UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of The Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

SYNALLOY CORPORATION |

(Name of Registrant as Specified in Its Charter) |

PRIVET FUND LP PRIVET FUND MANAGEMENT LLC RYAN LEVENSON UPG ENTERPRISES LLC PAUL DOUGLASS CHRISTOPHER HUTTER ANDEE HARRIS ALDO MAZZAFERRO BENJAMIN ROSENZWEIG JOHN P. SCHAUERMAN |

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials: |

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

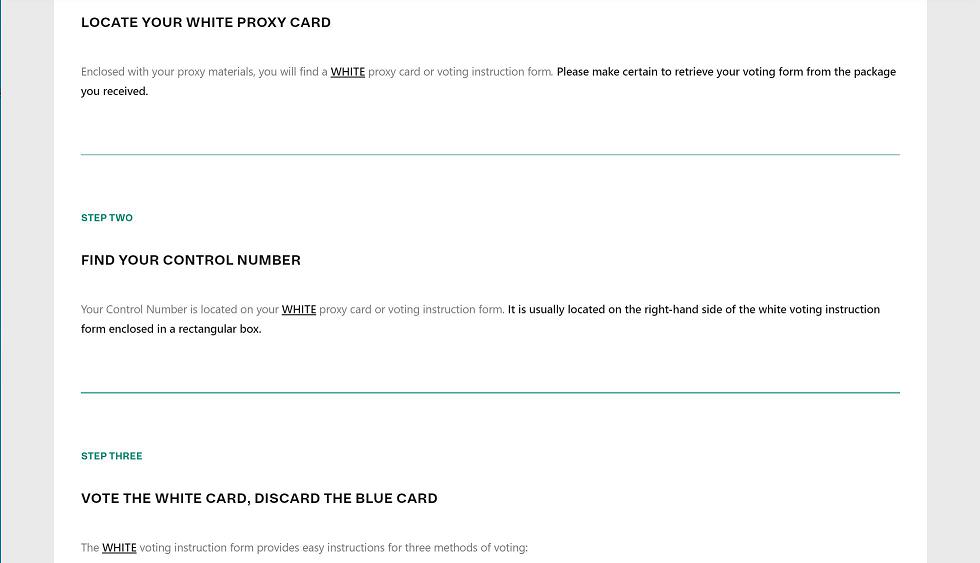

Privet Fund LP and UPG Enterprises LLC, together with the other participants named herein (collectively, the “Stockholder Group”), has made a definitive filing with the Securities and Exchange Commission of a proxy statement and accompanying WHITE proxy card to be used to solicit votes for the election of the Stockholder Group’s slate of highly qualified director nominees to the Board of Directors of Synalloy Corporation, a Delaware corporation (the “Company”), at the Company’s upcoming 2020 annual meeting of stockholders, or any other meeting of stockholders held in lieu thereof, and any adjournments, postponements, reschedulings or continuations thereof.

Item 1: On April 13, 2020, the Stockholder Group issued the following press release, which includes the full text of a letter that the Stockholder Group is mailing to the Company’s stockholders.

Privet Fund Management and UPG Enterprises Send Letter to Stockholders Regarding the Need for Urgent Change at Synalloy’s 2020 Annual Meeting

Group Holding ~25% of Synalloy’s Stock Sees Tremendous Opportunity to Deliver Enduring Value for All Stockholders Once the Current Board and Management Team Are Reconstituted

Believes the Board’s Demonstrated Failure to Hold Management Accountable Has Led to Years of Underperformance and Put Stockholders at Significant Risk in the Current Market Environment

Urges Stockholders to Vote the WHITE Proxy Card to Elect Privet and UPG’s Exceptional Five-Member Slate, Which is Laser-Focused on Implementing a Strong Turnaround Plan and Viable Long-Term Strategy

Launches www.StrengthenSynalloy.com to Provide Additional Information Regarding the Need for Immediate Change Atop Synalloy

ATLANTA--(BUSINESS WIRE)--Privet Fund Management LLC (together with its affiliates, “Privet”) and UPG Enterprises LLC (“UPG”), which collectively own approximately 24.9% of the outstanding common stock of Synalloy Corporation (NASDAQ: SYNL) (“Synalloy” or the “Company”), have filed a definitive proxy statement with the Securities and Exchange Commission and today issued the below letter to the Company’s stockholders. Privet and UPG have nominated a slate of five highly-qualified and experienced director candidates for election to Synalloy’s eight-member Board of Directors at the Company’s 2020 Annual Meeting of Stockholders.

We invite all stockholders to learn more about our case for urgent change atop Synalloy at www.StrengthenSynalloy.com.

The full text of Privet and UPG’s letter is below.

***

April 13, 2020

Dear Fellow Stockholders,

Privet Fund Management LLC (together with its affiliates, “Privet”) and UPG Enterprises LLC (together with its affiliates, “UPG”, and collectively with Privet, the “Stockholder Group” or “we” or “us”) are the largest stockholders of Synalloy Corporation (“Synalloy” or the “Company”), with aggregate ownership of approximately 24.9% of the Company’s outstanding common stock. As significant long-term stockholders, we have devoted a considerable amount of time and effort to thoroughly analyzing Synalloy’s past decade of strategic decisions, operational execution, corporate culture and leadership capabilities. Based on our assessment, we are confident that Synalloy’s high-quality operating assets and skilled workforce can – and should – be the foundation for meaningful long-term value creation.

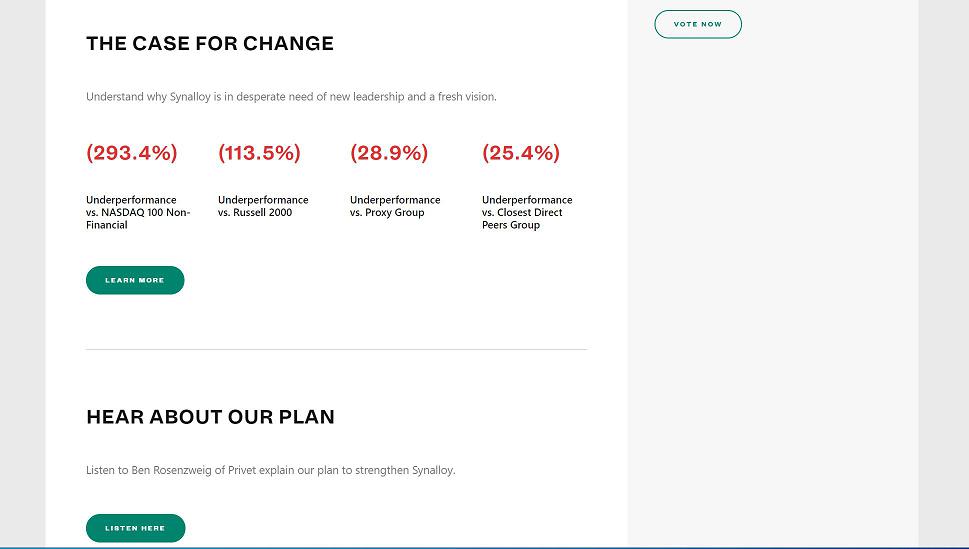

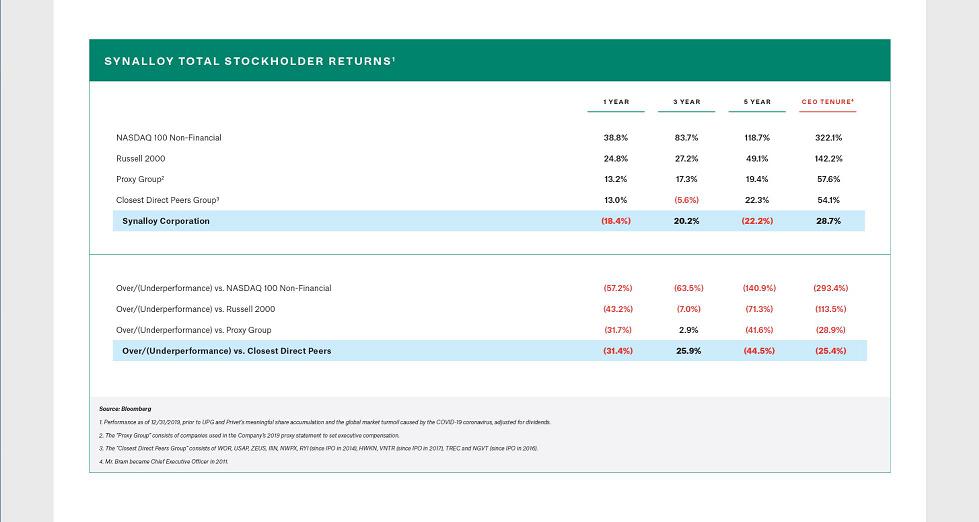

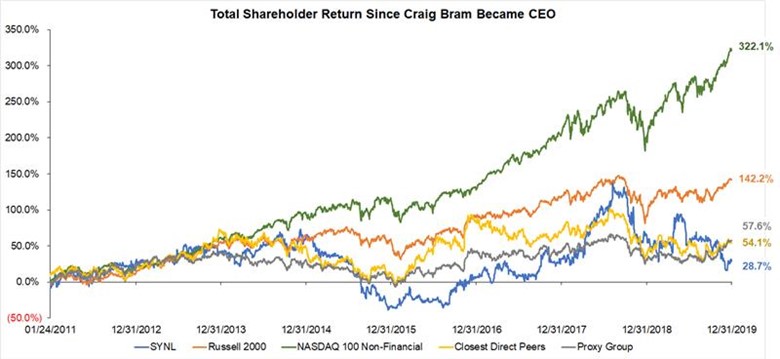

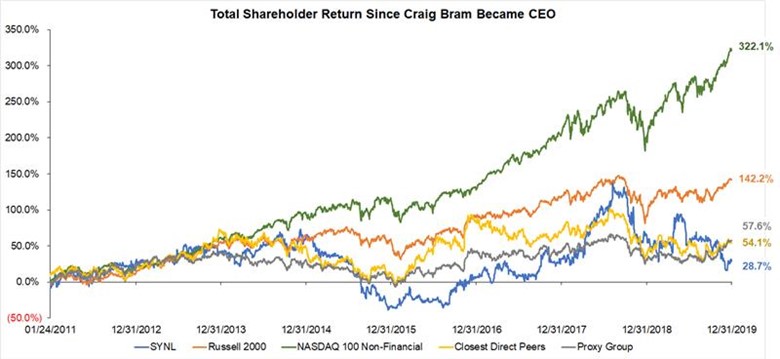

Regrettably, the current Board of Directors (the “Board”) and management team have squandered the profound opportunity that exists at Synalloy. Rather than deliver meaningful value for stockholders, the incumbent directors have overseen operational stagnation and presided over a protracted period of dramatic financial and stock price underperformance.

Source: Bloomberg. Performance as of 12/31/2019, inclusive of dividends.

We believe that any objective analysis of Synalloy’s past several years of dismal financial results and strategic missteps reinforces our assessment that sweeping changes are needed atop the Company. This is why we are soliciting your support to vote on the WHITE proxy card for our five exceptionally well-credentialed director candidates – Andee Harris, Christopher Hutter, Aldo Mazzaferro, Ben Rosenzweig and John Schauerman – for election to the Board at the Company’s upcoming 2020 Annual Meeting of Stockholders. We are confident that a better Board with enhanced strategic thinking and operational prowess can empower Synalloy to finally become a best-in-class business that produces quality long-term returns for stockholders.

However, if stockholders continue to hitch their wagon to the incumbent directors and Chief Executive Officer (“CEO”) Craig Bram, we fear that Synalloy will remain mired in the same failing culture that has destroyed more than $100 million of value in recent years. Mr. Bram is in his tenth year running Synalloy despite the fact that he had no experience leading a metals or chemicals company prior to being appointed by the Board. We have concluded that his lack of experience, combined with the Board’s weak oversight, directly contributed to the Company’s stock price underperforming the Russell 2000 by more than 100% over the past decade. Despite this inadequate performance, the incumbent directors used their positions to compensate Mr. Bram very generously with average annual compensation of nearly $1 million and a bonus every single year.

In response to our campaign, we believe the current Board has shown that it is incapable of refuting the objective facts about its abysmal track record managing stockholders’ capital. The directors are now spending all of their effort – and a meaningful amount of corporate resources that belong to stockholders – waging a low-road smear campaign against Privet and UPG that is anchored by a false, desperate narrative. They seem to feel that misrepresenting our intentions and misleading stockholders will mask their own lack of relevant qualifications and the absence of any tangible plan to turn the Company around. Unfortunately for them, this election contest to decide the future of Synalloy will ultimately be determined by facts, not misinformation.

FACT: Privet and UPG are not trying to acquire the Company.

Privet and UPG have no ulterior motives with respect to our investment in Synalloy. We are long-term, common stockholders owning the same class of stock as all other investors. We have committed a significant amount of our own capital to Synalloy. The only way our investment pays off is if the Company’s performance dramatically improves and the stock price appreciates. In contrast, the incumbent directors appear to have invested a minimal amount of capital in Synalloy and have instead amassed the majority of their own stockholdings via grants.

We are firmly aligned with all stockholders and completely focused on one path forward: overhauling the Board and implementing a superior strategic vision that produces long-term, sustainable value.

FACT: Synalloy’s chronic underperformance and culture of failure under the Company’s current leadership have persisted for nearly ten years.

We believe stockholders have been forced to endure what amounts to a lost decade over the course of Mr. Bram’s tenure. During a period of historic economic growth and equity market appreciation, when peers and relevant equity indices produced superior performance, Mr. Bram presided over consistently poor results. The sum total of his ineffectiveness has kept Synalloy mired in a perpetual state of mediocrity.

| · | Mr. Bram’s operational mismanagement is evidenced by indefensible margin deterioration. |

| o | In 2011, Mr. Bram’s first full year as CEO, the Company’s Adjusted EBITDA margins were 5.1% on $139 million of revenue.1 In 2019, the Company reported Adjusted EBITDA margins of only 4.4% after having more than doubled in size, to over $305 million in revenue.2 |

| o | The Company spent over $164 million from 2011 to 2019 on acquisitions and capital investments, only to see Adjusted EBITDA margins decline by roughly 14%.3 |

| · | Mr. Bram’s reckless spending has caused corporate costs to balloon. |

| o | In 2010, the year prior to Mr. Bram becoming the CEO and with the Company’s headquarters in Spartanburg, South Carolina, annual “unallocated corporate expenses” were just $1.5 million.4 When we fast forward to 2019, with the corporate headquarters moved to Richmond, Virginia in order to be located in Mr. Bram’s hometown (more than 275 miles from any of the Company’s manufacturing locations), unallocated corporate expenses have ballooned to more than $8.3 million.5 |

| o | In Mr. Bram’s tenure running a small holding company, stockholders have seen cumulative corporate expense growth of 442% compared to revenue growth of 174%. The entire point of Mr. Bram’s stated “growth through acquisition” strategy is to grow revenue and earnings at a much higher rate than fixed expenses – yet he has produced the opposite. |

| · | Mr. Bram’s inability to accurately forecast operating results only reinforces that he should not be a public company CEO. |

| o | Based on his demonstrated inability to deliver credible guidance, it is clear to us that Mr. Bram does not fully understand the Company’s operations or how to positively impact them. He appears to have no grasp on how to communicate anticipated results to stockholders through public guidance.6 |

1 Synalloy 2018 Midwest Ideas Investor Presentation filed on August 31, 2018.

2 Synalloy Fourth Quarter 2019 Earnings Release.

3 Synalloy 10-K Filings, 2011-2019.

4 Synalloy Fourth Quarter 2010 Earnings Release.

5 Synalloy Fourth Quarter 2019 Earnings Release.

6 Synalloy First Quarter 2015 Earnings Call, Second Quarter 2016 Earnings Call, Third Quarter 2017 Earnings Release and First Quarter 2019 Earnings Call.

| Date of Guidance | Forecasted CY Adjusted EBITDA | Actual CY Adjusted EBITDA | Forecasting Miss |

| April 27, 2015 | $27.5 million | $19.4 million | 29.5% |

| May 9, 2016 | $16.8 million | $5.5 million | 67.3% |

| November 7, 2017 | $17.0 million | $12.5 million | 26.5% |

| April 30, 2019 | $34.0 million | $13.5 million | 60.3% |

Mr. Bram’s blatant operational failures extend far beyond the aforementioned lapses. Despite failing to realize the full potential of Synalloy’s assets, the Synalloy Board has empowered Mr. Bram to aggressively spend more than $174 million of stockholder capital on acquisitions, capital expenditures and investing in other public companies (at a loss).7 Unfortunately, these decisions have led Synalloy to take on a significant amount of leverage, with the Company’s total debt now at $75.5 million, or 5.6x 2019 Adjusted EBITDA, compared to only $0.2 million of debt at the end of 2010 before Mr. Bram took over.8

Increased leverage, declining EBITDA margins and ineffective management are not what stockholders signed up for and certainly not what they deserve.

FACT: Synalloy’s current leadership lacks the capabilities, experience and ownership mentality needed to lead the Company to a value-enhancing turnaround.

Stockholders have spent far too long funding an inexperienced Board’s costly mistakes and poor supervision of Mr. Bram. We believe continuing to entrust Synalloy’s incumbent directors to oversee the Company will have disastrous results for stockholders, especially in light of the present market dynamics. An objective evaluation of their respective backgrounds and qualifications should lead stockholders to the same sobering conclusion.

| Prior Relevant C-Suite Experience | Prior Chemicals Management Experience |

Prior Metals Management Experience |

Prior Public Board Service | Sizable Stockholder Representative | |

|

Craig Bram |

- | - | - | - | - |

| Anthony Callander | - | - | - | - | - |

| Susan Gayner | - | - | - | Yes | - |

|

Henry Guy |

- | - | - | Yes | - |

| Jeffrey Kaczka | Yes | - | - | - | - |

| Amy Michtich | Yes | - | - | - | - |

| James Terry | - | - | - | - | - |

| Murray Wright | - | - | - | - | - |

Based on publicly available information.

7 Synalloy 10-K Filings, 2011-2019.

8 Synalloy 2011 and 2019 10-K Filings.

Unfortunately, as Mr. Bram’s decisions began producing eroding margins, mounting corporate costs and rising leverage, the Board’s inexperience and inability to stand up for stockholders became evident. This group of directors demanded no accountability from Mr. Bram and continued to compensate the management team exceedingly well. As just the most recent example, the Board awarded Mr. Bram incentive compensation of $597,450 for 2019 (in addition to salary of $495,000). By the Company’s own admission, 2019 Adjusted EBITDA performance missed the Company’s projection by 60%! Yet the Board saw fit to reward Mr. Bram anyway. This is not an uncommon pattern, as Mr. Bram has received incentive compensation every single year that he has been CEO, with his total annual compensation averaging $965,881.9

The Board’s lack of relevant expertise, public company experience and sound judgement has manifested itself most recently through a value-destructive self-preservation campaign. Instead of focusing on credible turnaround efforts and communicating specific ways in which they are planning to shepherd the Company through this turbulent period, the incumbent directors have reinforced the need for wholesale change by making a bizarre and ill-timed announcement about the Board’s plan to potentially run a sales process once the current pandemic concludes. We fail to understand why a Board that is purportedly focused on creating value for stockholders would announce now that it will possibly sell Synalloy or its assets at an indeterminate point in the future. We view this as nothing more than a stunt and entrenchment maneuver, designed to distract stockholders from the fact that the Board has failed in its duties to properly incent, oversee and drive value creation from the management team.

Given that Synalloy’s leadership could not deliver anything resembling decent performance over the past decade, during one of the greatest bull markets in history, stockholders have no basis to trust the same unqualified group to create value during the uncertain times ahead.

FACT: We have nominated a five-member slate of exceptional director candidates to refresh Synalloy’s eight-member Board and implement a fresh strategy to deliver long-term value.

To catalyze the urgent change that is needed, we have nominated an exceptionally qualified five-member slate of director candidates for election to Synalloy’s eight-member Board. Each of these nominees was carefully and deliberately selected to provide the specific expertise and leadership that the current Board lacks. Collectively, our director nominees have superior qualifications to those of the Company’s incumbent directors and backgrounds that are directly relevant to Synalloy’s business units. Our nominees are:

| 1. | Andee Harris is the Chief Executive Officer of Franklin Heritage LLC, a private equity firm that invests in cutting-edge technology and manufacturing companies, which she founded after serving as the Chief Executive Officer of HighGround Enterprise Solutions, Inc. and leading people analytics and performance management offerings at top software firms. |

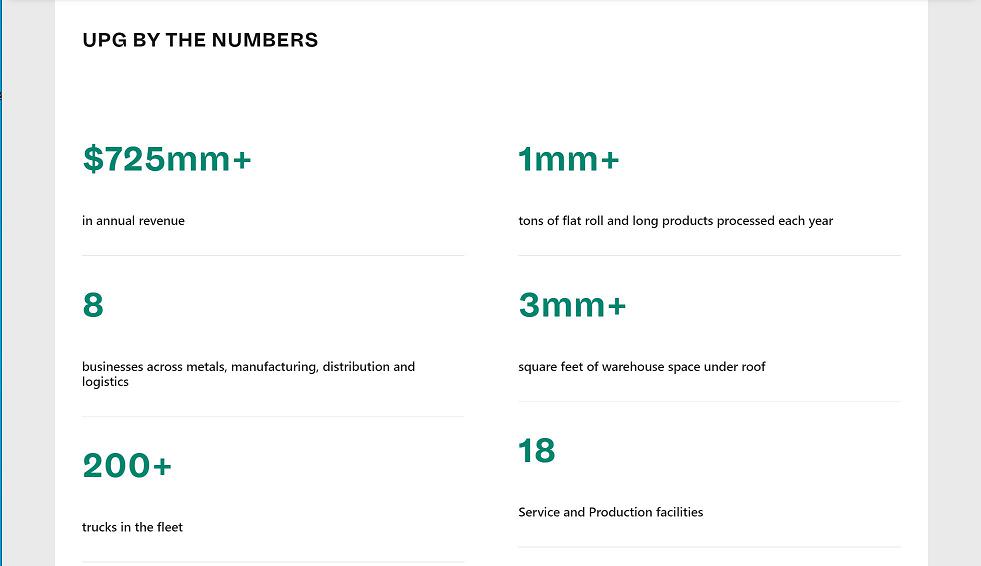

| 2. | Christopher Hutter is the Co-Founder and Manager of UPG Enterprises LLC, a successful high-growth operator of eight premier industrial companies across the metals, manufacturing, distribution and logistics sectors. |

9 Synalloy Corporation’s annual proxy statements and related disclosures from 2011 through the present day.

| 3. | Aldo Mazzaferro is the Managing Partner at Mazzaferro Research, a steel industry research boutique that he founded in 2017 after spending decades as a top metals analyst and industry executive at premier institutions, such as Macquarie Capital and The Goldman Sachs Group, Inc. (NYSE:GS). |

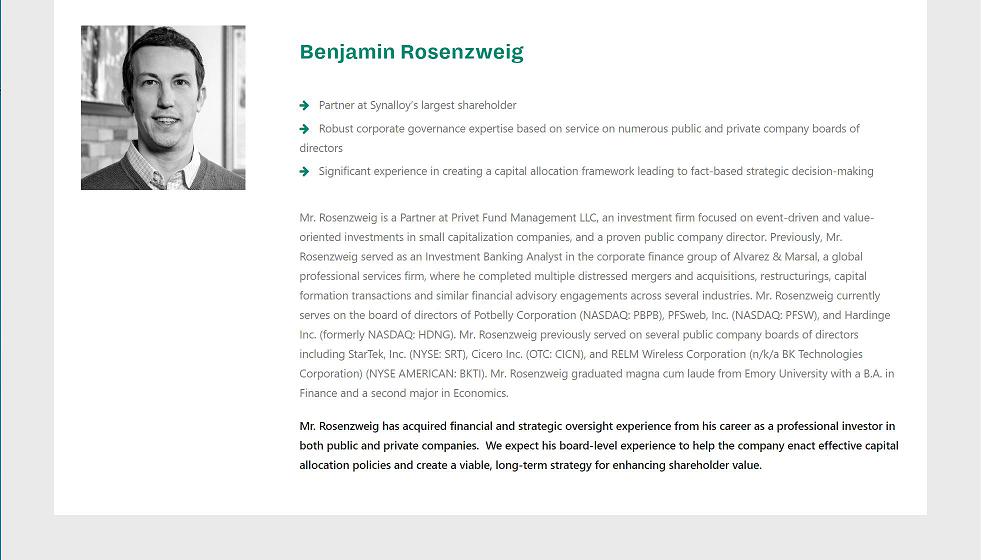

| 4. | Ben Rosenzweig is a Partner at Privet Fund Management LLC, Synalloy’s largest stockholder, and has an extensive track record as both an investor in business-to-business companies and a public and private company director. |

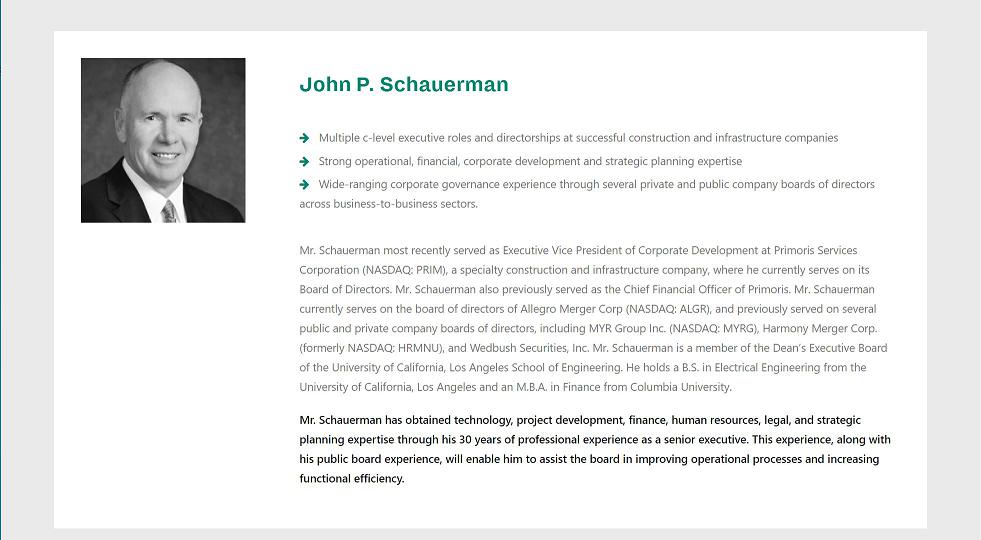

| 5. | John Schauerman most recently served as Executive Vice President of Corporate Development at Primoris Services Corporation (NASDAQ: PRIM), a specialty construction and infrastructure company, after formerly serving as its Chief Financial Officer, and has extensive executive and public and private company director experience across a broad range of successful industrial businesses. |

Drawing on their strong qualifications and pedigrees, we believe our nominees can help immediately address some of the glaring weaknesses in the boardroom by bringing:

| · | Successful operating expertise in the chemicals and metals sectors. Three of our five nominees – Christopher Hutter, Aldo Mazzaferro and John Schauerman – have extensive, hands-on experience in the metals and industrial space. Mr. Hutter is a proven organizational leader in the metals sector who has grown UPG Enterprises’ annual revenues to more than $725 million since its inception in 2014. Mr. Mazzaferro possesses vast knowledge of the steel and metals sectors based on many years of tangible experience as a research analyst, portfolio manager and corporate executive where he has received numerous accolades for his work. Mr. Schauerman is a seasoned operating executive in the construction and infrastructure industries with years of experience developing corporate strategy, implementing cost controls and executing value-creating mergers and acquisitions. |

| · | Extensive capital allocation and transaction acumen. All of our nominees have significant experience when it comes to capital allocation decision-making based on their tenures as public and private operating company executives and directors, professional investors and analysts. Mr. Hutter and Mr. Schauerman have each served as corporate executives responsible for overseeing the allocation of capital to industrial businesses and evaluating potential transactions. Ben Rosenzweig also has robust experience investing in business-to-business companies and then playing an active role in helping them improve their capital allocation policies, balance sheet and strategic decision-making. Mr. Rosenzweig also brings extensive knowledge of mergers, acquisitions and capital raising transactions based on his professional investing experience, board service and investment banking background. |

| · | Far-reaching public company corporate governance experience. While the current Board has only one member that currently serves on another public company’s board of directors, two of our nominees – Ben Rosenzweig and John Schauerman – have extensive corporate governance expertise that can immediately benefit Synalloy. Mr. Rosenzweig has served on numerous public and private company boards of directors, including multiple manufacturing companies. Mr. Schauerman has served on several public company boards of directors in the industrial and business-to-business sectors. This experience has enabled both Mr. Rosenzweig and Mr. Schauerman to acquire deep knowledge in areas such as audit procedures, compensation plan formulation, management oversight, strategic planning and transaction assessment. |

| · | The ability to improve accountability and effective organizational collaboration. Several of our nominees have demonstrable track records building and sustaining accountable corporate cultures. Christopher Hutter has built a family of holdings at UPG Enterprises that has consistently grown and realized synergies under his watch. Andee Harris has recognized expertise when it comes to helping address management-level and organizational inefficiencies based on her prior employee engagement and human capital management responsibilities at leading companies. Ms. Harris previously served as the Chief Executive Officer of a fast-growing performance management software business that she successfully sold in recent years. In addition to Mr. Hutter and Ms. Harris, our other nominees all have experience supervising and leading successful organizations of various sizes. |

In addition to addressing Synalloy’s flaws, our nominees have already been working to establish a comprehensive vision for value creation that will underpin our transition plan and long-term strategy once in the boardroom. The core tenets entail:

| · | Aggressive cost containment that eliminates excess spending, poor decision-making and wasted resources, while establishing a more streamlined operating model. |

| · | An enhanced and simplified supply chain that is able to capitalize on spending economies to realize savings, expand relationships with vendors and meaningfully improve historically poor inventory management. |

| · | Best-in-class business development and asset utilization processes within the Chemicals and Metals segments, where opportunities for revenue enhancement and operational efficiencies go unrealized despite significant growth potential. |

| · | Expanded internal collaboration and a unified corporate culture grounded in accountability, improved employee incentive structures and visible high-quality leadership that can re-energize the organization – resulting in greater value for stockholders, employees, customers and all stakeholders. |

| · | Effective capital allocation policies that redistribute spending from unnecessary corporate overhead into growing Synalloy’s individual business units, where the immediate impact can benefit day-to-day operations and result in improved returns on invested capital. |

We intend to share further details of our operating and strategic plan in the days to come.

We urge stockholders to help deliver the urgent wholesale change Synalloy needs by voting for our five highly-qualified nominees on the WHITE Proxy Card.

We believe stockholders are being presented with a clear choice at this year’s annual meeting: preserve a dangerous status quo by keeping Synalloy’s current leadership in place or deliver the urgent change needed by electing five accomplished, successful and motivated individuals to the Board. If elected, our nominees are ready to begin working alongside the incumbent directors to overhaul the management team and conduct a top-to-bottom assessment of Synalloy and its assets. We have every confidence that a refreshed and revived Board that possesses experience and directly relevant skillsets can identify what needs to be done to instill corporate accountability, increase profitability and ultimately deliver the level of enduring value creation that stockholders expect.

As a stockholder and owner of Synalloy, your support and your vote are crucial. Together, we can Strengthen Synalloy.

Please join us in voting the WHITE proxy card for all five of our exceptional nominees.

In the days and weeks ahead, stockholders should visit www.StrengthenSynalloy.com to learn more about our case for change and sign up for important updates.

We look forward to your support.

|

Sincerely,

Ben Rosenzweig

Privet Fund Management LLC |

Christopher Hutter

UPG Enterprises LLC |

***

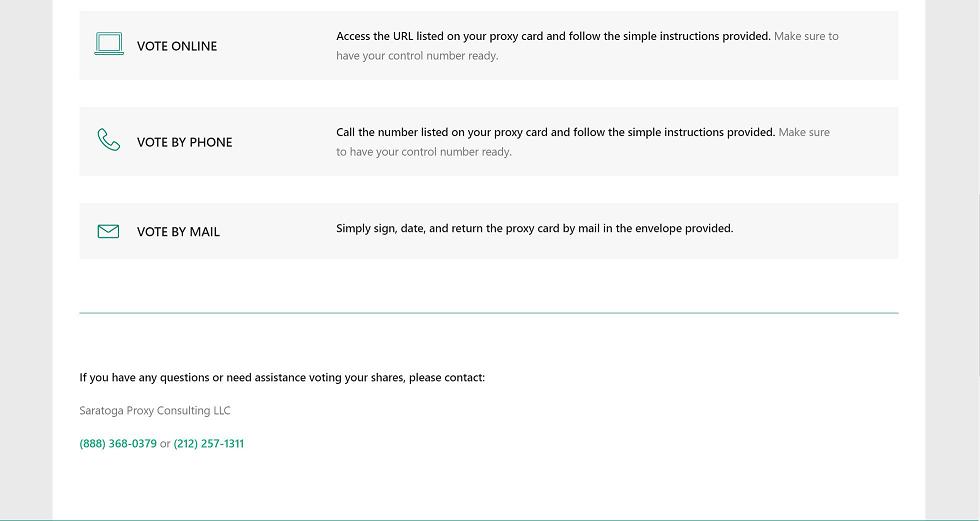

We urge Synalloy stockholders to vote FOR all five of the Stockholder Group’s highly-qualified nominees on the WHITE proxy card and to return it in your postage-paid envelope provided. If you have already voted Synalloy’s proxy card, you can change your vote by providing a later dated WHITE proxy card.

Should you have any questions or need assistance with voting, please contact Saratoga Proxy Consulting LLC at (888) 368-0379 or (212) 257-1311 or by email at info@saratogaproxy.com.

PROTECT YOUR INVESTMENT. PLEASE SIGN, DATE AND MAIL THE WHITE PROXY CARD TODAY!

About Privet Fund Management LLC

Privet Fund Management LLC is a private investment firm focused on investing in and partnering with small capitalization companies. The firm has flexible, long-term capital with the ability to effectuate investments across all levels of the capital structure. Privet was founded in 2007 and is based in Atlanta, GA.

About UPG Enterprises LLC

UPG Enterprises LLC is a strategic operator of a portfolio of metals and logistics companies. With locations throughout North America, its operations include Chicago Steel, Contractors Steel, Lamination Specialties, Maksteel, Mapes & Sprowl Steel, Metalex, Morton Rail Products and National Metalwares. Founded by families with multi-generational experience in steel, real estate and logistics, the company prides itself on having the integrity of a family-owned business with an entrepreneurial spirit.

Contacts

For Investors:

Privet Fund Management LLC

Ben Rosenzweig 404-419-2670

ben@privetfund.com

OR

Saratoga

Proxy Consulting LLC

John Ferguson / Joe Mills, 212-257-1311

jferguson@saratogaproxy.com / jmills@saratogaproxy.com

For Media:

Profile

Greg Marose / Charlotte Kiaie, 347-343-2999

gmarose@profileadvisors.com / ckiaie@profileadvisors.com

Item 2: On April 13, 2020, the Stockholder Group launched a website to communicate with the Company’s stockholders. The website address is www.StrengthenSynalloy.com. The following materials were posted by the Stockholder Group to www.StrengthenSynalloy.com.