UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

The Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

| SYNALLOY CORPORATION |

(Name of Registrant as Specified in Its Charter)

|

| |

PRIVET FUND LP

PRIVET FUND MANAGEMENT LLC

RYAN LEVENSON

UPG ENTERPRISES LLC

PAUL DOUGLASS

CHRISTOPHER HUTTER

ANDEE HARRIS

ALDO MAZZAFERRO

BENJAMIN ROSENZWEIG

JOHN P. SCHAUERMAN

|

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on

which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| ☐ | Fee paid previously with preliminary materials: |

☐ Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of

its filing.

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED MARCH 20, 2020

Privet

Fund LP AND UPG ENTERPRISES LLC

___________, 2020

Dear Fellow Synalloy Corporation Stockholder,

Privet Fund LP (together

with its affiliates, “Privet”) and UPG Enterprises LLC (together with its affiliates, “UPG” and collectively

with Privet, the “Stockholder Group” or “we” or “us”) are the largest stockholders of Synalloy

Corporation, a Delaware corporation (“Synalloy” or the “Company”), with aggregate ownership of approximately

24.8% of the outstanding shares of common stock of the Company.

For the reasons

set forth in the enclosed Proxy Statement, we believe significant changes to the composition of the Company’s Board of Directors

(the “Board”) and management team are necessary in order to ensure that the Company is being operated and overseen

in a manner consistent with your best interests. To hopefully facilitate these changes, we have nominated a slate of five (5) highly-qualified

and exceptionally well-credentialed director candidates—Andee Harris, Christopher Hutter, Aldo Mazzaferro, Benjamin Rosenzweig

and John P. Schauerman—for election to the Board at the Company’s upcoming 2020 Annual Meeting of Stockholders (the

“Annual Meeting”).

In our view, Synalloy’s

high-quality assets, skilled workforce and established supply chain should be the foundation of long-term value creation; yet,

the Company has continued to underperform during the incumbent leadership team’s watch. Given that the Board is comprised

primarily of individuals with limited operating experience across the steel, metals and chemicals verticals, we do not find it

surprising that the current mix of directors has failed to properly oversee strategic initiatives, establish and achieve performance

metrics or hold management accountable. Our objective analysis of Synalloy, coupled with our collective experience owning and managing

successful related businesses, leads us to believe that immediate change in the boardroom and a new strategic direction are

needed.

Many of you are

likely aware that Privet has spent years trying to directly engage with Synalloy’s leadership about various approaches for

enhancing stockholder value, including offering to acquire the Company in 2019. Now that Privet and UPG have formed the Stockholder

Group, however, we are completely focused on one path forward: reconstituting the Board and implementing a superior operating strategy

that can enable all stockholders to benefit from the turnaround we intend to orchestrate. Our singular mission is to put Synalloy

in a position to operate as a highly-competitive and profitable industry leader for years to come. We hope that our sizable investment

in Synalloy signals to all stockholders that the Stockholder Group is aligned with you and deeply committed to turning around the

Company in order to unlock its full potential.

We contend that

an objective analysis of Synalloy’s past several years of underwhelming performance reinforces that the Company is nowhere

close to industry leadership. We believe that it should be clear to all stockholders that the incumbent Board and management team

have failed—despite ample opportunity during their lengthy tenures—to unlock the tremendous potential trapped within

the Company’s underperforming assets. Our extensive analysis indicates that deteriorating operating performance and the wasting

of corporate resources have led to a trajectory of value destruction that can only be reversed once sweeping changes are made atop

the Company. It is clear to us that the current mix of directors appears ill-equipped to oversee strategic initiatives, establish

and achieve performance metrics and hold management accountable, as will be necessary to effect a successful turnaround.

As we will explain

in great detail in the weeks ahead, refreshing the Board is only one step toward a stronger Synalloy. In addition to needing deeper

industry expertise and more qualified oversight in the boardroom, we believe that Synalloy is in dire need of a new operating plan.

That is why our nominees—who possess significant operational experience and related expertise in the chemicals and metals

businesses—are already working to prepare the type of 100-day transition plan that can expedite the Company’s revitalization.

If they are elected to the Board, our nominees intend to implement a near-term and long-term strategy that emphasizes dramatically

improving margins, increasing cash flows, growing returns on incremental invested capital and installing a culture of accountability.

We feel that our nominees’ backgrounds and pedigrees will enable them to accomplish their goals alongside the incumbent directors

and put stockholders’ interests first.

We firmly believe

that with the right Board and strategic plan in place, Synalloy can finally become a best-in-class business that produces quality

long-term returns for stockholders. This is why the Stockholder Group is soliciting your support to elect our five nominees at

this year’s Annual Meeting. We feel there is a unique opportunity in front of all stockholders to take action and strengthen

Synalloy by adding the right people and perspectives to the Board at this critical point in the Company’s lifecycle.

If elected, our

nominees, subject to their fiduciary duties, are committed to implementing a comprehensive plan aimed at unlocking the full potential

of Synalloy. While we have confidence that our director nominees’ plans for Synalloy will put the Company on the right path

towards substantial stockholder value creation, there can be no assurance that the implementation of this comprehensive plan will

ultimately enhance stockholder value. In the event that our director nominees comprise less than a majority of the Board following

the Annual Meeting, there can be no assurance that any actions or changes proposed by our director nominees, including the implementation

of any plan, will be adopted or supported by the Board.

There are currently

eight (8) directors serving on the Board, all of whom have terms expiring at the Annual Meeting. The enclosed Proxy Statement is

soliciting proxies to elect only our five (5) nominees. Accordingly, the enclosed WHITE proxy card may only be voted for our

nominees and does not confer voting power with respect to any of the Company’s director nominees. Stockholders who return

the WHITE proxy card will only be able to vote for our five (5) nominees. You can only vote for the Company’s director

nominees by signing and returning a proxy card provided by the Company, voting in person at the Annual Meeting or otherwise providing

valid voting instructions to the Company (including by telephone or Internet). Stockholders should refer to the Company’s

proxy statement for the names, backgrounds, qualifications and other information concerning the Company’s nominees. Your

vote to elect our nominees will have the legal effect of replacing five (5) incumbent directors with our nominees. If all five

(5) of our nominees are elected, they would represent a majority of the directors on the Board.

We urge you to carefully

consider the information contained in the attached Proxy Statement and then support our efforts by signing, dating and returning

the enclosed WHITE proxy card today. The attached Proxy Statement and the enclosed WHITE proxy card are first being

mailed to stockholders on or about _____, 2020.

If you have already

voted for the Company’s slate of directors, you have every right to change your vote by signing, dating and returning a later

dated WHITE proxy card or by voting in person at the Annual Meeting.

If you have any

questions or require any assistance with your vote, please contact Saratoga Proxy Consulting LLC, which is assisting us, at its

address and toll-free numbers listed below.

| Thank you for your support, |

|

|

/s/ Ben Rosenzweig

Ben Rosenzweig

Privet Fund LP |

/s/ Christopher Hutter

Christopher Hutter

UPG Enterprises LLC |

If you have any questions, require assistance

in voting your WHITE proxy card,

please contact Saratoga at the phone numbers

listed below.

Saratoga Proxy Consulting, LLC

520 8th Avenue, 14th Floor

New York, NY 10018

(212) 257-1311

Stockholders may call toll-free: (888) 368-0379

info@saratogaproxy.com

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED MARCH 20, 2020

2020 ANNUAL MEETING OF STOCKHOLDERS

OF

Synalloy Corporation

_________________________

PROXY STATEMENT

OF

PRIVET FUND LP AND UPG ENTERPRISES LLC

_________________________

PLEASE SIGN, DATE AND MAIL THE ENCLOSED WHITE PROXY CARD TODAY

Privet Fund LP (“Privet

Fund”), Privet Fund Management LLC (“Privet Fund Management”) and Ryan Levenson (together with Privet Fund and

Privet Fund Management, “Privet”) and UPG Enterprises LLC (“UPG Enterprises”), Paul Douglass and Christopher

Hutter (together with UPG Enterprises and Mr. Douglass, “UPG” and collectively with Privet, the “Stockholder

Group” or “we” or “us”) are the largest stockholders of Synalloy Corporation, a Delaware corporation

(“Synalloy” or the “Company”), who collectively beneficially own approximately 24.8% of the outstanding

shares of common stock, $1.00 par value per share (the “Common Stock”), of the Company. We believe that the Board of

Directors of the Company (the “Board”) must be meaningfully reconstituted to ensure that the Board takes the necessary

steps for the Company’s stockholders to realize the maximum value of their investments. We have nominated a slate of highly

qualified and capable candidates who are fully committed to representing the best interests of stockholders. We are therefore seeking

your support at the Company’s upcoming 2020 annual meeting of stockholders scheduled to be held on [___, ___ __. 2020 at

_:__ a.m. ET], at [_______] (including any adjournments or postponements thereof and any meeting which may be called in lieu thereof,

the “Annual Meeting”), for the following purposes:

| 1. | To elect the Stockholder Group’s five (5) director nominees, Andee Harris, Christopher Hutter,

Aldo Mazzaferro, Benjamin Rosenzweig and John P. Schauerman (each a “Nominee” and collectively, the “Nominees”),

to serve until the 2021 annual meeting of stockholders and until their respective successors are duly elected and qualified; |

| 2. | To hold a non-binding advisory vote on the compensation of the Company’s named executive

officers (say-on-pay); |

| 3. | To ratify the Audit Committee’s selection of KPMG, LLP as the Company’s independent

registered public accounting firm for the fiscal year ending December 31, 2020; and |

| 4. | To transact such other business as may properly come before the Annual Meeting. |

This Proxy Statement

is soliciting proxies to elect only our Nominees. Accordingly, the enclosed WHITE proxy card may only be voted for our Nominees

and does not confer voting power with respect to any of the Company’s director nominees. Stockholders who return the WHITE

proxy card will only be able to vote for our five (5) Nominees. See “Voting and Proxy Procedures” below for additional

information. You can only vote for the Company’s director nominees by signing and returning a proxy card provided by the

Company. Stockholders should refer to the Company’s proxy statement for the names, backgrounds, qualifications and other

information concerning the Company’s nominees.

The participants

in this solicitation intend to vote their shares (the “Group Shares”) FOR the election of the Nominees, [FOR/AGAINST]

the non-binding advisory vote on executive compensation, and FOR the ratification of the selection of KPMG, LLP as the Company’s

independent registered public accounting firm for the fiscal year ending December 31, 2020, as described herein. While we currently

intend to vote all of the Group Shares in favor of the election of the Nominees, we reserve the right to vote some or all of the

Group Shares for some or all of the Company’s director nominees, as we see fit, in order to achieve a Board composition that

we believe is in the best interest of all stockholders. We would only intend to vote some or all of the Group Shares for some or

all of the Company’s director nominees in the event it were to become apparent to us, based on the projected voting results

at such time, that by voting the Group Shares we could help elect the Company nominee(s) that we believe are the most qualified

to serve as directors and thus help achieve a Board composition that we believe is in the best interest of all stockholders. Stockholders

should understand, however, that all shares of Common Stock represented by the enclosed WHITE proxy card will be voted at

the Annual Meeting as marked.

The Company has

set the close of business on [__], 2020 as the record date for determining stockholders entitled to notice of and to vote at the

Annual Meeting (the “Record Date”). The mailing address of the principal executive offices of the Company is 4510 Cox

Road, Suite 201, Richmond, Virginia 23060. Stockholders of record at the close of business on the Record Date will be entitled

to vote at the Annual Meeting. According to the Company, as of the Record Date, there were [__] shares of Common Stock outstanding.

This Proxy Statement

and the enclosed WHITE proxy card are first being mailed to stockholders on or about [__________], 2020.

THIS SOLICITATION

IS BEING MADE BY THE STOCKHOLDER GROUP AND NOT ON BEHALF OF THE BOARD OR MANAGEMENT OF THE COMPANY. THE STOCKHOLDER GROUP IS NOT

AWARE OF ANY OTHER MATTERS TO BE BROUGHT BEFORE THE ANNUAL MEETING OTHER THAN AS DESCRIBED HEREIN. SHOULD OTHER MATTERS, WHICH

THE STOCKHOLDER GROUP IS NOT AWARE OF A REASONABLE TIME BEFORE THIS SOLICITATION, BE BROUGHT BEFORE THE ANNUAL MEETING, THE PERSONS

NAMED AS PROXIES IN THE ENCLOSED WHITE PROXY CARD WILL VOTE ON SUCH MATTERS IN THEIR DISCRETION.

THE STOCKHOLDER

GROUP URGES YOU TO SIGN, DATE AND RETURN THE WHITE PROXY CARD IN FAVOR OF THE ELECTION OF THE NOMINEES.

IF YOU HAVE ALREADY

SENT A PROXY CARD FURNISHED BY MANAGEMENT TO THE COMPANY, YOU MAY REVOKE THAT PROXY AND VOTE FOR THE ELECTION OF THE NOMINEES BY

SIGNING, DATING AND RETURNING THE ENCLOSED WHITE PROXY CARD. THE LATEST DATED PROXY IS THE ONLY ONE THAT COUNTS. ANY PROXY

MAY BE REVOKED AT ANY TIME PRIOR TO THE ANNUAL MEETING BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER DATED PROXY FOR

THE ANNUAL MEETING OR BY VOTING IN PERSON AT THE ANNUAL MEETING.

Important Notice Regarding the Availability

of Proxy Materials for the Annual Meeting

This Proxy Statement and our WHITE

proxy card are available at [_____]

IMPORTANT

Your vote is

important, no matter how many shares of Common Stock you own. We urge you to sign, date, and return the enclosed WHITE proxy card

today to vote FOR the election of our Nominees and in accordance with the Stockholder Group’s recommendations on the other

proposals on the agenda for the Annual Meeting.

| · | If your shares of Common Stock are registered in your own name, please sign and date the enclosed

WHITE proxy card and return it to the Stockholder Group c/o Saratoga Proxy Consulting LLC (“Saratoga”) in the

enclosed envelope today. |

| · | If your shares of Common Stock are held in a brokerage account, you are considered the beneficial

owner of the shares of Common Stock, and these proxy materials, together with a WHITE voting form, are being forwarded to

you by your broker. As a beneficial owner, if you wish to vote, you must instruct your broker how to vote. Your broker cannot vote

your shares of Common Stock on your behalf without your instructions. |

| · | Depending upon your broker, you may be able to vote either by toll-free telephone or by the Internet.

Please refer to the enclosed voting form for instructions on how to vote electronically. You may also vote by signing, dating and

returning the enclosed voting form. |

Since only your

latest dated proxy card will count, we urge you not to return any proxy card you receive from the Company. Even if you return the

management proxy card marked “withhold” as a protest against the incumbent directors, it will revoke any proxy card

you may have previously sent to us. Remember, you can vote for our Nominees only on our WHITE proxy card. So please make

certain that the latest dated proxy card you return is the WHITE proxy card.

If you have any questions, require assistance

in voting your WHITE proxy card,

please contact Saratoga at the phone numbers

listed below.

Saratoga Proxy Consulting, LLC

520 8th Avenue, 14th Floor

New York, NY 10018

(212) 257-1311

Stockholders may call toll-free: (888) 368-0379

info@saratogaproxy.com

BACKGROUND TO SOLICITATION

The following is a chronology of material events leading up

to this proxy solicitation:

| · | As an investment firm that seeks to invest in undervalued and underfollowed small capitalization

companies, Privet identified the Company in early 2015 as a company that could potentially meet Privet’s investment criteria.

At this time, Privet began its exhaustive diligence process on the Company. This process was extremely research-intensive in an

effort to build a comprehensive understanding of the Company’s industry, in general, as well as the Company itself and its

position in its industry in relation to its competitors. After completing significant diligence, Privet concluded that the Company

met the firm’s internal investment criteria. |

| · | In September 2015, based on conclusions reached from its diligence, Privet began building a position

in the Company. |

| · | Throughout 2016, representatives of Privet held multiple telephonic calls with Craig C. Bram, the

Company’s President and Chief Executive Officer and a director, to discuss several topics pertaining to the Company, its

operating performance and management’s strategy. |

| · | On September 19, 2016, Privet filed a Schedule 13D with the Securities and Exchange Commission

(the “SEC”) disclosing beneficial ownership of 652,421 shares, representing approximately 7.5% of the Company’s

then outstanding Common Stock, making Privet the Company’s largest stockholder. |

| · | On March 17, 2017, Ryan Levenson, the managing member of Privet Fund Management, met with Mr. Bram

at the Company’s headquarters in Richmond, Virginia to discuss multiple topics pertaining to the Company, its operating performance

and management’s strategy. |

| · | Also on March 17, 2017, after the close of business, Privet filed Amendment No. 1 to its Schedule

13D with the SEC disclosing beneficial ownership of 774,308 shares, representing approximately 8.9% of the Company’s then

outstanding Common Stock. |

| · | On April 3, 2017, Privet filed Amendment No. 2 to its Schedule 13D with the SEC disclosing beneficial

ownership of 948,997 shares, representing approximately 10.9% of the Company’s then outstanding Common Stock. |

| · | On September 7, 2017, Dennis Loughran, the Company’s Chief Financial Officer, sent an email

to Privet representatives reminding them of the Company’s participation in an upcoming investor conference and reiterating

the Company’s full year 2017 Adjusted EBITDA forecast of $17 million. (Note: on March 13, 2018, the Company reported actual

Adjusted EBITDA for full year 2017 of $12.5 million). |

| · | On September 29, 2017, Privet filed Amendment No. 3 to its Schedule 13D with the SEC disclosing

beneficial ownership of 1,066,109 shares, representing approximately 12.2% of the Company’s then outstanding Common Stock. |

| · | On August 10, 2018, the Company issued a press release announcing an “at-the-market”

equity offering whereby it would sell, from time to time, shares of Common Stock up to an aggregate amount of $10 million. The

closing price of the Common Stock on August 9, 2018, prior to this announcement, was $23.88. |

| · | Later on August 10, 2018, Mr. Levenson had a telephonic conversation with Mr. Bram during which

Mr. Levenson expressed concern with the Company’s recently announced $10 million “at-the-market” offering of

equity securities. Mr. Levenson conveyed to Mr. Bram his belief that it was a perfectly opportune time to raise capital, but that

the Company should explore a more conventional capital raising mechanism to ensure a higher certainty of raising its targeted amount

of equity capital. |

| · | On August 11, 2018, Mr. Levenson and Mr. Bram exchanged emails discussing the conversation that

took place the previous day. Mr. Bram defended the Company’s decision to pursue the “at-the-market” offering

due to its lower discount to current share price and his belief that the market for the Company’s shares would continue to

see upward momentum over an extended period of time, enabling the “at-the-market” offering to be effective. |

| · | On October 9, 2018, representatives of Privet met with Mr. Bram in Atlanta, Georgia to discuss

the Company’s strategy, operations and capital allocation priorities. The Privet representatives also gave Mr. Bram more

information about Privet, including providing details on its history and overall strategic objectives. |

| · | On October 31, 2018, Privet and the Company entered into a mutual non-disclosure agreement (the

“NDA”) to facilitate an open dialogue about the financial performance and future prospects of the Company. The NDA

did not include any standstill provisions. |

| · | On November 14, 2018, representatives of Privet met with Messrs. Bram and Loughran, Murray H. Wright,

the Chairman of the Board, and Henry L. Guy, a member of the Board, in Richmond, Virginia to further discuss the Company, its strategic

priorities and the Board’s perspectives with respect to the foregoing. |

| · | On November 16, 2018, the Company terminated its “at-the-market” offering of equity

securities. As of the date of termination, the Company had issued and sold 44,378 shares of Common Stock for aggregate net proceeds

of $1,002,712, compared to the $10 million that the Company had publicly communicated it intended to raise. The closing price of

the Common Stock on November 15, 2018, the day prior to this announcement, was $16.27. |

| · | On December 27, 2018, Privet filed Amendment No. 4 to its Schedule 13D with the SEC disclosing

beneficial ownership of 1,241,070 shares, representing approximately 14.0% of the Company’s then outstanding Common Stock. |

| · | On March 21, 2019, representatives of Privet had a call with Mr. Bram to discuss the Company’s

recent operating results, capital structure decisions and the details of recently announced 2019 guidance. |

| · | On April 18, 2019, Mr. Levenson and Benjamin Rosenzweig, a partner at Privet Fund Management, met

with Messrs. Bram, Wright and Guy at the Company’s headquarters in Richmond, Virginia. At this meeting, Messrs. Levenson

and Rosenzweig stated their belief that the Company possessed valuable assets and that Privet would be interested in potentially

exploring an acquisition of the Company in a consensual, Board-approved transaction at a purchase price of $19.00 per share, a

premium of approximately 29% to the closing price of the Common Stock on April 17, 2019. Messrs. Bram, Wright and Guy indicated

that they would discuss Privet’s interest with the other members of the Board, but that, in their collective opinion, the

indicated potential purchase price was meaningfully too low. |

| · | On April 23, 2019, Privet sent a letter to the Board proposing to acquire all of the outstanding

Common Stock not already owned by Privet for $20.00 per share, in cash, representing a premium of 42% to the closing price of the

Common Stock on April 22, 2019. The proposal was subject to, among other things, the negotiation and execution of a mutually satisfactory

definitive acquisition agreement, regulatory approvals and satisfactory completion of due diligence. The letter stated that, as

the Company’s largest stockholder, Privet was intimately familiar with the Company’s business and operations and would

be able to complete a full diligence review in an expedited timeframe if given access to relevant diligence information. |

| · | Also on April 23, 2019, Privet filed Amendment No. 5 to its Schedule 13D with the SEC disclosing

beneficial ownership of 1,296,070 shares, representing approximately 14.5% of the Company’s then outstanding Common Stock,

and disclosing that it had sent the April 23rd letter to the Board. |

| · | On April 26, 2019, Privet received a letter from Mr. Bram stating the Board’s belief that

Privet’s proposed $20.00 purchase price undervalued the Company. In the letter, Mr. Bram cited the Company’s forecasted

2019 revenue and Adjusted EBITDA of $340 million and $34 million, respectively, as a key reason underlying the Board’s valuation

beliefs. (Note: The Company’s actual FY 2019 Revenue and Adjusted EBITDA were $305.2 million and $13.5 million, respectively,

or 10% and 60% below such guidance). |

| · | On May 23, 2019, Privet sent a letter to the Board reiterating its $20.00 per share acquisition

proposal and its belief that its offer represents a premium value for stockholders. Privet expressed its willingness to receive

additional information and work quickly to complete diligence and reach a definitive acquisition agreement. Privet also committed

to evaluate any additional information that management or its financial advisors may provide that would support a higher value. |

| · | Also on May 23, 2019, Privet filed Amendment No. 6 to its Schedule 13D with the SEC disclosing

it had sent the May 23rd letter to the Board. |

| · | On May 29, 2019, Privet received a letter from Mr. Bram stating that the Company has not been placed

for sale, but Mr. Bram suggested Privet negotiate with the Board to increase its offer price in order to reach a consensual agreement

or it could tender for the Company’s shares at $20.00 per share. Mr. Bram also stated that the Company would make itself

available to respond to certain of Privet’s information requests. |

| · | On June 6, 2019, Privet sent Mr. Bram a detailed list of diligence items that it required in order

to evaluate whether an increased offer was warranted. Privet notified Mr. Bram that it had retained the services of financial and

legal advisory firms to assist with the potential transaction and that Privet was ready to move forward collaboratively with the

Company in completing its due diligence in order to reach a definitive agreement. |

| · | On June 7, 2019, Mr. Bram responded to Privet’s diligence request list by stating that the

Company would be prepared to respond to certain items on the list over the following weeks. |

| · | On June 20, 2019, Privet and its advisors received access to an electronic data room containing

a subset of the diligence items identified in the diligence request list. |

| · | On July 1, 2019, representatives of Privet, including its financial advisors, and the Company held

a telephonic meeting to discuss the Company’s financial information. |

| · | During July 2019, representatives of the Company provided Privet and its financial advisor with

select non-public financials and other information. |

| · | On August 2, 2019, Mr. Bram sent an email to Messrs. Levenson and Rosenzweig stating that the Board

required Privet to make an updated offer to acquire the Company by August 19, 2019. |

| · | On August 19, 2019, Privet sent a letter to the Board updating its previous offer to acquire all

of the outstanding Common Stock not already owned by Privet from $20.00 to $18.50 per share, in cash. The letter noted that, subsequent

to Privet’s initial indication of interest in late April, the Company reduced its 2019 Adjusted EBITDA guidance by nearly

27%, while Privet’s valuation for the Company was only decreasing by 5%.*

Privet also urged the Board to retain a financial advisor in order to assist with the evaluation of Privet’s offer. |

| · | On August 20, 2019, Privet filed Amendment No. 7 to its Schedule 13D with the SEC disclosing beneficial

ownership of 1,221,449 shares, representing approximately 13.6% of the Company’s then outstanding Common Stock, and disclosing

that it had sent the August 19th letter to the Board. |

| · | On August 23, 2019, the Company issued a press release announcing that the Board unanimously rejected

Privet’s proposal and terminated the NDA. The press release also noted that the Company terminated further conversations

with Privet. |

| · | On September 5, 2019, representatives of Privet had a telephonic conversation with Messrs. Bram,

Wright and Guy regarding the Company’s ongoing strategy and value creation plan. |

| · | Over the course of September 2019, representatives of Privet and the Company had discussions regarding

entering into a new non-disclosure agreement regarding certain of the Company’s activities in connection with prospective

investments. Privet engaged in good faith negotiations with the Company, but ultimately the parties were unable to reach agreement

on the terms of a non-disclosure agreement. |

*

Based on firm Enterprise Value.

| · | On October 4, 2019, Mr. Bram sent an email to Messrs. Levenson and Rosenzweig containing materials

relating to the Company’s current analysis and discussions regarding a contemplated future merger with Universal Stainless

and Alloy Products, Inc. (“USAP”), a current portfolio holding of Privet. |

| · | On October 7, 2019, representatives of the Company and Privet had a telephonic conversation to

discuss the potential USAP transaction. |

| · | Throughout October 2019, representatives of Privet had multiple conversations with Mr. Bram relating

to his perceptions about USAP and the perceived merits of a combination between the two companies. |

| · | On October 14, 2019, the Company delivered a public letter to the Chief Executive Officer of USAP,

in which Mr. Bram proposed an all-stock combination between USAP and the Company. |

| · | On November 6, 2019, the Company received a letter from the Chief Executive Officer of USAP. The

letter stated that the Board of Directors of USAP unanimously concluded that the pursuit

of a potential business combination with the Company was not in the best interests of USAP and

its stockholders. |

| · | On November 12, 2019, the Company released its 2019 third quarter earnings results. Excluding net

sales of American Stainless Tubing, LLC (“ASTI”), net sales for the third quarter of 2019 decreased 16.2% compared

to net sales for the third quarter of 2018. Adjusted EBITDA decreased to $2.8 million from $10.3 million for the third quarter

of 2018. The Company lowered its expected full year 2019 Adjusted EBITDA forecast to $15 million, down from the expected $22 million

it had projected just three months earlier and $30 million it had projected approximately six months earlier. |

| · | On November 15, 2019, representatives of the Company and Privet had a telephonic conversation to

discuss the Company’s operating results. On the call representatives of Privet communicated their disappointment with the

deteriorating financial results of the Company. Given Privet’s large ownership position and extensive experience having representatives

successfully serve as board members of its portfolio companies, Mr. Levenson expressed his belief that it would be mutually beneficial

for Privet to enter into an agreement with the Company pursuant to which Privet would be able to designate two members to the Board. |

| · | On November 21, 2019, Mr. Bram sent an email to Messrs. Levenson and Rosenzweig stating that the

Board would be agreeable to adding one person, designated by Privet, to the 2020 slate of directors to be voted on by the stockholders

at the Annual Meeting. However, as a condition to this one person joining the Board at a future date, the Company required Privet

to execute a standstill agreement for a three-year period. Such standstill agreement required Privet to vote its shares in favor

of the Board’s recommendations, limited Privet’s ownership to no more than 15% of the Company’s outstanding shares

of Common Stock and contained additional limitations on Privet’s actions during the term of the proposed agreement. |

| · | On November 22, 2019, the Company announced that it would not be declaring a dividend on the Common

Stock for 2019. This was only the second year in the past twelve years in which the Company did not pay a dividend. |

| · | On December 3, 2019, Mr. Levenson had a telephonic conversation with Mr. Bram during which Mr.

Levenson expressed disappointment at being unable to come to an agreement regarding Board representation for Privet. Mr. Levenson

again reiterated Privet’s belief in the value of all of the Company’s assets, and discussed with Mr. Bram whether the

Board might be amenable to considering an alternative transaction whereby Privet would explore acquiring just the Chemicals unit

of the Company, enabling the Company to focus on its Metals unit, which appeared to Privet to be Mr. Bram’s primary focus. |

| · | On December 6, 2019, Mr. Bram sent an email to Messrs. Levenson and Rosenzweig stating that the

Board discussed Privet’s verbal proposal to explore a purchase of the Chemicals unit. Mr. Bram expressed the Board’s

unanimous belief that it was not the correct time to consider a sale of the Chemicals unit. |

| · | On January 23, 2020, UPG Enterprises began purchasing shares of Common Stock. |

| · | On March 3, 2020, Privet entered into a group agreement (the “Group Agreement”) with

UPG for the purposes of engaging in discussions with the Company regarding ways to enhance stockholder value. |

| · | On March 5, 2020, Privet filed Amendment No. 8 to its Schedule 13D with the SEC disclosing beneficial

ownership of 1,535,507 shares, representing approximately 17.0% of the Company’s then outstanding Common Stock (and an aggregate

of 2,258,908 shares, representing approximately 25.0% of the Company’s then outstanding Common Stock when including shares

held by UPG), and disclosing that it had entered into the Group Agreement. |

| · | Also on March 5, 2020, UPG filed a Schedule 13D with the SEC disclosing beneficial ownership of

723,401 shares, representing approximately 8.0% of the Company’s then outstanding Common Stock (and an aggregate of 2,258,908

shares, representing approximately 25.0% of the Company’s then outstanding Common Stock when including shares held by Privet),

and disclosing that it had entered into the Group Agreement. |

| · | On March 6, 2020, the Company released its 2019 fourth quarter and full year earnings results.

Excluding net sales of ASTI, net sales for the fourth quarter of 2019 decreased 17.4% compared to net sales for the fourth

quarter of 2018. Adjusted EBITDA decreased to $2.5 million from $5.9 million for the fourth quarter of 2018. Adjusted EBITDA

for the full year 2019 was $13.5 million, which was down from the Company’s guidance for the year given on November 12, 2019

of $15 million, down further from the Company’s projection of $22 million made on August 13, 2019 and down even further from

the Company’s projection of $30 million made on April 30, 2019. In total, a 55% Adjusted EBITDA miss to original guidance

in approximately eight months. |

| · | On March 16, 2020, Privet, UPG and the Nominees entered into a Joint Filing and Solicitation Agreement

(the “Joint Filing and Solicitation Agreement”), which superseded the Group Agreement, pursuant to which the parties

agreed, among other things, to (i) form a group with respect to the securities of the Company, (ii) solicit proxies for the election

of the Nominees at the Annual Meeting and (iii) split expenses incurred in connection with the group’s activities between

Privet and UPG based on each of Privet’s and UPG’s pro rata ownership percentage of shares of Common Stock, as adjusted

each month. |

| · | Later on March 16, 2020, Privet Fund delivered a letter (the “Nomination Letter”) to

the Company, in accordance with its organizational documents, nominating the Nominees for election to the Board at the Annual Meeting. |

| · | On March 18, 2020, the Stockholder Group issued a press release announcing the nomination of the

Nominees for election to the Board at the Annual Meeting and explaining its belief why meaningful change to the Board is required.

Also on March 18, 2020, Privet filed Amendment No. 9 to its Schedule 13D and UPG filed Amendment No. 1 to its Schedule 13D, respectively,

with the SEC disclosing the delivery of the Nomination Letter and the issuance of the press release. |

| · | On March 20, 2020, the Stockholder Group filed its preliminary proxy statement with the SEC. |

REASONS FOR THE SOLICITATION

WE BELIEVE THAT IMMEDIATE AND WHOLESALE CHANGE

IS NEEDED ATOP SYNALLOY

As Synalloy’s largest

stockholder with combined ownership of approximately 24.8% of the Company’s outstanding Common Stock, the Stockholder

Group has a vested interest in enhancing value for all stockholders. In our view, Synalloy’s high-quality assets, skilled

workforce and established supply chain should be the foundation of long-term value creation—not the prolonged underperformance

delivered by the Company’s current leadership. After several years of disappointing results, we feel it is abundantly clear

that the incumbent Board and Chief Executive Officer Craig Bram have failed—despite their lengthy tenures—to unlock

Synalloy’s considerable potential.

It is critical to stress

that the Stockholder Group did not reach these conclusions in a hasty or rash manner. We have expended a significant amount of

time and effort in recent years thoroughly analyzing Synalloy’s strategic priorities, operational execution, capital allocation

decisions, competitive landscape, corporate culture and governance. We have spent years as a large, outside stockholder trying

to engage with Synalloy’s leadership about approaches for unlocking the Company’s full potential. When it became clear

to us that meaningful strategic and operational change would be required in order to improve performance, we offered to acquire

the Company at a premium price in order to create value for stockholders.1

Rather than thoughtfully pursuing potentially value-maximizing strategic alternatives or overhauling the management team, the incumbent

Board maintained the status quo as operating results continued to deteriorate and tremendous stockholder value has been squandered.

Given that the Board is

comprised primarily of individuals with limited operating experience across the steel, metals and chemicals verticals, we do not

find it surprising that the current mix of directors has failed to properly oversee strategic initiatives, establish and achieve

performance metrics or hold management accountable. Our objective analysis of Synalloy, coupled with our collective experience

owning and managing successful related businesses, leads us to believe that immediate change in the boardroom and a new strategic

direction are needed.

We

believe stockholders deserve directors who collectively possess the objectivity, perspective and qualifications to make decisions

that are in the best interests of stockholders, and whom they can trust to lead a turnaround at Synalloy. That is why

Privet and UPG have formed the Stockholder Group – to focus on one path forward: overhauling Synalloy’s Board

and implementing a superior operating strategy and a revitalized corporate culture that can produce long-term, sustainable value.

As a result, we are seeking

your support to elect our highly-qualified, five-member slate of directors at the Annual Meeting. Our Nominees will bring substantial

relevant experience and deep industry expertise to the Board and are committed to acting in the best interests of all stockholders.

If elected, they are prepared to immediately begin executing on a tactical operating plan for Synalloy that we believe can dramatically

increase margins, grow cash flows and improve returns on incremental invested capital.

1

See Privet Fund’s 13D/A filed on April 23, 2019. (Note: On April 23, 2019, Privet offered to acquire all of the

outstanding Common Stock of Synalloy for $20.00 per share, in cash, representing a premium of 42%. Once rejected by the

Company (and following a meaningful reduction in the Company’s 2019 operating results outlook), Privet offered at a

later date to acquire all of the outstanding Common Stock for $18.50 per share.)

We

Are Deeply Concerned With the Company’s Poor Financial Performance Under the Incumbent Board and Management Team, Particularly

Mr. Bram

Synalloy’s

total stockholder return (“TSR”) figures have dramatically lagged the Company’s proxy peer group and closest

direct peer group over several time horizons. In addition, the Company’s TSR dramatically lags relevant equity indices throughout

Mr. Bram’s tenure as Chief Executive Officer.

| SYNALLOY TSR1 | |

| |

| |

| |

|

| | |

| 1 Year | | |

| 3 Year | | |

| 5 Year | | |

| CEO Tenure4 | |

| | |

| | | |

| | | |

| | | |

| | |

| NASDAQ 100 Non-Financial | |

| 38.8 | % | |

| 83.7 | % | |

| 118.7 | % | |

| 322.1 | % |

| Russell 2000 | |

| 24.8 | % | |

| 27.2 | % | |

| 49.1 | % | |

| 142.2 | % |

| Proxy Group2 | |

| 13.2 | % | |

| 17.3 | % | |

| 19.4 | % | |

| 57.6 | % |

| Closest Direct Peers Group3 | |

| 13.0 | % | |

| (5.6 | %) | |

| 22.3 | % | |

| 54.1 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Synalloy Corporation | |

| (18.4 | %) | |

| 20.2 | % | |

| (22.2 | %) | |

| 28.7 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Over/(Underperformance) vs. NASDAQ 100 Non-Financial | |

| (57.2 | %) | |

| (63.5 | %) | |

| (140.9 | %) | |

| (293.4 | %) |

| Over/(Underperformance) vs. Russell 2000 | |

| (43.2 | %) | |

| (7.0 | %) | |

| (71.3 | %) | |

| (113.5 | %) |

| Over/(Underperformance) vs. Proxy Group | |

| (31.7 | %) | |

| 2.9 | % | |

| (41.6 | %) | |

| (28.9 | %) |

| Over/(Underperformance) vs. Closest Direct Peers Group | |

| (31.4 | %) | |

| 25.9 | % | |

| (44.5 | %) | |

| (25.4 | %) |

Source: Bloomberg

1. Performance as of 12/31/2019,

prior to UPG and Privet’s meaningful share accumulation and the global market turmoil caused by the COVID-19 coronavirus,

adjusted for dividends.

2. The “Proxy Group”

consists of companies used in the Company’s 2019 proxy statement to set executive compensation.

3. The “Closest Direct

Peers Group” includes WOR, USAP, ZEUS, IIIN, NWPX, RYI (since IPO in 2014), HWKN, VNTR (since IPO in 2017), TREC and NGVT

(since IPO in 2016).

4. Mr. Bram became Chief Executive

Officer in 2011.

Given

the historic economic growth and equity market appreciation over the periods in which we measured Synalloy’s TSR, we imagine

many stockholders are confounded by this underperformance. We firmly believe that

these dismal results largely stem from Mr. Bram’s inability to oversee the execution of a viable strategy and the Board’s

failure to hold the management team accountable. We feel that a reconstituted Board, comprised of directors with the right blend

of operational knowledge, oversight experience and financial expertise, is required to ensure proactive steps are taken to reverse

the Company’s troubled history of underperformance.

We

Are Deeply Concerned With the Company’s Track Record of Weak Operational Execution

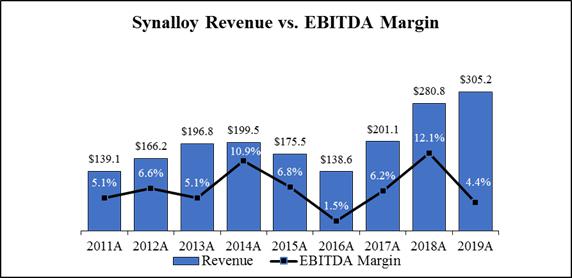

We believe that all stockholders

should be alarmed by Synalloy’s history of producing extremely inconsistent and poor results over a prolonged period of time.

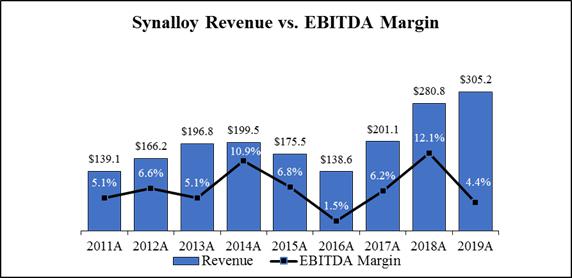

As shown in the following chart, Synalloy’s adjusted earnings before interest, taxes, depreciation and amortization (“Adjusted

EBITDA”) margins have not increased since Mr. Bram became the Chief Executive Officer in January 2011.2

Note: $ figures in millions.

Synalloy’s margin erosion took place even

though the Company has cumulatively allocated $160 million toward capital expenditures and acquisitions since 2011.3

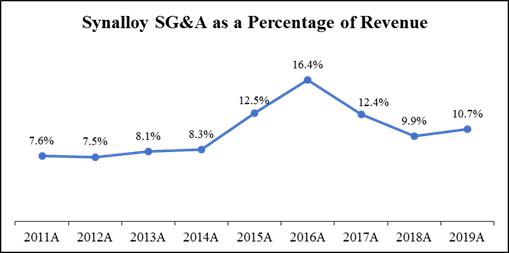

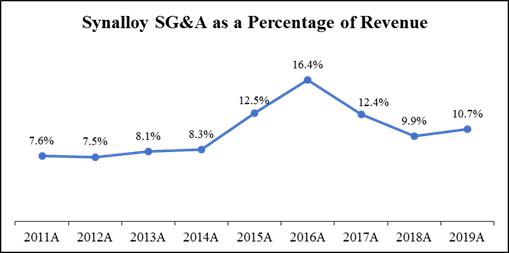

We believe these

margin issues are driven, in large part, by a bloated corporate expense structure that the Board has failed to curb. Selling,

general and administrative expenses (“SG&A”) as a percentage of revenue continues to rise even as Synalloy

shifts toward what is essentially a “holding company” structure.4

The structure is supposed to allow for acquisitions of businesses capable of operating on their own. Unfortunately, we have

found few instances in which these businesses have garnered any material benefit from leveraging a (consistently rising)

corporate cost base.

2

Source: Company filings.

3

Source: Company filings.

4

Source: Company filings.

In the year prior to Mr.

Bram’s appointment, the Company’s annual “unallocated corporate expenses” stood at $1.5 million.5

In the nine subsequent years, these “unallocated corporate expenses” have steadily ballooned and totaled $8.4 million

in 2019.6 In our view, management

has not only failed to improve expense management across the Company’s business units, but it has effectively added costs

at an exponentially higher rate than it has added revenue.

In the face of this margin

deterioration and explosive growth in corporate expenses, we have yet to see any evidence that the Board is capable of taking effective

action to create an operational improvement plan or hold management accountable for this waste of stockholders’ capital.

We believe this is clear evidence of the Board’s inability to impact the business for the benefit of stockholders and is

representative of the corporate malaise that must be reversed at Synalloy.

5

Source: Company filings.

6

Source: Company filings.

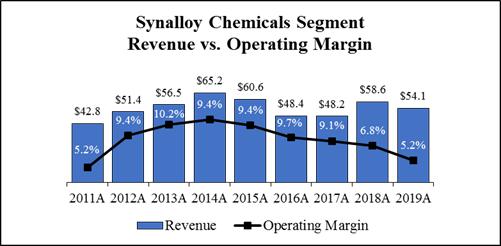

We Are Deeply Concerned That the Company’s

Chemicals Segment Has Been Orphaned and Cannot Recognize its Full Potential Under Present Leadership

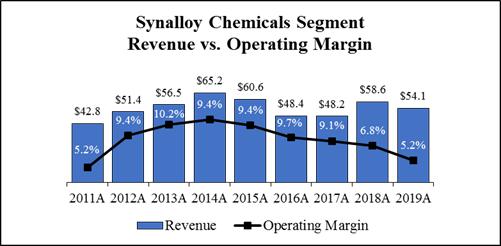

In addition to failing to drive operational improvements across

Synalloy’s business units, we believe that Mr. Bram and the Board have been overconsumed with transaction activity and opportunities

related to the Company’s Metals Segment. Meanwhile, the Company’s Chemicals Segment has failed to create any demonstrable

value in the form of revenue or earnings growth over the past nine years.7

Note: $ figures in millions.

We believe that Synalloy’s

Chemicals Segment is a tremendous asset. Mr. Bram has acknowledged this in the past, noting that the Chemicals Segment is extremely

stable, with little cyclicality and meaningful long-term relationships with large, well-capitalized customers.8

However, following a sizable capital expansion in 2012 and the acquisition of CRI Tolling, LLC in 2013, the Chemicals Segment’s

margins have steadily eroded, culminating in a significant decline over the past two years even though revenue has remained roughly

in-line with historical averages.9

We feel strongly that the Chemicals Segment is full of untapped

potential and presents a prime opportunity for value creation with proper oversight from a more capable leadership team.

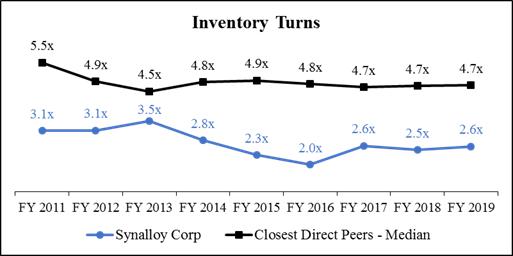

We Are Deeply Concerned With the Company’s

Apparent Inability to Effectively Manage its Supply Chain and Working Capital in the Metals Segment

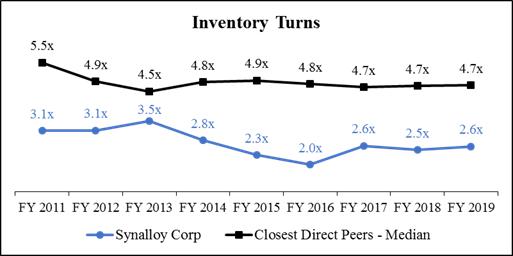

We believe that tight controls over working capital and the

supply chain are essential to generating acceptable margins in the metals industry. Unfortunately, since Mr. Bram took over in

2011, the Company has consistently and dramatically underperformed its peers when it comes to managing inventory.10

We find this especially troubling given inventory represents the largest component of the Company’s working capital.

7

Source: Company filings.

8

Mr. Bram has even used the term “steady Eddie” to describe his view of the Chemicals business in public

presentations. See “Synalloy Corporation Management Interview“ from April 11, 2018.

9

Source: Company filings.

10

Source: Company filings, Peer Group filings, Bloomberg.

Note: “Closest Direct Peers”

includes WOR, USAP, ZEUS, IIIN, NWPX, RYI (since IPO in 2014), HWKN, VNTR (since IPO in 2017), TREC and NGVT (since IPO in 2016).

By only turning its inventory approximately two-and-a-half

times per year over the past nine years, the Company has been dramatically more exposed to fluctuations in raw material prices

than its peers.11

This is apparent in the Company’s financial statements, in which it explicitly calls out the effect of changes in commodity

prices on its operating earnings. Through the Company’s inability to efficiently manage its inventory combined with its seeming

unwillingness to expend the necessary capital to effectively hedge its commodity exposure, Synalloy has incurred substantial losses

attributable to inventory price changes over Mr. Bram’s tenure. We believe this represents further evidence of poor leadership

and insufficient foresight.

11 Since the Company turns its inventory at a lower rate than

competitors, the Company’s inventory components are held on its balance sheet for longer periods of time prior to sale than

those of its closest direct peers, thereby increasing the Company’s exposure to commodity price fluctuations.

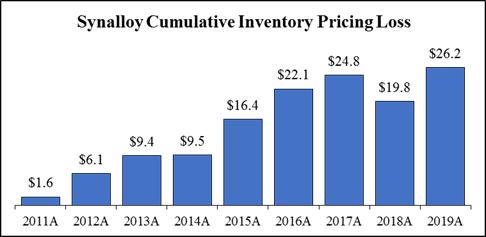

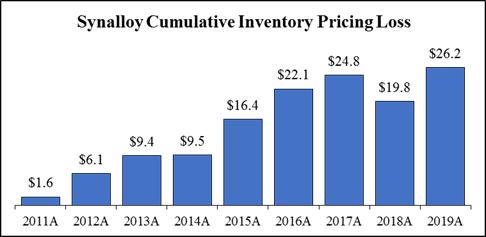

Note: $ figures in millions.

We believe the cumulative

amount of Synalloy’s earnings that have been lost to inventory pricing is staggering, representing more than 21%

of total reported Adjusted EBITDA over the previous nine years.12

Just as alarming, the Company

has claimed inventory pricing losses due to commodity fluctuations in eight of the previous nine years that Mr. Bram has been in

charge. If, as Mr. Bram continually posits, commodity price fluctuations (mainly Nickel) ultimately determine whether the Company

sees a profit or a loss in its financial statements, we are unable to reconcile the Company claiming losses in eight of the past

nine years when the price of the Nickel commodity has risen in four of those same nine years. We question why the incumbent Board

has remained idle as the management team continues to incur losses under nearly every commodity price environment due to its haphazard

inventory management approach.

We

feel the incumbent Board has proven over the years that it lacks either the ability or willingness to take corrective action with

respect to the Company’s inventory position, which has had a destructive effect on the Company’s financial results.

It is evident to us that if operating losses resulting from working capital mismanagement are allowed to persist, stockholders

will continue to suffer.

12

Source: Company filings.

We Are Deeply Concerned With the Company’s

Record of Capital Allocation Decisions

We believe Synalloy’s

track record of capital allocation reveals excessive, debt-fueled spending combined with mismanagement of valuable assets that

management has been unable to profitably oversee. As a self-described “growth” company, Synalloy has been incredibly

acquisitive in order to produce revenue growth.13

Unfortunately, due to the plethora of operational issues outlined above, revenue growth through acquisitions and capital expenditures

has not translated to material income growth or value creation for stockholders.

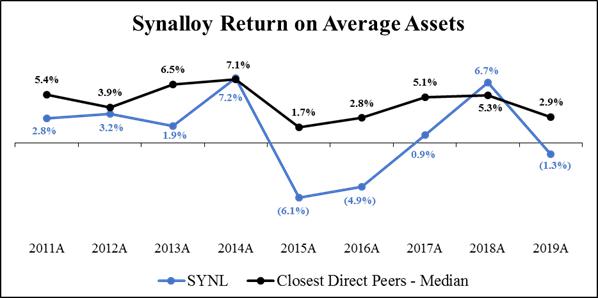

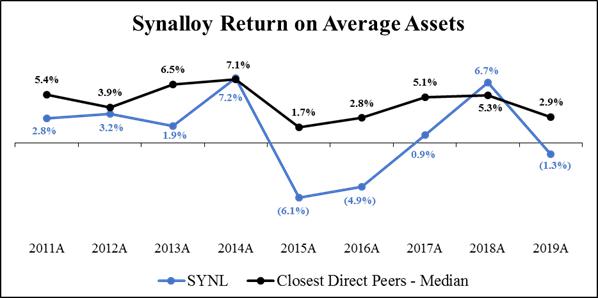

Because Mr. Bram and the

management team have primarily focused their energy on becoming a larger enterprise while, in our view, not possessing the relevant

skillsets necessary to effectively operate metals and chemicals businesses, the Company’s returns on both assets and invested

capital have markedly deteriorated over the past nine years.14

Note: “Closest Direct Peers”

includes WOR, USAP, ZEUS, IIIN, NWPX, RYI (since IPO in 2014), HWKN, VNTR (since IPO in 2017), TREC and NGVT (since IPO in 2016).

13 Since Mr. Bram became CEO in January of 2011, the Company has

acquired Palmer of Texas Tanks, Inc., CRI Tolling, LLC, Specialty Pipe and Tube, Inc., Marcegaglia stainless assets, Marcegaglia

galvanized assets and American Stainless Tubing, Inc.

14

Source: Company filings, Peer Group filings, Bloomberg.

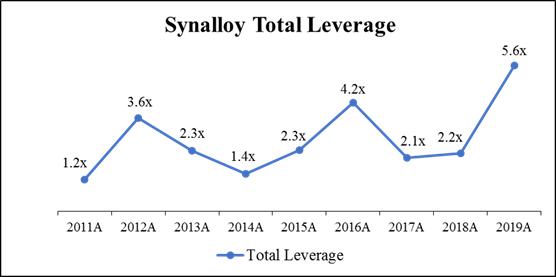

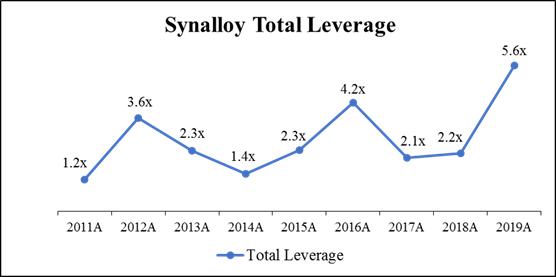

We are also troubled by

the fact that, due to Synalloy’s poor execution of its “holding company” strategy, the Company has been unable

to improve—or even maintain—the operating record of most of its acquired businesses. This has caused the credit profile

of the Company to deteriorate as leverage continues to increase.15

Whether

viewed through the lens of share price performance, operating performance or return on capital invested, the reality is that Synalloy’s

results have been abysmal. The facts and figures associated with Synalloy’s lost decade only reinforce our view that

the Board and management must be held to account by stockholders at this year’s Annual Meeting for their substantial underperformance.

We hope all stockholders can concur with us that reckless spending on acquisitions and top-line growth is not a real strategy,

especially when both management and the Board have exposed themselves, in our view, as ill-equipped operators.

15

Source: Company filings.

WE

BELIEVE A SOLUTION EXISTS TO CREATE VALUE FOR ALL SYNALLOY STOCKHOLDERS

We

Have Recruited a Slate of Highly-Qualified Industry Experts and Operators to Implement a Value-Enhancing Plan That We Believe Will

Restore Stockholder Confidence and Unlock Value

In

contrast to the incumbent Board and management team, our Nominees–Andee Harris, Christopher Hutter, Aldo Mazzaferro, Benjamin

Rosenzweig and John P. Schauerman–collectively possess proven cross-sector operating experience, deep capital allocation

and transaction expertise, strong governance knowledge from previous public and private company directorships and significant alignment

of interests with stockholders. Given the prolonged period of underperformance and reckless spending overseen by the incumbent

directors, we believe that a meaningful change to the Board best positions the Company to effectively realize its potential. Our

slate can also ensure that Synalloy’s success or failure is no longer inextricably linked to the questionable decisions of

one underperforming executive: Mr. Bram.

While

Mr. Bram and the Board may try to enact incremental improvements now that an election contest has begun, we firmly believe that

our highly-qualified slate of director Nominees has superior qualifications and perspectives for turning around Synalloy:

Andee

Harris is currently the Founder and Chief Executive Officer of Franklin Heritage,

LLC, a private equity firm that invests in cutting-edge technology and manufacturing companies. She previously served as the Chief

Executive Officer of a fast-growing performance management software company successfully sold to a private equity firm. We believe

her background and skillset are ideal for Synalloy’s Board:

- Extensive business-to-business sales generation and marketing

experience stemming from previous senior-level roles at companies of various sizes.

- Deep expertise when it comes to helping address management-level

and organizational inefficiencies based on prior employee engagement and human capital management responsibilities.

- Proven track record as a c-level executive and an investor

in both tech-oriented businesses and manufacturers.

- We believe the Board has failed to hold management

accountable and create a coherent corporate culture to fuel organic growth. As such, we feel that Ms. Harris would fill multiple

gaps in the boardroom if she were to be elected.

Christopher Hutter is the Co-Founder

and Manager of UPG Enterprises, which is a successful high-growth operator of eight premier industrial companies across the metals,

manufacturing, distribution and logistics sectors. We believe his background and skillset are ideal for Synalloy’s Board:

- Demonstrated business builder and organizational leader

that has grown UPG Enterprises’ annual revenues to more than $725 million since its inception in 2014.

- Significant operational knowhow and management capabilities

across industrial segments, particularly steel and metals.

- Diverse c-level experience spanning areas that include corporate

strategy, operations management, mergers and acquisitions, logistics and warehousing and supply chain optimization.

- Given the perceived limited experience and expertise

possessed by the Board across the sectors in which Synalloy operates, we feel that Mr. Hutter and his exceptional operational capabilities

will be valuable additions to the Board if he is elected.

Aldo Mazzaferro

is the Managing Partner and Director of Research at Mazzaferro Research, LLC, a steel industry research boutique firm that

he founded in 2017 after spending decades as a top metals analyst and industry executive. We

believe his background and skillset are ideal for Synalloy’s Board:

| · | Exceptionally vast knowledge of the steel and metals segments

based on many years of tangible experience as a research analyst, portfolio manager and corporate executive. |

| · | Unique perspectives and expertise when identifying developments,

trends, fluctuations, cycles and hedging opportunities across the steel and metals markets. |

| · | Sector-specific executive experience as a chief financial

officer with responsibility for measuring, assessing and improving corporate performance. |

| · | Given the Board’s seeming inability to address

the Metals Segment’s margin deterioration and effectively manage commodity exposure, we feel that Mr. Mazzaferro and his

exceptional steel and metals background will represent important additions to the Board if he is elected. |

Benjamin Rosenzweig is a

Partner at Privet Fund Management, an investment firm focused on event-driven and value-oriented investments in small capitalization

companies, and a proven public company director. We believe his background and skillset

are ideal for Synalloy’s Board:

| · | Significant experience investing in business-to-business

companies and then playing an active role in helping them improve their capital allocation policies, balance sheet and financial

management and strategic decision-making. |

| · | Robust corporate governance expertise based on service

on numerous public and private company boards of directors, including multiple manufacturing companies. |

| · | Strong background leading and working on mergers

and acquisitions, restructurings and refinancing situations, strategic board-level reviews and turnaround plans. |

| · | In our view, the Board has failed to enact an effective

capital allocation policy and lacks a viable strategy for enhancing stockholder value. We feel that Mr. Rosenzweig, a representative

of the Company’s largest stockholder, and his financial and strategic acumen will add important value to the Board if he

is elected. |

John P. Schauerman is a private

investor after most recently serving as Executive Vice President of Corporate Development at Primoris Services Corporation (NASDAQ:

PRIM), a specialty construction and infrastructure company. We believe his background

and skillset are ideal for Synalloy’s Board:

| · | Strong operational, financial, corporate development

and strategic planning expertise gained from c-level executive roles and directorships at construction and infrastructure companies. |

| · | Wide-ranging corporate governance experience as

a result of service on several private and public company boards of directors across business-to-business sectors. |

| · | Proven record of helping companies catalyze organic growth, generate new business opportunities

and execute on mergers and acquisitions. |

| · | We believe the Board has exhibited an inability

to effectively integrate new acquisitions and displayed a lack of business generation and operational acumen. As a result, we feel

that Mr. Schauerman would fill important voids in the boardroom if he were to be elected. |

We believe so much in

the future value-creation opportunity at Synalloy that we have invested meaningful amounts of capital in the Company and are now

its largest stockholders by a wide margin. Our five-member slate has already begun working as a unit to develop a near-term operating

plan and long-range strategy that we are confident will enhance stockholder value. We are focusing on initiatives that members

of our slate have already successfully implemented at other companies and believe will improve operational effectiveness and address

Synalloy’s underperformance. We intend to release our comprehensive vision for a stronger Synalloy in the weeks ahead.

PROPOSAL ONE

ELECTION OF DIRECTORS

The Board is currently

composed of eight (8) directors, each with terms expiring at the Annual Meeting. We are seeking your support at the Annual Meeting

to elect our five (5) Nominees in opposition to the Company’s director nominees. If all five (5) of the Nominees are elected,

such Nominees will represent a majority of the members of the Board. In the event that our director Nominees comprise less than

a majority of the Board following the Annual Meeting, there can be no assurance that any actions or changes proposed by our Nominees

will be adopted or supported by the full Board.

THE NOMINEES

The following information

sets forth the name, age, business address, present principal occupation, and employment and material occupations, positions, offices,

or employments for the past five (5) years of each of the Nominees. The nomination was made in a timely manner and in compliance

with the applicable provisions of the Company’s governing instruments. The specific experience, qualifications, attributes

and skills that led us to conclude that the Nominees should serve as directors of the Company is set forth above in the section

entitled “Reasons For Our Solicitation” and below. This information has been furnished to us by the Nominees. All of

the Nominees are citizens of the United States of America.

Andee Harris,

age 46, is the Founder and Chief Executive Officer of Franklin Heritage, LLC, a private equity firm that invests in cutting-edge

technology and manufacturing, which she founded in December 2019. Ms. Harris has also served as an Adjunct Professor at Northwestern

University’s Kellogg School of Management, where she teaches a course on launching and leading startups, since March 2020.

From December 2017 to December 2019, Ms. Harris served as the Chief Executive Officer of HighGround Enterprise Solutions, Inc.,

an employee engagement, recognition and performance management software company, after previously serving as its Chief Operating

and Engagement Officer from April 2016 to December 2017. Prior to that, Ms. Harris served as a Senior Vice President at The Marcus

Buckingham Company, a performance management and coaching software company, from October 2015 to March 2016, where she played a

key role in its sale to Automatic Data Processing, Inc. From 2013 to October 2015, Ms. Harris served as Chief Revenue Officer of

Syndio Social Inc., a social network and people analytics software company. From 2011 to 2013, Ms. Harris held several roles with

Emtec, Inc. (“Emtec”), an IT consulting firm, including Chief Marketing Officer, Managing Director and Senior Vice

President of Human Capital Management Strategy. Ms. Harris joined Emtec upon its acquisition of Emerging Solutions, LLC, a software

services company where she served as a founding partner, Head of Sales and Marketing and Chief Operating Officer, from 1999 until

2011. Ms. Harris began her career in 1996 as a consultant at Accenture plc (NYSE: ACN), an international professional services

company. Ms. Harris has earned a number of professional recognitions, including being named as a Prominent Woman in Technology

by the Illinois Technology Association from 2015 – 2017 and as a Notable Woman in Manufacturing by Crain’s Chicago

Business in 2020. Ms. Harris holds a B.A. from the University of Michigan in Organizational Psychology and a Certification as an

Executive Coach from Columbia University.

We believe that

Ms. Harris’ extensive executive leadership experience, together with her expertise in technology, business services and manufacturing,

will make her a valuable addition to the Board.

Christopher Hutter,

age 40, has served as Co-Founder and Manager of UPG Enterprises LLC (f/k/a Union Partners I LLC), an operator of a diverse set

of industrial companies focused on metals, manufacturing, distribution and logistics, since its founding in August 2014. At UPG

Enterprises, Mr. Hutter oversees operations and growth initiatives at the holding company and portfolio company level, and has

extensive experience in large scale acquisitions, transaction structuring and business operations and integration across a broad

spectrum of industries. Previously, Mr. Hutter served as the Managing Director and CFO of InSite Real Estate, L.L.C., a private

investment holding company focused on warehousing, development, logistics and transportation across North America and Europe, from

2008 to 2014. Mr. Hutter graduated cum laude from University of Illinois with a Bachelor of Science degree in Finance and

earned a Master of Business Administration in Finance from Lewis University.

We believe that

Mr. Hutter’s significant industry knowledge and perspective as a stockholder of the Company will make him a valuable addition

to the Board.

Aldo Mazzaferro,

age 66, serves as the Managing Partner and Director of Research at Mazzaferro Research, LLC, a steel industry research boutique

firm, which he founded in October 2017. Prior to this, he served as the Senior Steel & Metals Research Analyst and a Managing

Director during his tenure at Macquarie Capital (USA) Inc., an investment banking company, from 2011 to September 2017. Previously,

Mr. Mazzaferro served as a Senior Steel, Metals & Mining Analyst at Burke & Quick Partners LLC, an agency brokerage firm

that provides portfolio management, financial planning and advisory services, in 2011, as Chief Financial Officer of Steel Development

Company, LLC, a start-up steel company, from 2008 to 2011, and as Vice President in the Global Investment Research Group at The

Goldman Sachs Group, Inc. (NYSE:GS), a multinational investment banking and securities firm, from 2000 to 2008. From 1998 to 2000,

he served as Portfolio Manager and Analyst at Anvil Capital Management, LLC, a hedge fund focused on steel, metals, capital goods

and energy, which he co-founded. Prior to that, he served as a Director and Senior Steel Industry Analyst at Deutsche Morgan Grenfell,

Inc., the former securities and investment banking subsidiary of Deutsche Bank AG (NYSE: DB), from 1987 to 1998. From 1985 to 1987,

he served as a Research Analyst in the Cyclicals Group at J. & W. Seligman & Co., an investment firm. Mr. Mazzaferro began

his career in 1981 as an Equity Research Analyst in the Steel and Industrials Group at Standard & Poor’s Corp., a financial

services company. Mr. Mazzaferro is a CFA charterholder. He earned his BA in English from Holy Cross College and an MBA in Finance

from Northeastern University.

We believe that

Mr. Mazzaferro’s extensive experience and exceptional understanding of the metals industry, coupled with his deep knowledge

of the capital markets, will make him a valuable addition to the Board.

Benjamin Rosenzweig,

age 34, currently serves as a Partner at Privet Fund Management LLC, an investment firm focused on event-driven, value-oriented

investments in small capitalization companies, having joined the firm in September 2008. Prior to that, Mr. Rosenzweig served as

an Investment Banking Analyst in the corporate finance group of Alvarez & Marsal, a global professional services firm, from

2007 to 2008, where he completed multiple distressed mergers and acquisitions, restructurings, capital formation transactions and

similar financial advisory engagements across several industries. Mr. Rosenzweig currently serves as a director of each of Potbelly

Corporation (NASDAQ: PBPB), a restaurant chain (since April 2018), PFSweb, Inc. (NASDAQ: PFSW), a global commerce service provider

(since May 2013), Cicero Inc. (OTC: CICN), a provider of desktop activity intelligence (since February 2017), and Hardinge Inc.

(formerly NASDAQ: HDNG), a global designer, manufacturer and distributor of machine tools (since October 2015). Previously, Mr.

Rosenzweig served as a director of each of StarTek, Inc. (NYSE: SRT), a global business process management company, from May 2011

to December 2018, and RELM Wireless Corporation (n/k/a BK Technologies Corporation) (NYSEAMERICAN: BKTI), a manufacturer of wireless

communications equipment, from September 2013 to September 2015. Mr. Rosenzweig graduated magna cum laude from Emory University

with a Bachelor of Business Administration degree in Finance and a second major in Economics.

We believe that

Mr. Rosenzweig’s significant public company board experience and financial expertise makes him well qualified to serve on

the Board.

John P. Schauerman,

age 63, is currently a private investor after most recently serving as Executive Vice President of Corporate Development of Primoris

Services Corporation (“Primoris”) (NASDAQ:PRIM), a specialty construction and infrastructure company, from February

2009 to December 2012, where he was responsible for developing and integrating Primoris’ overall strategic plan, including

the evaluation and structuring of new business opportunities and acquisitions. Prior to that, Mr. Schauerman served as Primoris’

Chief Financial Officer from February 2008 to February 2009, during which time Primoris went public through a merger with Rhapsody

Acquisition Corp. Mr. Schauerman has served as a director of Primoris since November 2016 and also previously served as a director

of the company from July 2008 to May 2013, and as a director of its predecessor entity, ARB, Inc. (“ARB”), from 1993

to July 2008. Mr. Schauerman joined ARB in 1993 as Senior Vice President, and, prior to that, served as Senior Vice President of

Wedbush Morgan Securities, Inc., a regional investment bank focused on financing activities for middle market companies (n/k/a

Wedbush Securities, Inc.). Mr. Schauerman has served as a director of Allegro Merger Corp (NASDAQ:ALGR), a blank check investment

company, since July 2018. Previously, Mr. Schauerman served as a director of each of MYR Group Inc. (NASDAQ: MYRG), a holding company

of specialty electrical construction service providers, from March 2016 through November 2016, Harmony Merger Corp. (formerly NASDAQ:HRMNU),

a former blank check investment company, from March 2015 through July 2017, Quartet Merger Corporation (formerly NASDAQ:QTETU),

a former blank check company, from November 2013 to October 2014, and Wedbush Securities, Inc., a leading financial services and

investment firm, from August 2014 through February 2018. Mr. Schauerman is a member of the Dean’s Executive Board of the

UCLA School of Engineering. Mr. Schauerman holds an MBA in Finance from Columbia University and a B.S. in Electrical Engineering

from the University of California, Los Angeles.

We believe that

Mr. Schauerman’s financial and operational expertise coupled with his public company board experience would make him a valuable

addition to the Board.

The principal business

address of Ms. Harris is 200 South Wacker Drive, Suite 2650, Chicago, Illinois 60606. The principal business address of Mr. Hutter

is 1400 16th Street, Suite 250, Oak Brook, Illinois 60523. The principal business address of Mr. Mazzaferro is 15 Midwood

Road, Stony Brook, New York 11790. The principal business address of Mr. Rosenzweig is 79 West Paces Ferry Road, Suite 200B, Atlanta,

Georgia 30305. The principal business address of Mr. Schauerman is 6488 E. Gainsborough Road, Scottsdale, Arizona 85251.

As of the date hereof,

Mr. Hutter does not directly own any securities of the Company. Mr. Hutter, as a manager of UPG Enterprises, may be deemed the

beneficial owner of the 723,401 shares of Common Stock directly owned by UPG Enterprises, as further explained elsewhere in this

Proxy Statement.

As of the date hereof,

Ms. Harris and Messrs. Mazzaferro, Rosenzweig and Schauerman do not own beneficially any securities of the Company and have not

entered into any transactions in securities of the Company during the past two years

Each of the Nominees

may be deemed to be a member of a “group” for the purposes of Section 13(d)(3) of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”). Each of the Nominees specifically disclaims beneficial ownership of shares of Common

Stock that he or she does not directly own. For information regarding purchases and sales during the past two (2) years by the

members of the Group of securities of the Company, see Schedule I.

On March 3, 2020,

Privet and UPG entered into the Group Agreement. Pursuant to the Group Agreement, Privet and UPG agreed, among other things, to

form a group for the purpose of engaging in discussions with the Company regarding means to enhance stockholder value. On March

16, 2020, Privet, UPG and the Nominees (collectively, the “Group”) entered into the Joint Filing and Solicitation Agreement,

which superseded the Group Agreement. Pursuant to the Joint Filing and Solicitation Agreement, the parties agreed, among other