UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of The Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

| Synalloy Corporation |

(Name of Registrant as Specified in Its Charter) |

Privet Fund LP Privet Fund Management LLC Ryan Levenson UPG Enterprises LLC Paul Douglass Christopher Hutter Andee Harris Aldo Mazzaferro Benjamin Rosenzweig John P. Schauerman |

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials: |

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Privet Fund LP and UPG Enterprises LLC, together with the other participants named herein (collectively, the “Stockholder Group”), has made a definitive filing with the Securities and Exchange Commission of a proxy statement and accompanying WHITE proxy card to be used to solicit votes for the election of the Stockholder Group’s slate of highly qualified director nominees to the Board of Directors of Synalloy Corporation, a Delaware corporation (the “Company”), at the Company’s upcoming 2020 annual meeting of stockholders, or any other meeting of stockholders held in lieu thereof, and any adjournments, postponements, reschedulings or continuations thereof.

Item 1: On May 12, 2020, the Stockholder Group issued the following press release, which includes the full text of a letter that the Stockholder Group is mailing to the Company’s stockholders, which was also posted to www.StrengthenSynalloy.com:

Privet Fund and UPG Enterprises Send Letter to Synalloy Stockholders Outlining Their Strategic Plan for Long-Term Value Creation

Stockholder Group Lays Out Credible and Comprehensive Plan to Deliver Up to $25 Per Share in Value for Long-Suffering Synalloy Stockholders

Highlights That Appointing Chris Hutter, a Proven Manufacturing Industry Operator, as Interim Chief Executive Officer Can Help Synalloy Expeditiously Cut Waste and Grow Profits

Reiterates that Neither Privet nor UPG Have Any Intent to Acquire or Facilitate a Sale of Synalloy

Reminds Stockholders of Upcoming Record Date of May 19, 2020

Urges Stockholders to Vote the WHITE Proxy Card to Elect Its Exceptional Five-Member Slate, Which is Prepared to Implement a Strategic Plan That Can Harness Synalloy’s High-Quality Operating Assets and Tremendous Workforce to Unlock Value

ATLANTA--(BUSINESS WIRE)--Privet Fund Management LLC (together with its affiliates, "Privet") and UPG Enterprises LLC (together with its affiliates, “UPG” and collectively with Privet, “we” or “us”), which collectively own approximately 24.9% of the outstanding common stock of Synalloy Corporation (NASDAQ: SYNL) (“Synalloy” or the "Company"), today sent a letter to stockholders in connection with their nomination of five highly-qualified candidates for election to the Company’s eight-member Board of Directors (the “Board”) at Synalloy’s upcoming 2020 Annual Meeting of Stockholders (the “Annual Meeting”) scheduled to be held on June 30, 2020. Visit www.StrengthenSynalloy.com to read the letter and obtain important information about the capabilities Privet and UPG can bring to the table to help Synalloy become a thriving public company for years to come.

As a reminder, we are urging stockholders to vote on the WHITE proxy card to elect our entire slate: Andee Harris, Chris Hutter, Aldo Mazzaferro, Ben Rosenzweig and John Schauerman.

The full text of the letter is below.

***

May 12, 2020

Dear Fellow Stockholders,

Privet Fund Management LLC (together with its affiliates, "Privet") and UPG Enterprises LLC (together with its affiliates, "UPG", and collectively with Privet, the "Stockholder Group" or "we" or "us") are the largest stockholders of Synalloy Corporation ("Synalloy" or the "Company"). We each invested a significant amount of our own capital in Synalloy based on a shared view: the Company’s high-quality operating assets and tremendous workforce should be the pillars of long-term value creation. Unfortunately, Synalloy’s significant potential has been stifled over the past decade by a Board of Directors (the “Board”) and management team that have presided over exceedingly poor operational execution, haphazard capital allocation decisions and a culture of mediocrity that continues to yield value-destructive inefficiencies and waste.

Fortunately, stockholders no longer need to be shackled to Synalloy’s underperforming leadership. This year’s Annual Meeting of Stockholders (the “Annual Meeting”) on June 30th presents stockholders with a unique opportunity to strengthen Synalloy by installing new leadership with the right strategic plan for value creation. Privet and UPG have nominated five highly-qualified, independent individuals for election to Synalloy’s Board. We are now urging stockholders to vote on the WHITE proxy card to elect our entire slate: Andee Harris, Chris Hutter, Aldo Mazzaferro, Ben Rosenzweig and John Schauerman.

As owners of nearly 25% of Synalloy’s common stock, Privet and UPG are firmly aligned with Synalloy’s stockholders. In contrast to the incumbent Board, which has admitted to having no plan other than to explore a hypothetical post-pandemic sale from a position of operational weakness, we welcome the opportunity to articulate our strategy for finally delivering the value that long-suffering stockholders deserve.

DO NOT BE MISLED BY SYNALLOY’S INCUMBENT BOARD! This is the most important Annual Meeting in Synalloy’s history – and stockholders finally have the opportunity to break through the status quo toward a superior path forward. We ask stockholders to focus on the facts and determine for themselves which set of director nominees presents the best alternative.

The Stockholder Group and Its Nominees Have a Credible and Comprehensive Plan for Delivering Up to $25 Per Share in Near-Term Value

Privet and UPG are tremendously excited about the opportunity for value creation at Synalloy. There is no doubt in our minds that the Company’s valuable assets can produce highly-attractive earnings if they are supported by the right leadership with the right plan. This is why we assembled an exceptionally well-qualified slate of director nominees and identified a proven operator – Chris Hutter, co-founder of UPG – to serve as interim Chief Executive Officer and oversee the implementation of a superior strategy.

To expeditiously transform Synalloy into a growing, functioning public market participant, we intend to focus on returning the Company’s operations to more stable footing. If elected to the Board, our nominees will work with the management team to ensure that all six of Synalloy’s business units are organized efficiently, with world-class operational execution augmented by strategic decision-making. Prior to formulating the details of our plan, we conducted an in-depth analysis of each business unit, assessing its strategy, operations, capital allocation and financial results (where publicly available). We are confident that our initiatives can dramatically improve the near-term earnings power of the Company, resulting in a meaningfully higher share price for stockholders.

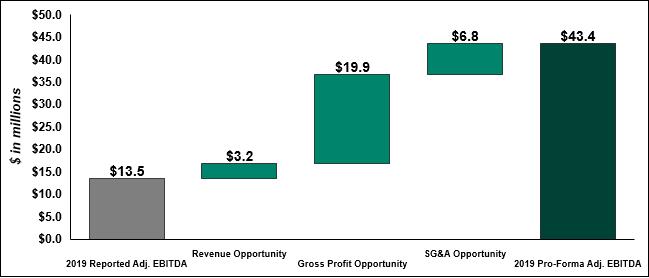

When taken together, we are confident that the elements of our plan can increase the Company’s earnings power (as measured by 2019 Adjusted EBITDA) from $13.4 million to more than $43 million per year.1 We expect to be able to deliver this value without meaningfully altering the Company’s footprint or relying on future growth opportunities.

1 Pro-forma based on FY 2019 actual results.

Our plan contemplates the immediate appointment of Mr. Hutter as interim Chief Executive Officer. As the co-architect of UPG’s industry-leading offerings and exceptional growth, he is exceptionally well versed in metals manufacturing and has helped to return many of UPG’s portfolio companies to profitable growth. This experience has allowed him to quickly gain a comprehensive understanding of Synalloy’s assets and has enabled him, in consultation with Privet and the Stockholder Group’s nominees, to formulate a targeted series of measures to efficiently expand Synalloy’s operating margins to industry norms. These actions include:

Prioritize Immediate Strategic Revenue Opportunities

| · | Utilize Mr. Hutter and UPG’s relationships to be able to sell certain complementary products, including ornamental and stainless tubing, to existing UPG customers. |

| · | Implement targeted selling efforts within the Chemicals segment, exploiting the meaningful amount of unused capacity to return volume to 2014-2015 levels. |

Pursue Operationally-Focused Gross Profit Enhancements

| · | Unlock meaningful supply chain opportunities, leveraging UPG’s extensive footprint and experience, through: |

| o | Vendor rebates |

| o | Volume discounts |

| o | Third party freight consolidations |

| · | Apply considerable operational expertise to realize manufacturing efficiencies: |

| o | Remove bottlenecks |

| o | Increase capacity utilization |

| o | Enhance workflow design to boost plant productivity |

| · | Improve inventory management practices: |

| o | Re-evaluate procurement strategy |

| o | Focus on demand management and accurate resource planning |

| o | Expand internal collaboration and utilize UPG’s complementary footprint to lower lead times |

| · | Restructure plant-level accounting policies and incentive compensation plans to properly encourage and drive the necessary changes. |

Remove Non-Economic and Wasteful SG&A Spending

| · | Establish a shared services agreement with UPG, whereby Synalloy can take advantage of certain back office functions – enjoying higher quality, experienced service at a fraction of the cost. This includes: |

| o | Reductions in previously fixed overhead items such as marketing, IT, HR, insurance, finance and professional services costs. |

| · | Eliminate non-essential, discretionary spending (like the corporate jet) in order to redeploy capital into operational investments that drive earnings growth. |

| · | Instill a culture of transparency, accountability and world-class governance to ensure management is held to account and fully aligned with stockholders. |

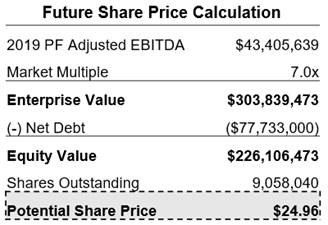

Utilizing a conservative market multiple for a diversified metals company of 7x Adjusted EBITDA2, we believe there is a path for Synalloy’s stock to trade up to $25 per share in the near future. We believe this value creation is achievable even before considering the impact of longer-term strategic growth opportunities or accretive acquisitions.

It is important to reiterate that, while a meaningful amount of these opportunities stem from the potential collaboration between Synalloy and UPG, neither Privet nor UPG have any intent to acquire Synalloy. It has become abundantly clear to us that Synalloy is woefully undermanaged relative to its potential and, as large equity holders, we are eager to utilize our experience and relationships to create value that will accrue to all stockholders. By partnering with UPG, Synalloy can enjoy many of the cost and scale benefits of being a larger enterprise without losing its status as an independent public company.

Unfortunately, Synalloy has made no effort to learn more about UPG’s businesses and Mr. Hutter’s experience as a world-class operator. This has led to the Company making ill-informed and misleading statements about UPG. Unable to impeach UPG’s track record or Mr. Hutter’s prowess, Synalloy has resorted to questioning their bona fides simply because the Company has been unwilling to make the effort to verify them.

To provide stockholders with the facts about everything UPG and Privet have to offer, we have prepared a brief background presentation now available on our Strengthen Synalloy website. This presentation will help stockholders understand the fact that Mr. Hutter oversees complex manufacturing operations that are directly comparable (and complementary) to Synalloy’s holdings. Further, UPG has nearly two-and-a-half times the revenue, employs more people across more locations and interfaces with a meaningfully higher number of customers and vendors than Synalloy. Simply put, UPG is exactly what Chief Executive Officer Craig Bram stated Synalloy could become when he was hired in 2011.3

This Election Contest Comes Down to One Question: Which Set of Nominees Has the Better Plan and Vision for Enhancing Stockholder Value?

This election contest is not about Privet and UPG getting “control” of the Board. It is about putting the right individuals in place to implement the most prudent operational and strategic plan that can create the highest probability of long-term success for Synalloy. Our plan, as outlined above, offers that opportunity.

We are confident that our director nominees, working in conjunction with certain incumbent directors, can quickly put Synalloy on a path away from chronic earnings erosion and toward stable financial footing. Once this has occurred, the Company can be viewed as a more exciting career venture for a highly-qualified Chief Executive Officer candidate, and the new Board will be able to act expeditiously to recruit Synalloy’s next leader. It is only after the Board is comprised of individuals who have track records of successful business judgment and possess relevant expertise and experience that the Board is positioned to make a prudent selection as to the Company’s future leadership.

2 7.0x is the current median market valuation of the Company’s closest direct peer group. This group consists of WOR, USAP, ZEUS, IIIN, NWPX, RYI, HWKN, VNTR, TREC and NGVT.

3 “The strategy that I outlined for our Board of Directors upon my appointment as President and CEO back in January 2011, was to embark on a growth plan which included not only organic growth of our existing businesses but the active pursuit of acquisitions that met certain criteria. We determined that at a minimum, Synalloy should set a goal of $500 million in annual revenue.” Exhibit 99.1 to Synalloy’s 8-K dated January 9, 2015.

As a reminder, each of our director candidates was carefully and deliberately selected to provide the specific skills and leadership that the current Board lacks. Collectively, our slate possesses significant industry expertise, strong operational experience, established records of public board service, and demonstrated capital allocation and strategic planning acumen. Our nominees are:

Andee Harris is the Chief Executive Officer of Franklin Heritage LLC, a private equity firm that invests in cutting-edge manufacturing and technology companies, which she founded after serving as the Chief Executive Officer of HighGround Enterprise Solutions and overseeing people analytics and performance management offerings at top software firms.

Chris Hutter is the Co-Founder and Manager of UPG Enterprises LLC, a successful high-growth operator of eight premier industrial companies across the metals, manufacturing, distribution and logistics sectors.

Aldo Mazzaferro is the Managing Partner at Mazzaferro Research, a steel industry research boutique that he founded in 2017 after spending decades as a top metals analyst and industry executive at premier institutions, such as Macquarie Capital and The Goldman Sachs Group, Inc. (NYSE:GS).

Ben Rosenzweig is a Partner at Privet Fund Management LLC, Synalloy’s largest stockholder, and has an extensive track record as both an investor in business-to-business companies and a public and private company director.

John Schauerman most recently served as Executive Vice President of Corporate Development at Primoris Services Corporation (NASDAQ: PRIM), a specialty construction and infrastructure company, after formerly serving as its Chief Financial Officer, and has extensive executive and public board experience across a range of successful industrial businesses.

Stockholders Should Not be Misled by Synalloy’s Incumbent Board!

The Facts Pertaining to the Current Directors and Mr. Bram Speak For Themselves

The Board has a well-documented history of abysmal judgement and ineffective oversight that should cause stockholders to question any assertions and commitments it makes during this election contest. It is important to remember that when the Board installed Mr. Bram as Chief Executive Officer in January 2011, it tapped an executive with zero relevant operational or product leadership experience in the chemicals or metals sectors. Mr. Bram’s previous job was running a two-location retail printing business where current Synalloy Chairman Murray Wright is the Chairman as well.4 Stockholders have been the ones who have suffered as a result of the Board’s decision.

Since Mr. Bram took over, Synalloy has dramatically underperformed its peer group and every relevant equity market benchmark. Years of debt-fueled acquisitions and questionable capital expenditures have led to little more than hollow revenue growth. Unsurprisingly, a singular focus on getting bigger at the expense of getting better have produced extraordinarily poor asset utilization and no material earnings growth. Once again, stockholders have been the ones who have suffered as a result of the Board’s failure to craft and execute upon a more effective strategy.

To add insult to injury for stockholders, the Board has rewarded Mr. Bram with extravagant compensation and endorsed his reckless spending throughout his tenure. Mr. Bram has received nearly $1 million per year in average compensation, while exacerbating an already bloated corporate cost structure by directing the Company to take an ownership interest in a private jet. Synalloy has co-owned this jet with a local real estate firm that Chairman Wright has been an investor in.

4 Prior to becoming CEO of Synalloy, Mr. Bram was the CEO of Bizport, a “document management company” according to the Company’s proxy statements. However, we have found that, at the time Mr. Bram ran Bizport, it was a two-location retail printing business with less than 50 employees. Mr. Wright is Chairman of Bizport and his ownership interest is undetermined.

Stockholders should take note of the lack of responses that Synalloy has offered to a number of factual points and legitimate concerns raised by Privet and UPG:

| · | The Board has not provided an explanation for why it hired, retained and consistently rewarded Mr. Bram despite no demonstrable qualifications to run Synalloy, which, not surprisingly, has produced negligible total stockholder returns throughout his lengthy tenure. |

| · | The Board has not addressed why it is in stockholders’ best interests to maintain a set of incumbent directors with no operating experience in the chemicals or metals sectors and minimal public company governance experience. |

| · | The Board has never explained why it is in stockholders’ best interests for Mr. Wright, who became a director nearly 20 years ago, to continue serving as a director, let alone Chairman of the Board. |

| · | The Board has failed to oversee the implementation of cost containment protocols or measures to stem the losses from inventory price changes (despite millions of dollars per year in losses that could have been eliminated through prudent resource planning and supply chain management). |

| · | The Board has not clarified why it was appropriate for the Company to own a private jet, let alone co-own it with a business that Mr. Wright invested in. |

| · | The Board has completely ignored concerns regarding the lack of disclosure surrounding director Susan Gayner’s appointment to the Board (Ms. Gayner is married to the Co-Chief Executive Officer of Markel Corp., which was Synalloy’s largest stockholder at the time of her appointment). |

| · | The Board has failed to adequately explain why running a hypothetical, highly conditional future sales process is preferable to installing new leadership at Synalloy that is capable of executing a turnaround plan. |

It should be clear that the incumbent directors and Mr. Bram are incapable of building Synalloy into a true growth company – one that stockholders can expect to generate consistently high returns on its capital. On the other hand, our nominees’ strategic plan is grounded in basic business fundamentals and can have an immediate positive impact on the Company’s financial position, market reputation and corporate culture. Our plan reduces excess and pointless spending and offers many avenues for operational improvements and efficiencies. It is truly the best path to strengthening Synalloy.

Synalloy leadership is obviously not able to devise a strategy that offers anywhere near the magnitude of potential value presented by our plan. The incumbents have shown themselves to be incapable stewards of stockholder capital and seem to lack any self-awareness of their shortcomings. The fact that the incumbent Board has failed to recognize the need for change is the strongest EVIDENCE yet that such change is urgently needed. After months of being shown their repeated failings, the incumbent Board can bring in new directors, say it will recruit a new Chief Executive Officer and even introduce a new Chairman – but stockholders will still be left with only a slightly different variation of the status quo that has failed to deliver results.

It is time for new leadership that is committed to unlocking the tremendous potential of Synalloy’s assets and employees.

Please join us in voting the WHITE proxy card for all five of our exceptional nominees.

We encourage stockholders to be on the lookout for the comprehensive version of our strategic plan that we intend to release in the coming weeks. Stockholders should visit www.StrengthenSynalloy.com to learn more about our case for change and sign up for important e-mail updates.

We look forward to your support.

|

/s/ Ben Rosenzweig Ben Rosenzweig Privet Fund Management LLC

|

/s/ Chris Hutter Chris Hutter UPG Enterprises LLC

|

***

About Privet Fund Management LLC

Privet Fund Management LLC is a private investment firm focused on investing in and partnering with small capitalization companies. The firm has flexible, long-term capital with the ability to effectuate investments across all levels of the capital structure. Privet was founded in 2007 and is based in Atlanta, GA.

About UPG Enterprises LLC

UPG Enterprises LLC is an operator of a diverse set of industrial companies focused on metals, manufacturing, distribution and logistics. Our success continues to be driven from within, starting with our dedicated employees who operate with a sense of urgency, commitment to customers and flexibility to do what's right on the spot without question. With 25 locations throughout North America, its operations continue to grow with the intention of building a business based on culture, respect and growth. Founded by two families with multi-generational experience in various industries, UPG prides itself on having a long-term approach to business, entrepreneurial spirit and excellent teams that represent its family of companies. To learn more, visit www.upgllc.com.

Contacts

For Investors:

Privet Fund Management LLC

Ben Rosenzweig 404-419-2670

ben@privetfund.com

OR

Saratoga Proxy Consulting LLC

John Ferguson / Joe Mills, 212-257-1311

jferguson@saratogaproxy.com / jmills@saratogaproxy.com

For Media:

Profile

Greg Marose / Charlotte Kiaie, 347-343-2999

gmarose@profileadvisors.com / ckiaie@profileadvisors.com

###

Item 2: On May 12, 2020, the Stockholder Group posted a presentation to www.StrengthenSynalloy.com, a copy of which is attached hereto as Exhibit 1 and is incorporated herein by reference.