UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

SYNALLOY CORPORATION

(Name of Registrant as Specified in Its Charter)

PRIVET FUND LP

PRIVET FUND MANAGEMENT LLC

RYAN LEVENSON

UPG ENTERPRISES LLC

PAUL DOUGLASS

CHRISTOPHER HUTTER

ANDEE HARRIS

ALDO MAZZAFERRO

BENJAMIN ROSENZWEIG

JOHN P. SCHAUERMAN

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Title of each class of securities to which transaction applies:

Aggregate number of securities to which transaction applies:

Per unit price

or other underlying value of transaction computed pursuant to

Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

Proposed maximum aggregate value of transaction:

Total fee paid:

☐ Fee paid previously with preliminary materials:

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

Amount previously paid:

Form, Schedule or Registration Statement No.:

Filing Party:

Date Filed:

Privet Fund LP and UPG Enterprises LLC, together with the other participants named herein (collectively, the “Stockholder Group”), has made a definitive filing with the Securities and Exchange Commission of a proxy statement and accompanying WHITE proxy card to be used to solicit votes for the election of the Stockholder Group’s slate of highly qualified director nominees to the Board of Directors of Synalloy Corporation, a Delaware corporation (the “Company”), at the Company’s upcoming 2020 annual meeting of stockholders, or any other meeting of stockholders held in lieu thereof, and any adjournments, postponements, reschedulings or continuations thereof.

Item 1: On June 19, 2020, the Stockholder Group mailed the following letter to stockholders, which was also posted to www.StrengthenSynalloy.com.

June 19, 2020

Dear Fellow Stockholders,

Privet Fund Management LLC (together with its affiliates, “Privet”) and UPG Enterprises LLC (together with its affiliates, “UPG”, and collectively with Privet, the “Stockholder Group” or “we” or “us”) are the largest stockholders of Synalloy Corporation (“Synalloy” or the “Company”), with aggregate ownership of approximately 24.9% of the Company’s outstanding common stock. We have nominated five highly-qualified individuals for election to Synalloy’s eight-member Board of Directors (the “Board”) at the Annual Meeting of Stockholders (the “Annual Meeting”) scheduled to be held on June 30, 2020. By doing so, we are offering long-suffering stockholders the opportunity to finally unshackle themselves from a failed leadership team that has spent the past decade delivering indefensible underperformance, racking up a dangerous amount of debt and deliberately failing to disclose decades of side business dealings.

Unfortunately, since Synalloy’s incumbent Board apparently does not believe that it can secure stockholders’ support with facts, it has resorted to a series of desperate and disingenuous efforts to mislead and confuse investors. We urge stockholders to not be misled and to carefully review the facts before casting a vote that will decide the future of your Company.

We believe the choice should ultimately be clear for stockholders at this year’s Annual Meeting, particularly in light of Synalloy’s stock recently sinking to an alarming $7.98 per share during intraday trading:1

| ü | Voting on Privet and UPG’s WHITE Proxy Card for Andee Harris, Chris Hutter, Aldo Mazzaferro, Ben Rosenzweig and John Schauerman can ensure Synalloy benefits from a more aligned and qualified Board, a new Chief Executive Officer with significant industry operating experience and a credible strategic plan that targets up to $25 per share in near-term value. |

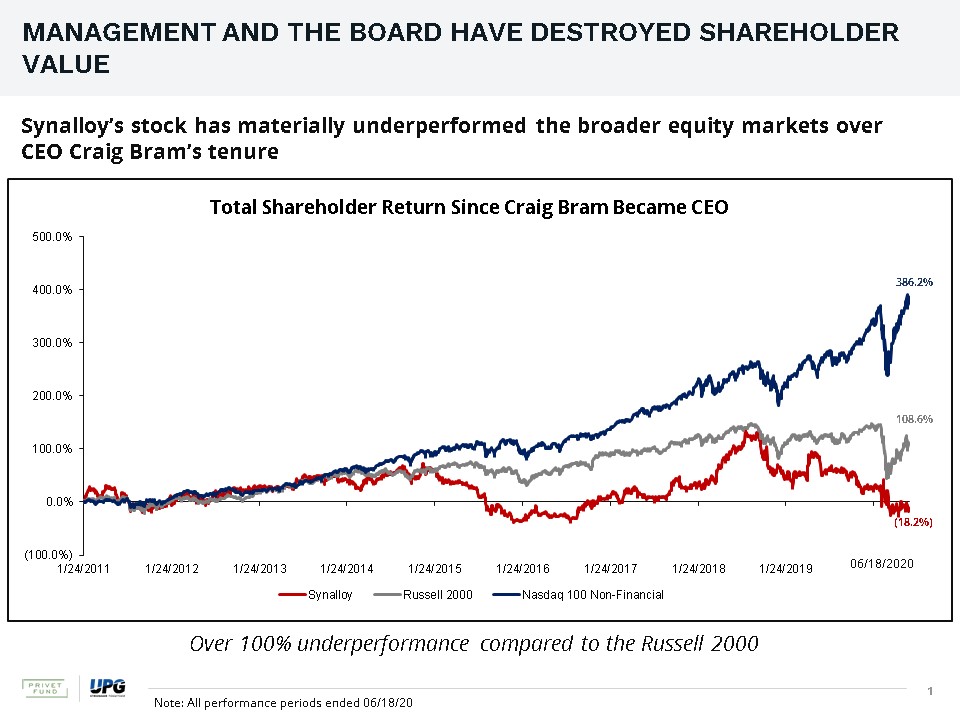

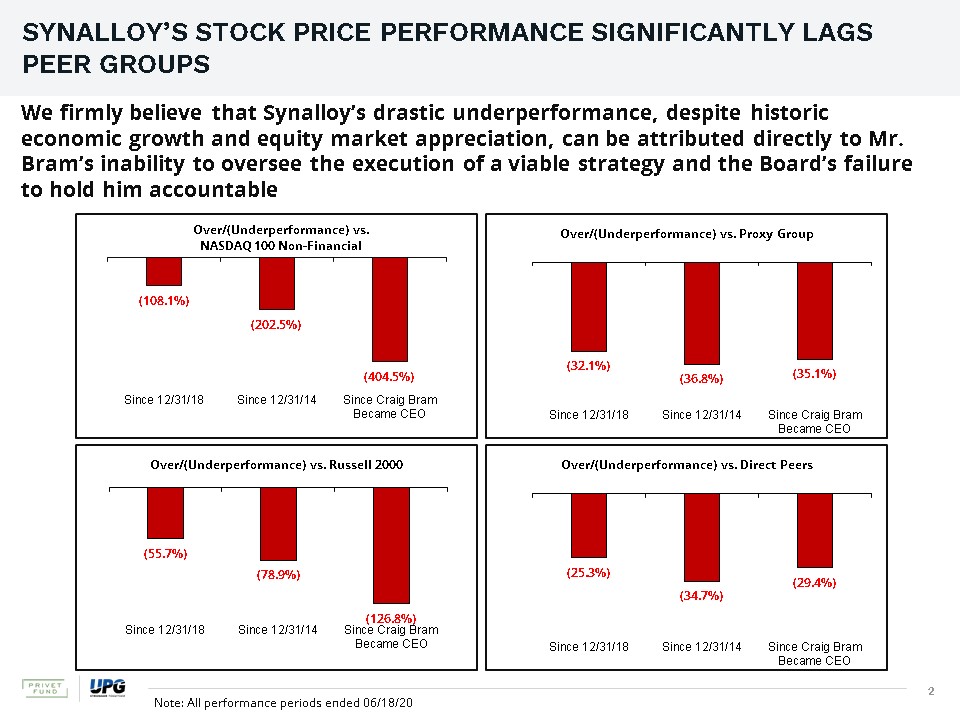

| x | Voting on Synalloy’s blue proxy card – and disregarding the recommendation of Institutional Shareholder Services, a leading independent proxy advisory firm – amounts to doubling down on the same long-tenured directors and Chief Executive Officer responsible for a 22% stock price decline in 2019 and 293% stock price underperformance relative to the NASDAQ 100 Non-Financial Index over the past decade.2 |

Stockholders who have already voted on Synalloy’s blue card can change their vote by returning a later dated WHITE Proxy Card. Please direct any questions pertaining to the voting process to Saratoga Proxy Consulting at (888) 368-0379 or (212) 257-1311 or by email at info@saratogaproxy.com.

While we recognize that a great deal of information has been shared throughout this election contest, Privet and UPG feel it is important to emphasize four indisputable realities in the lead-up to this year’s Annual Meeting:

| 1. | Reality: Synalloy has delivered dismal financial results and destroyed a significant amount of stockholder value over the past decade. |

| Ø | Synalloy has gone to great lengths to mislead stockholders about the Company’s significant stock price decline in 2019 and overall long-term underperformance. Stockholders voting in this election contest know they have continually suffered far greater losses than investors exposed to the broader market and other peer companies. In fact, long-term stockholders have persistently suffered as Synalloy’s stock price underperformed the Russell 2000 by 113.5% and its peer group by 25.4% over the past nine years – a period of tremendous economic growth and prosperity.3 |

__________________________

1 Synalloy Corporation’s common stock traded as low as $7.98 per share on June 18, 2020.

2 Calculated as of 12/31/2019.

3 Calculated as of 12/31/2019.

1

| Ø | To add insult to injury, the Board has rewarded Chief Executive Officer Craig Bram, who had no public company or relevant industry leadership experience prior to his surprising appointment, with average annual compensation of $1 million per year over the last decade, while the value of stockholders’ investment deteriorated. |

| 2. | Reality: Chairman Murray Wright and Chief Executive Officer Craig Bram have been perpetuating a web of conflicts and cronyism atop the Company for decades. |

| Ø | Mr. Wright and Mr. Bram have not been honest and open with stockholders about their mutual involvement at a half-dozen other companies unrelated to Synalloy over the previous three decades. Along with Synalloy’s General Counsel Robby Peay (who followed Mr. Bram from his previous company), they have run a corporation that belongs to stockholders as if it was their own private partnership. |

| Ø | Not only does this represent a seemingly insurmountable conflict, but Messrs. Wright and Bram appear to have deliberately hidden their past relationships from stockholders. Unfortunately, it is not just disclosure lapses and egregious omissions that should trouble stockholders. Stockholders should be very concerned that Mr. Bram has been running his private investment firm Horizon Capital Management out of Synalloy’s corporate offices, representing a gross misuse of stockholder resources. |

| 3. | Reality: Synalloy’s leadership is deliberately seeking to confuse stockholders regarding the “cumulative voting effect” in order to retain power and remain entrenched on the Board. |

| Ø | Whatever the Board may try to assert, Synalloy has not actually withdrawn any of its nominees and is seeking to elect ALL EIGHT of its director candidates in order to maintain control. Synalloy has not made any binding commitment to put any Privet and UPG nominees on the Board. This eleventh hour attempt by the incumbent directors to keep control of the Board is nothing more than a disingenuous and hollow entrenchment maneuver to try to confuse stockholders and manipulate the corporate voting machinery. |

| Ø | Do NOT be fooled – you have a choice. By voting our WHITE Proxy Card, you can deliver real change to Synalloy. Stockholders that vote our WHITE Proxy Card may vote FOR or WITHHOLD on as many of our nominees as desired. Do not be misled into voting the blue card when you truly desire needed change. |

| 4. | Reality: Only Privet and UPG are offering stockholders a viable strategy, an experienced Chief Executive Officer with a track-record of success and nominees with strong experience serving on public company boards of directors and leading industrials businesses. |

| Ø | While Synalloy’s current leadership prefers to share excuses rather than credible plans, our nominees have a comprehensive strategy for increasing revenue, improving margins and reducing wasteful spending. This strategic plan is a tangible roadmap for addressing excessive debt, revitalizing a neglected employee base, enhancing operations and ultimately delivering up to $25 per share in near-term value. |

| Ø | Chris Hutter, who helped build UPG into a metals and manufacturing powerhouse 2.5x the size of Synalloy, is prepared to immediately focus 100% of his time on serving as Synalloy’s interim Chief Executive Officer and is looking forward to working closely with a reconstituted Board to reposition the Company as a thriving public market participant. |

2

The case for urgent and meaningful change atop Synalloy stems as much from leadership’s dishonesty as the past decade of dismal results and value destruction. Stockholders should not double down on dramatic operational and financial underperformance or a culture of conflicts and cronyism fostered by the incumbent Board. Only by voting on the WHITE Proxy Card to elect all five of our nominees will stockholders benefit from our strategic plan and vision for a stronger Synalloy. We look forward to working with all Synalloy stakeholders – including employees, customers, vendors, stockholders and community leaders – to help the Company succeed and thrive for years to come under a refreshed and strengthened Board.

We encourage stockholders to visit www.StrengthenSynalloy.com to review important information and materials that can inform your decision ahead of this month’s Annual Meeting, including:

| · | A presentation introducing Privet and UPG |

| · | Biographies and endorsements of our highly-qualified nominees and proposed interim Chief Executive Officer (Chris Hutter) |

| · | An overview of our case for meaningful change |

| · | A letter and presentation exposing Synalloy’s web of conflicts and disclosure lapses |

| · | A presentation detailing our plan for achieving up to $25 per share in near-term value |

| · | A podcast in which nominee Ben Rosenzweig explains our plan to strengthen Synalloy (https://bit.ly/SYNLpodcast20) |

| · | Instructions regarding how to vote on the WHITE Proxy Card |

We greatly appreciate the support we have received so far and look forward to moving past this election contest so that we can work constructively to effect positive change at Synalloy on behalf of all stockholders.

Thank you.

| Andee Harris | Chris Hutter | Aldo Mazzaferro | Ben Rosenzweig | Chris Hutter |

3

Item 2: On June 19, 2020, the Stockholder Group issued the following supplemental slides to its investor presentation: