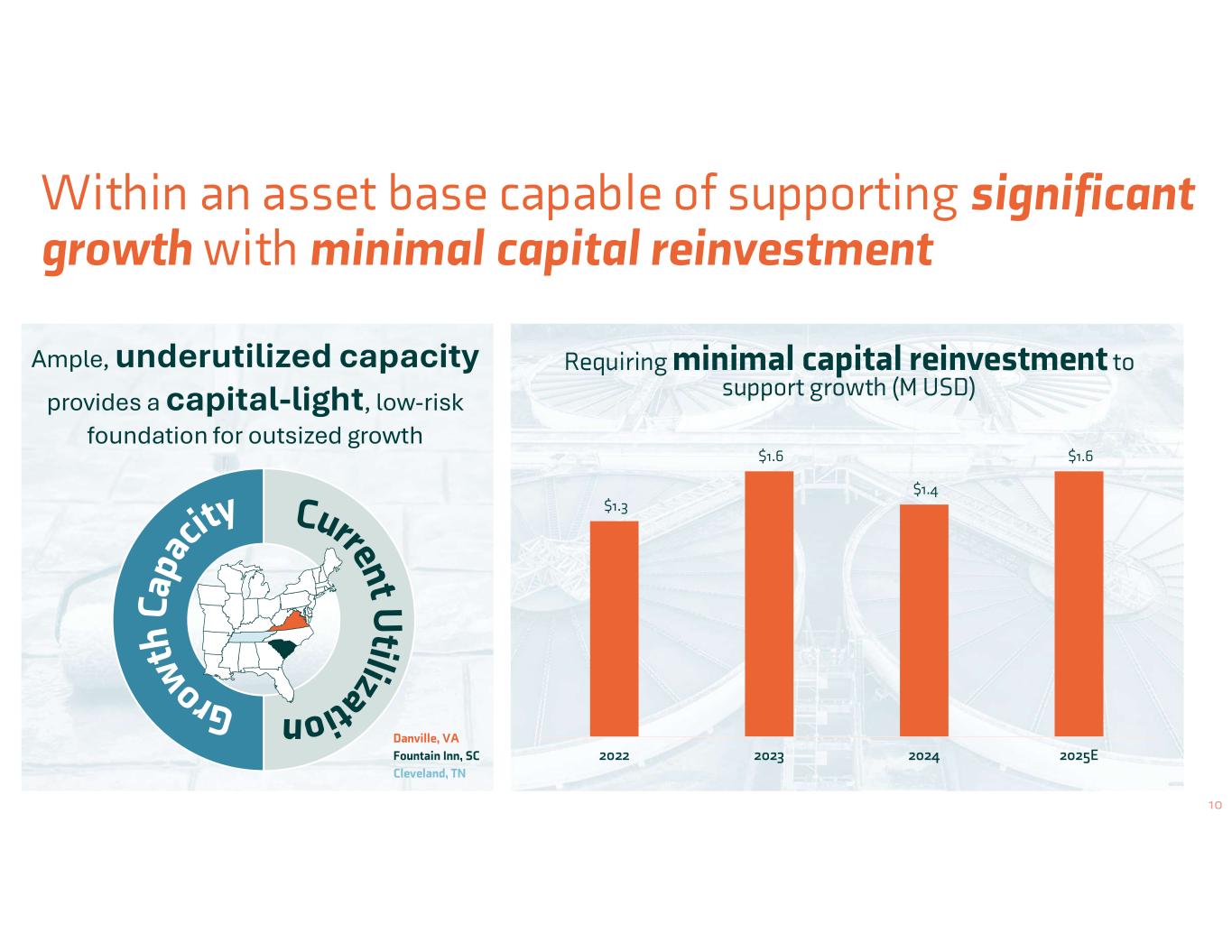

Ample, underutilized capacity provides a capital-light, low-risk foundation for outsized growth Requiring minimal capital reinvestment to support growth (M USD) Danville, VA Fountain Inn, SC Cleveland, TN Within an asset base capable of supporting significant growth with minimal capital reinvestment $1.3 $1.6 $1.4 $1.6 2022 2023 2024 2025E 10

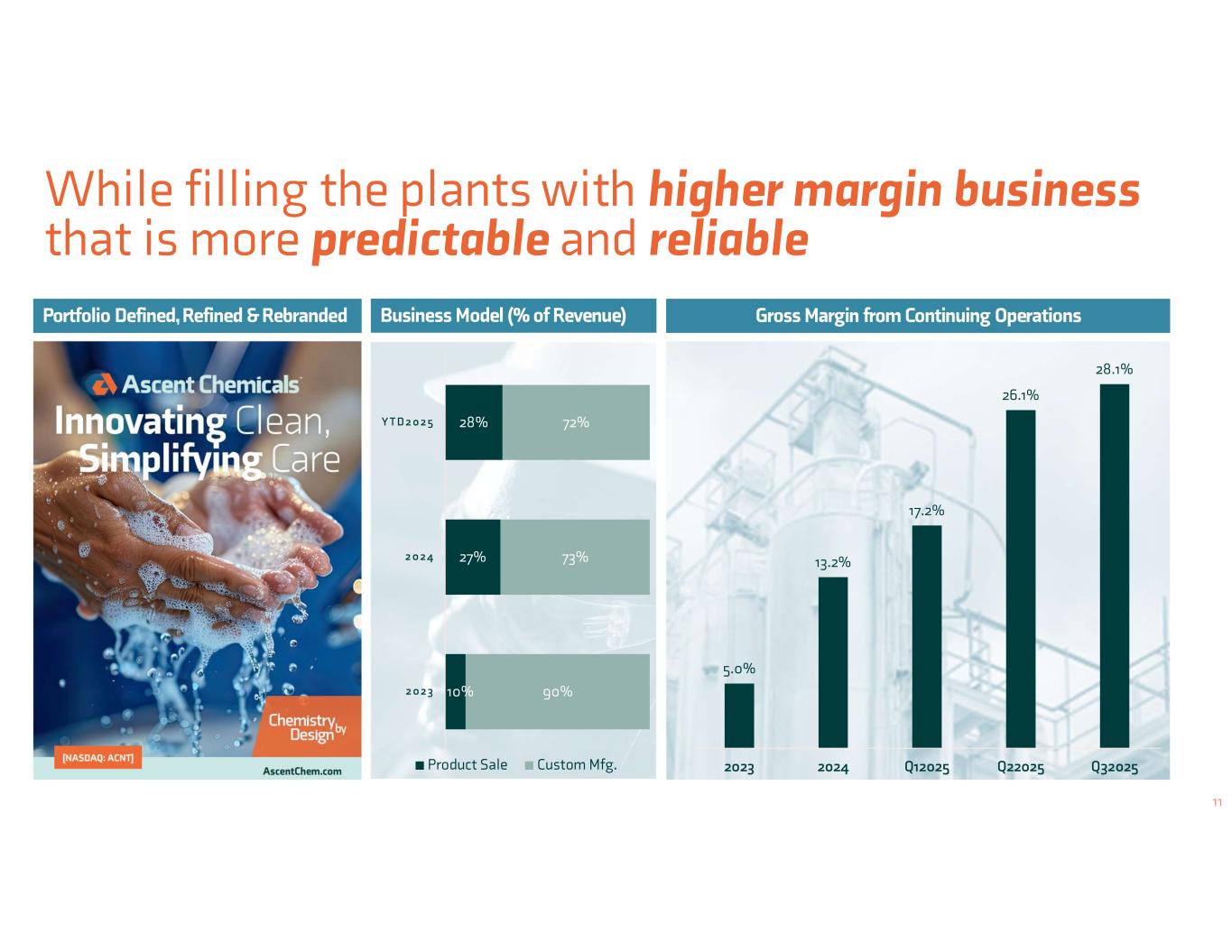

While filling the plants with higher margin business that is more predictable and reliable Portfolio Defined, Refined & Rebranded Gross Margin from Continuing Operations 11 5.0% 13.2% 17.2% 26.1% 28.1% 2023 2024 Q12025 Q22025 Q32025 Business Model (% of Revenue) 10% 27% 28% 90% 73% 72% 2 0 2 3 2 0 2 4 Y T D 2 0 2 5 Product Sale Custom Mfg.

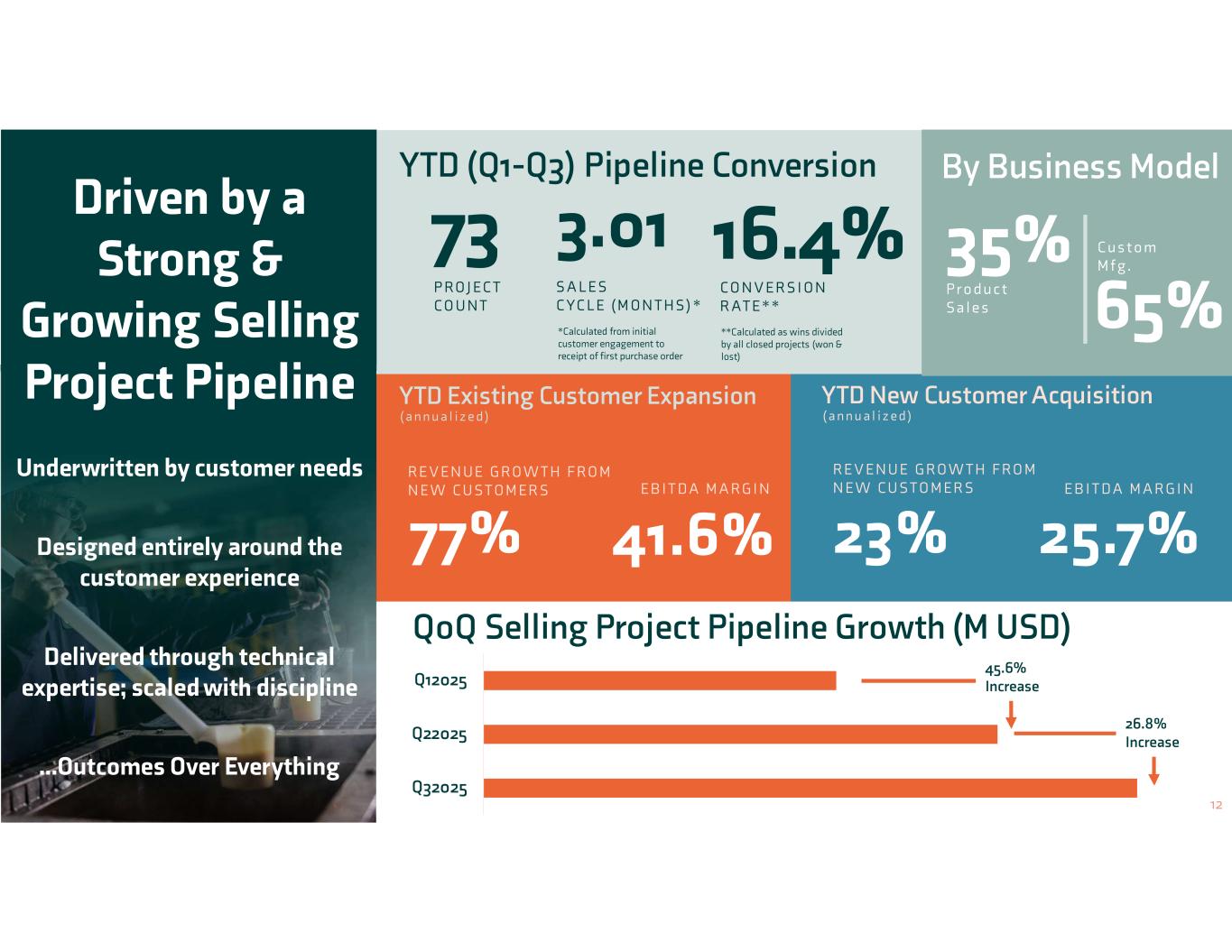

YTD Existing Customer Expansion YTD New Customer Acquisition P RO J EC T CO U N T 73 S A L E S C YC L E ( M O N T H S ) * 3.01 YTD (Q1-Q3) Pipeline Conversion ( a n n u a l i z e d ) ( a n n u a l i z e d ) Driven by a Strong & Growing Selling Project Pipeline Underwritten by customer needs Designed entirely around the customer experience Delivered through technical expertise; scaled with discipline …Outcomes Over Everything 77% 41.6% E B I T DA M A RG I N CO N V E R S I O N R AT E * * 16.4% QoQ Selling Project Pipeline Growth (M USD) Q32025 Q22025 Q12025 45.6% Increase 23% R E V E N U E G ROW T H F RO M N E W C U S TO M E R S 25.7% E B I T DA M A RG I N 12 26.8% Increase R E V E N U E G ROW T H F RO M N E W C U S T O M E R S By Business Model P r o d u c t S a l e s 35% 65% C u s t o m M f g. *Calculated from initial customer engagement to receipt of first purchase order **Calculated as wins divided by all closed projects (won & lost)

2026-2030 Durable Earnings-Growth The Path Forward

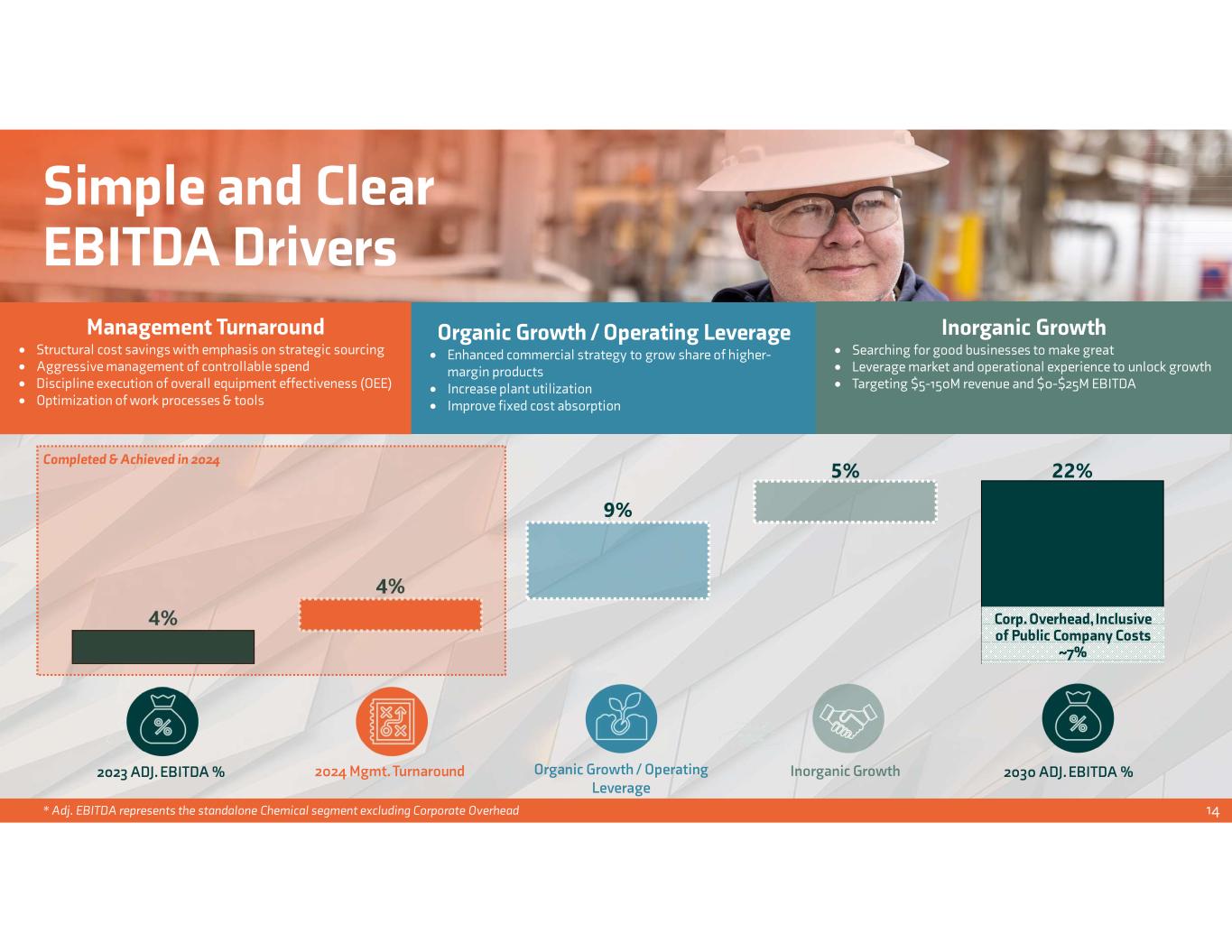

Simple and Clear EBITDA Drivers Management Turnaround Structural cost savings with emphasis on strategic sourcing Aggressive management of controllable spend Discipline execution of overall equipment effectiveness (OEE) Optimization of work processes & tools Organic Growth / Operating Leverage Enhanced commercial strategy to grow share of higher- margin products Increase plant utilization Improve fixed cost absorption 4% 4% 9% 5% 22% * Adj. EBITDA represents the standalone Chemical segment excluding Corporate Overhead 2023 ADJ. EBITDA % 2030 ADJ. EBITDA %2024 Mgmt. Turnaround Organic Growth / Operating Leverage Inorganic Growth Corp. Overhead, Inclusive of Public Company Costs ~7% 14 Completed & Achieved in 2024 Inorganic Growth Searching for good businesses to make great Leverage market and operational experience to unlock growth Targeting $5-150M revenue and $0-$25M EBITDA

And strong liquidity to support investor- friendly capital allocation priorities Every internal investment and acquisition is about accelerating progress, creating synergies that make sense, and delivering real, sustainable value. It's not only about size, it's about outcomes that matter, both strategically and operationally. Our goal is simple: to align every move with our mission and ensure it drives maximum impact for our shareholders. Financial Profile: $5-150MM Revenue | $0-$25MM EBITDA Investment Type: Private or Publicly Held Asset Types: Specialty Chemicals Manufacturing, Distribution, Product Lines & Brands and Co-Packagers M&A Investment Focus $0 ~$58M D E B T C A P A C I T Y ~$30M C A P A C I T Y T O I N V E S T ~$88M+ + = D E B T C A S H 15 Capital Allocation Active, but Disciplined1. Fund high-ROIC organic growth (top priority). We will underwrite projects where ROIC > WACC and where incremental FCF aligns with the DCF trajectory. 2. Selective, discipline M&A. Accretive on ROIC and FCF per share within a 3–5 year window; avoid growth that dilutes FCF/ROIC just to increase scale. 3. Share repurchases as a flexible, valuation-sensitive tool. Use when shares trade meaningfully below intrinsic value. Avoid growth that dilutes FCF/ROIC just to increase scale Repurchased 7.2% of Outstanding Shares Q12025-Q32025 % Based on OS as of 12/31/2024

Portfolio Optimized Strategic clarity. Focus. Efficiency. Stabilized and Growth Ready Predictability. Confidence. Credibility. Reduced risk. Growth Capacity In-Place Optionality. Scale. Margin. Growth. Resilience. Near-Term Upside Undervalued, leverage multiple upside. Strong Balance Sheet Stability. Strategic firepower for earnings-accretive M&A. Under-covered & Under Valued Early discovery can drive outsized investment returns when larger pools of capital follow. Why invest in ……the right people, proven together, trusted by each other, and aligned to win the next phase 16 ?

Ryan Kavalauskas Chief Financial Officer rkavalauskas@ascentco.com 17

Appendix 18

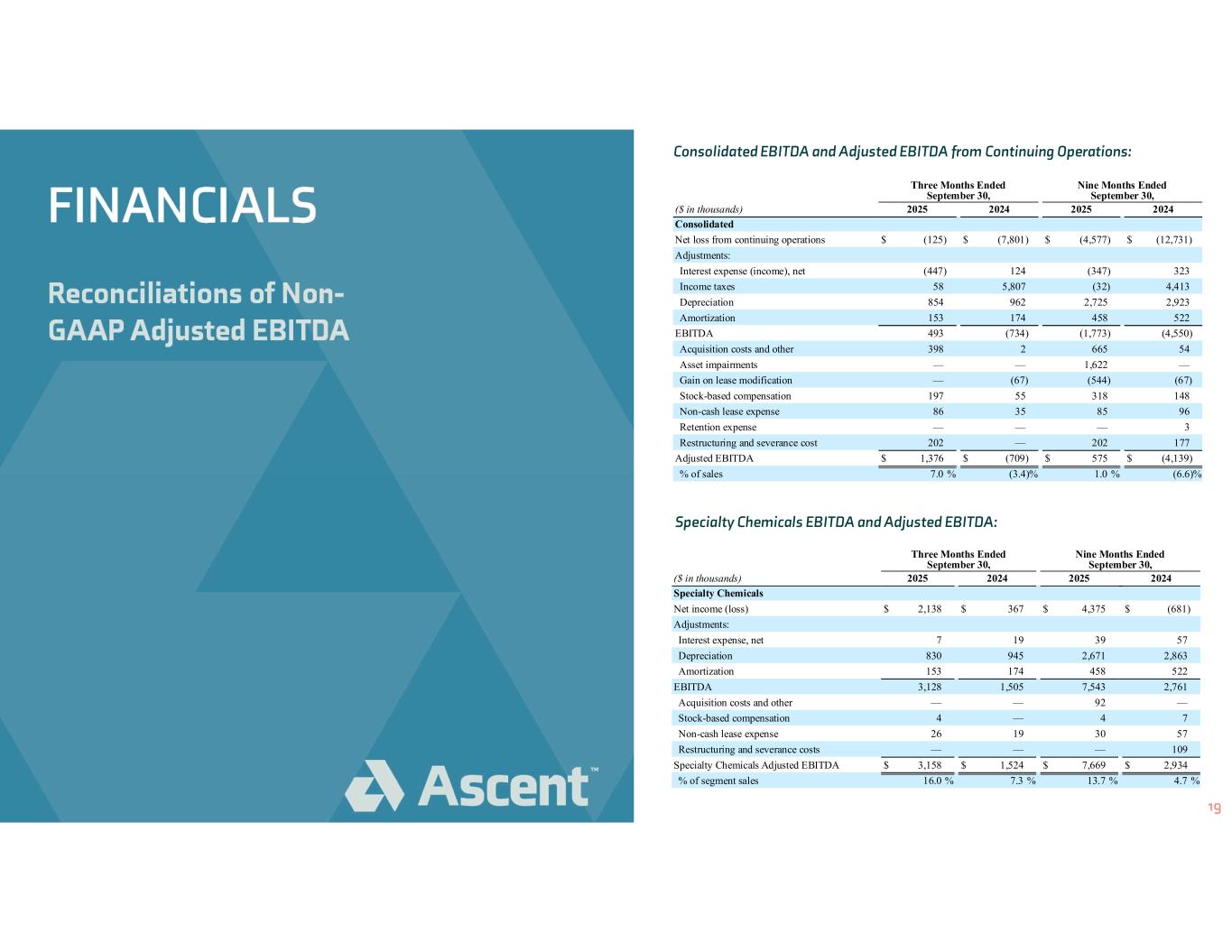

Reconciliations of Non- GAAP Adjusted EBITDA FINANCIALS Consolidated EBITDA and Adjusted EBITDA from Continuing Operations: Specialty Chemicals EBITDA and Adjusted EBITDA: 19 Three Months Ended September 30, Nine Months Ended September 30, ($ in thousands) 2025 2024 2025 2024 Consolidated Net loss from continuing operations $ (125) $ (7,801) $ (4,577) $ (12,731) Adjustments: Interest expense (income), net (447) 124 (347) 323 Income taxes 58 5,807 (32) 4,413 Depreciation 854 962 2,725 2,923 Amortization 153 174 458 522 EBITDA 493 (734) (1,773) (4,550) Acquisition costs and other 398 2 665 54 Asset impairments — — 1,622 — Gain on lease modification — (67) (544) (67) Stock-based compensation 197 55 318 148 Non-cash lease expense 86 35 85 96 Retention expense — — — 3 Restructuring and severance cost 202 — 202 177 Adjusted EBITDA $ 1,376 $ (709) $ 575 $ (4,139) % of sales 7.0 % (3.4)% 1.0 % (6.6)% Three Months Ended September 30, Nine Months Ended September 30, ($ in thousands) 2025 2024 2025 2024 Specialty Chemicals Net income (loss) $ 2,138 $ 367 $ 4,375 $ (681) Adjustments: Interest expense, net 7 19 39 57 Depreciation 830 945 2,671 2,863 Amortization 153 174 458 522 EBITDA 3,128 1,505 7,543 2,761 Acquisition costs and other — — 92 — Stock-based compensation 4 — 4 7 Non-cash lease expense 26 19 30 57 Restructuring and severance costs — — — 109 Specialty Chemicals Adjusted EBITDA $ 3,158 $ 1,524 $ 7,669 $ 2,934 % of segment sales 16.0 % 7.3 % 13.7 % 4.7 %