Roadshow Presentation

Follow-on Equity Offering

September 2013

Free Writing Prospectus

Registration Statement No. 333-185064 |

Roadshow Presentation

Follow-on Equity Offering

September 2013

Free Writing Prospectus

Registration Statement No. 333-185064 |

Forward

– Looking Statements

2

Statements in this presentation that are not historical facts are forward-looking

statements within the meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended. Such

forward-looking statements involve risks and uncertainties that could cause actual outcomes and

results to differ materially from those described in the forward-looking statements.

We believe that the expectations represented by our forward-looking statements are

reasonable, yet there can be no assurance that such expectations will prove to be

correct. Furthermore, unless otherwise stated, the forward-looking statements contained herein are

made as of the date of the presentation, and we do not undertake any obligation to update

publicly or to revise any of the included forward-looking statements, whether as a

result of new information, future events or otherwise unless required by applicable

legislation or regulation. The forward-looking statements contained herein are expressly

qualified by this cautionary statement. Readers are cautioned that these forward-looking

statements involve certain risks and uncertainties, including those contained in

filings with the U.S. Securities and Exchange Commission.

Information regarding market and industry statistics contained in this presentation is based

on information available to us that we believe is accurate. It is generally based on

management estimates and publications that are not produced for investment or economic

analysis.

We have filed a registration statement with the Securities and Exchange Commission for the

offering to which this communication relates. Before you invest, you should read the

prospectus and the prospectus supplement in that registration statement and other

documents we have filed with the Securities and Exchange Commission for more complete

information about us and this offering. The risks and uncertainties described under the caption “Risk Factors”

of the prospectus and the prospectus supplement included in the registration statement should

be considered in evaluating the forward-looking statements. You may obtain these

documents, and the documents incorporated by reference therein for free by visiting

EDGAR on the Securities and Exchange Commission’s web site at www.sec.gov.

|

Over-allotment Option: ..………..

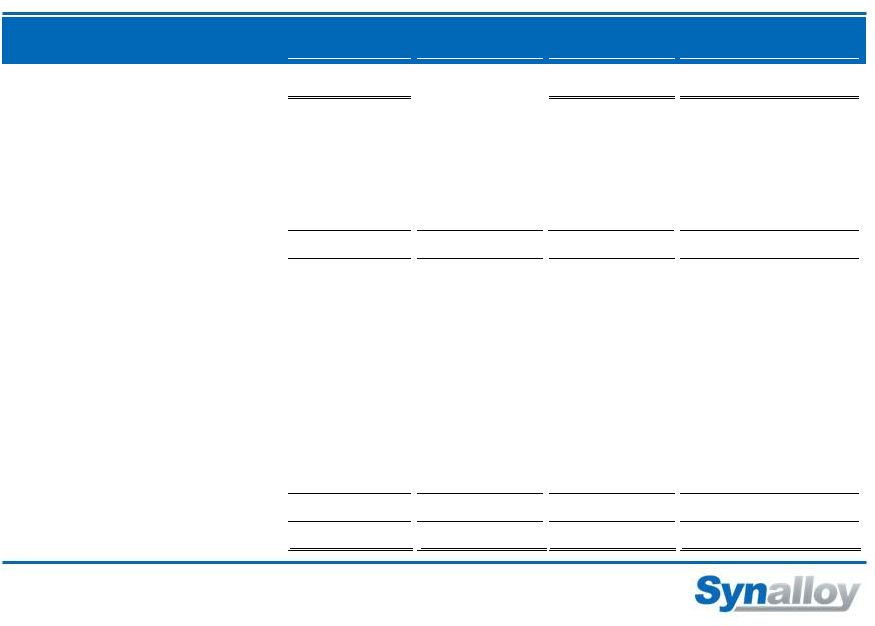

Offering Summary

3

Issuer: ……………………………

Synalloy Corporation

Ticker/Exchange: ………………..

SYNL / NASDAQ

Issue: ……………………………..

Offering Size: ….…………………

Use of Proceeds: ……….………

approximately $3.5 million in new equipment

for the CRI Facility, approximately $2.0 million

in new equipment for the Company's

fabrication facilities and to pay down the

Company's line of credit

Lock-Up Provision: ………………

90 days

Expected Pricing: ………………..

Week of September 23, 2013

Bookrunners: ……………………..

Sterne Agee and BB&T Capital Markets

To fund growth initiatives including

15%, all primary

1,500,000 shares of common stock, all primary

Common Stock Follow-on |

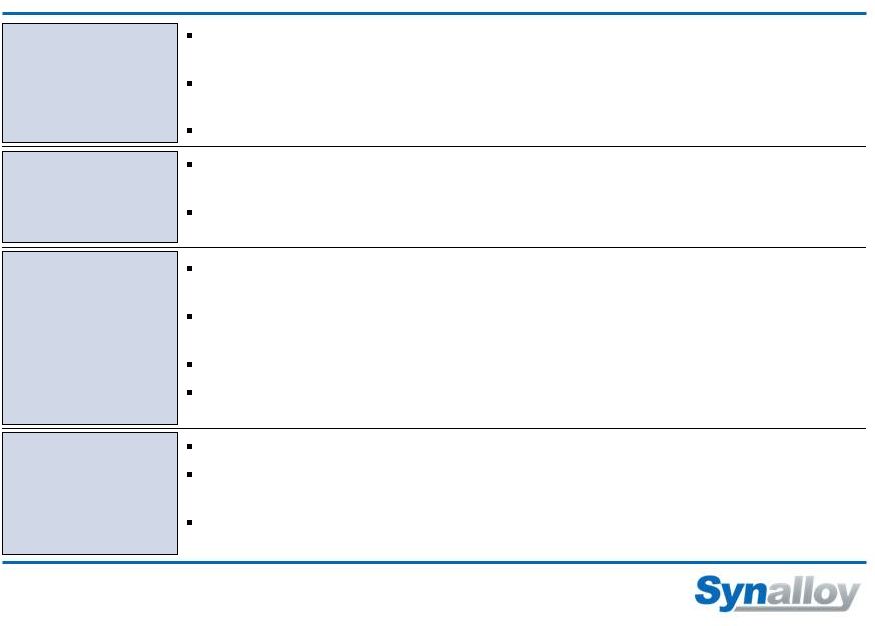

Today’s Presenters

4

President

and

CEO

since

January

2011

and

Director

of

the

Company

since

2004

Previously

Managing

Director

of

Avitas

Capital,

LLC

–

Investment

Banking

and

Private

Equity

Previously

Founder,

President

and

CEO,

BIZPORT,

Ltd.

–

Document

Management

Company

30 years experience in business management, financial operations, logistics, and

management consulting

MBA in Finance from Virginia Commonwealth University

CFO and Vice President of Finance since June 2010

Previously served as Assistant Vice President of Finance of Synalloy

Previously Divisional Vice President of Finance, Buffets, Inc.; Vice President of

Accounting and Corporate Controller at Ryan’s Restaurant Group, Inc.;

Senior Audit Team Member at PriceWaterhouse LLP

B.S. from Indiana University at South Bend; currently holds CPA

Craig C. Bram –

President & CEO

Richard D. Sieradzki –

CFO & Vice President of Finance |

Investment Highlights

5

Fabrication business in the early stages of a major turnaround with backlog up

225% since the beginning of 2013

Poised

for

improved

pipe

manufacturing

pricing

and

profitability

following

a

favorable

anti-dumping ruling

Recently

acquired

production

capacity

in

the

Specialty

Chemicals

segment

New

Metals

segment

manufacturing

initiatives

providing

increased

throughput

and

efficiencies

Proven

M&A Capability

Disciplined

M&A

Strategy

–

experienced

at

the

Management

and

Board

levels

Palmer of Texas acquired in August 2012 at approximately 5.5X trailing EBITDA,

performing in line with expectations and contributing to increasing

margins CRI acquired in August 2013, adding much needed capacity at a

significant discount to replacement value and accretive in first year

Advantageous

Macro Environment

Shale “revolution”

resulting in low natural gas prices and setting the stage for increased

infrastructure spending for the foreseeable future

Already serving the growing domestic energy market, and focused on additional

opportunities

Repositioned

for Growth

Recent expansion of sales and marketing has lead to successful penetration of new

end markets with strong growth characteristics

The shift in sales has not only provided the foundation for strong revenue growth,

it will generate the opportunity to fuel margin expansion

Growing list of blue chip customers across both segments

Conditions

Ripe to Excel |

Synalloy

Overview 6

Company Overview

Synalloy

Metals

Comprised of BRISMET,

Synalloy Fabrication and

Palmer

Targets customers requiring

materials which are:

3 Facilities totaling 520k sq. ft

Comprised of

Manufacturers Chemicals

and CRI Tolling

Produces specialty

chemicals for a diverse

set of industries

Longstanding blue chip

customer base

Stable, attractive margins

(1)

LTM as of June 29, 2013.

(2)

Adjusted for non-cash items and for inventory gains/losses attributable to

movement in nickel prices; Adjusted EBITDA is a non-GAAP metric

– see Appendix for reconciliation tables.

Synalloy

Chemicals

Diversified industrial manufacturer of metal and specialty chemical products sold

into a wide range of end markets

Revenues

(1)

: $217.5MM

Adjusted EBITDA

(1)(2)

: $17.9MM

Approximately 600 employees

Founded in 1945 and headquartered in Spartanburg, SC

Business Segments

•

Corrosion-resistant

•

Suitable for high-purity

processes

•

Over 1,100 specialty

formulations |

Our

Products and Services 7

Stainless

Steel Pipes

Titanium

Pipes

Super Duplex

Pipes

Nickel Alloy

Pipes

Bending

X-Ray

Heat

Treating

Freight/

Logistics

Fiberglass

Tanks

Steel Tanks

Field Erected

Tanks

Tank

Accessories

Sulfated

Derivatives

Additives

Lubricants

Defoamers

Dry Blending

High Viscosity

Liquid Mixing

Dispersions |

Oil

and Gas Select End Markets Served

8

Metals Segment

Power

Chemicals

Water/Waste Water

Specialty Chemicals Segment

Agricultural

Metal Working

Paper

Petroleum & Mining |

Experienced Management Team

9

Title

Years of Experience

Craig Bram

President and CEO

30+

Richard Sieradzki

CFO and Vice President of Finance

35+

Kyle Pennington

President –

Synalloy Metals

25+

John Tidlow

Executive

Vice

President

–

Synalloy

Fabrication

25+

Kevin Hrebenar

Executive

Vice

President

of

Operations

–

Synalloy

Chemicals

25+

Greg Gibson

20+

Executive Vice President of Sales – Synalloy Chemicals |

|

BRISMET –

Overview

11

North American leader in welded stainless steel

and special alloy pipe production

Operates a 190,000 square-

foot facility in Bristol, TN

Produces welded pipe

sizes from ½”

to 120”

Capabilities

Forming

X-Ray / Testing

End Preparation

Surface Finishing

Heat Treatment

Welding

Cold Working /

Plannishing

Diverse equipment capabilities to provide large and small diameter pipe in a

wide range of schedules/wall thicknesses, gauges and long lengths

Stainless

Steel Pipes

Titanium

Pipes

Super Duplex

Pipes

Nickel Alloy

Pipes

Product Overview

Business Overview |

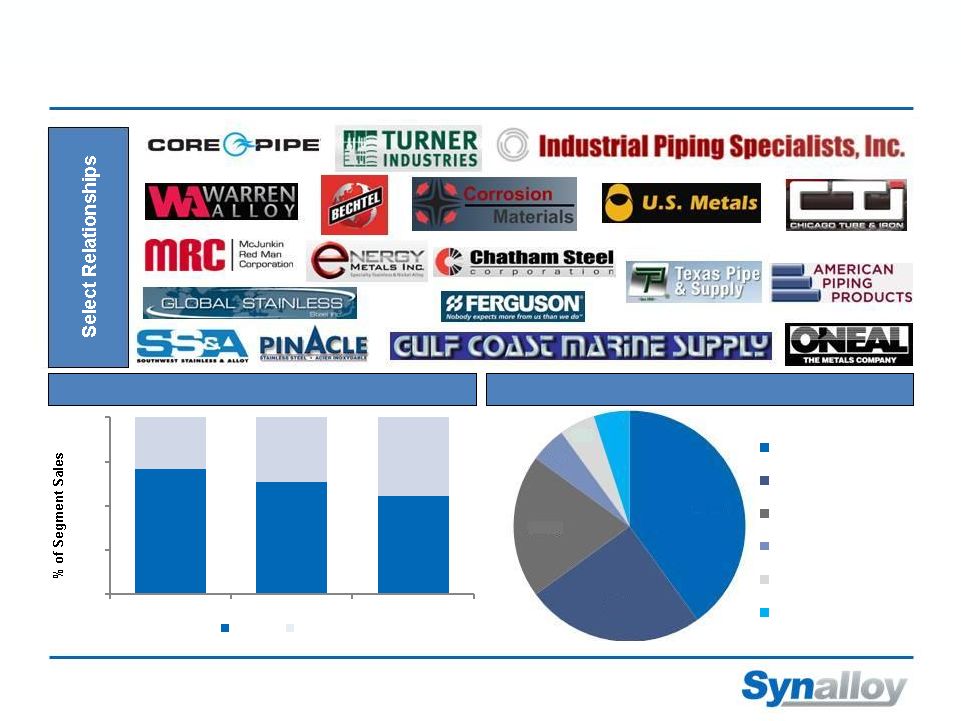

BRISMET –

Key Relationships

12

Customer Breakdown

End Markets

40%

25%

20%

5%

5%

5%

Oil & Gas

Power/Energy

Chemical

Pulp & Paper

Mining

Water/Waste Water

71%

63%

55%

29%

37%

45%

0%

25%

50%

75%

100%

2010

2011

2012

Top 10

Other |

Synalloy Fabrication –

Overview

13

Comprised of BristolFab and, its sister

company, Ram-Fab LLC

Provides complete turn-key pipe

fabrication solutions across a wide

variety of market segments

Fabrication

capabilities

from

1/2”

to

144”

(12.7 millimeters to 4 meters) in

diameter

Combined union and non-union

fabrication capabilities allow for

comprehensive fabrication offerings for

both domestic and international projects

Services include: Modular Construction,

OEM Services, and Commercial

Bonding

Business Description

Industry leader in high nickel alloy, stainless steel, carbon and chrome

pipe fabrication for over 40 years

Bristol, Tennessee

Crossett, Arkansas

Capabilities

Cutting / Forming /

Bending

Warehousing

Freight Logistics

Surface Finishing

Heat Treatment

Painting

X-Ray |

Synalloy Fabrication –

Key Relationships

14

End Markets

Customer Breakdown

50%

15%

15%

10%

10%

Chemicals

Water & Waste Water

Oil & Gas

Mining

Power & Energy

Pulp & Paper

87%

92%

91%

13%

8%

9%

0%

25%

50%

75%

100%

2010

2011

2012

Top 10

Other |

Palmer

of Texas – Overview

15

Fiberglass

Tanks

Steel Tanks

Field Erected

Tanks

Tank

Accessories

Strategically located in the heart of the Permian Basin in West Texas with

direct access to emerging shale oil plays, Palmer is able to provide

customers with the majority of their tank battery

Capabilities

On-site Delivery /

Setup

Drafting /

Engineering

Field Services

Painting / Coating

Operates a 125,000 square-

foot facility situated on 20

acres in Andrews, TX

Produces fiberglass and

steel tanks for 50 to 1,000

barrels of volume

Product Overview

Business Overview

Industry leader in manufacturing fiberglass and steel liquid

storage tanks and separation equipment |

Palmer

of Texas – Permian Focused

16

Key Relationships

Increasing End Market Demand

The Permian Basin accounts for two-thirds of oil production in Texas and

approximately 15% of the entire United States

2012 Permian Basin production was 1.25 million bbl/d and is expected to grow to

1.85 million

bbl/d

by

2015

and

to

3.5

million

bbl/d

by

2025

(1)

Over

492

rigs

(~25%

of

US

total)

are

operating

in

the

Permian

Basin

(1)

(1)

U.S. Energy Information Administration 2013 Short-Term Energy Outlook

Report. |

Synalloy Metals –

Drivers of Growth

Automated steel tank line will be fully operational by the end of 2013, increasing

production by approximately 30%

17

Palmer’s Steel

Production Capacity

Ramping Up

Oil & Gas Demand in

Palmer’s Immediate

Area

Receipt of Pressure

Vessel Certification

Will open up numerous additional clients who want to purchase tanks and pressure

vessels from a single vendor

Horizontal

drilling

technology

and

higher

oil

prices

are

driving

a

shale

oil

drilling

boom

in

the Permian Basin and Eagle Ford Shale, increasing the need for tanks

Anti-Dumping Ruling

Potential

Nickel Price

Appreciation

Nickel prices are currently at 2009 recessionary levels, where 30% of the

world’s production is unprofitable, indicating potential for price

increases Improving prices and margins following the soon to be implemented

duty increases on imported pipe from Asian countries

Strong

Backlog

Improving Conversion

Margins

Conversion margins on current backlog have improved substantially over prior

years Current

backlog

is

at

a

historical

high

-

$63

million

Favorable Natural Gas

Price Environment

Early stages of increased infrastructure spending due to lower natural gas prices

from the shale “revolution” |

|

Synalloy Chemicals –

Overview

19

One of the largest custom chemical formulators in the U.S. with attractive,

stable margins and longstanding customer relationships

Select Products & Services

Combines state of the art equipment and the most advanced

technology to provide a wide variety of specialty chemicals for

customers across over 20 industries

Full service Chemical Manufacturer with high-

temperature reaction vessels, extensive

blending and mixing vessels, powder blending

capabilities and a variety of methods for

particle size reduction

Business Overview

Manufacturers Chemicals

CRI Tolling

High quality toll manufacturer that provides

outside manufacturing resources including high

viscosity mixing, liquid mixing, dispersions, wet

milling, filtration & purification, liquid mixing,

dispersions, and dry bulk bagging

Dispersions

Additives

Lubricants

Liquid Mixing

125,000 sq. ft. facility

–

Cleveland, TN

135,000 sq. ft. facility

–

Fountain Inn, SC |

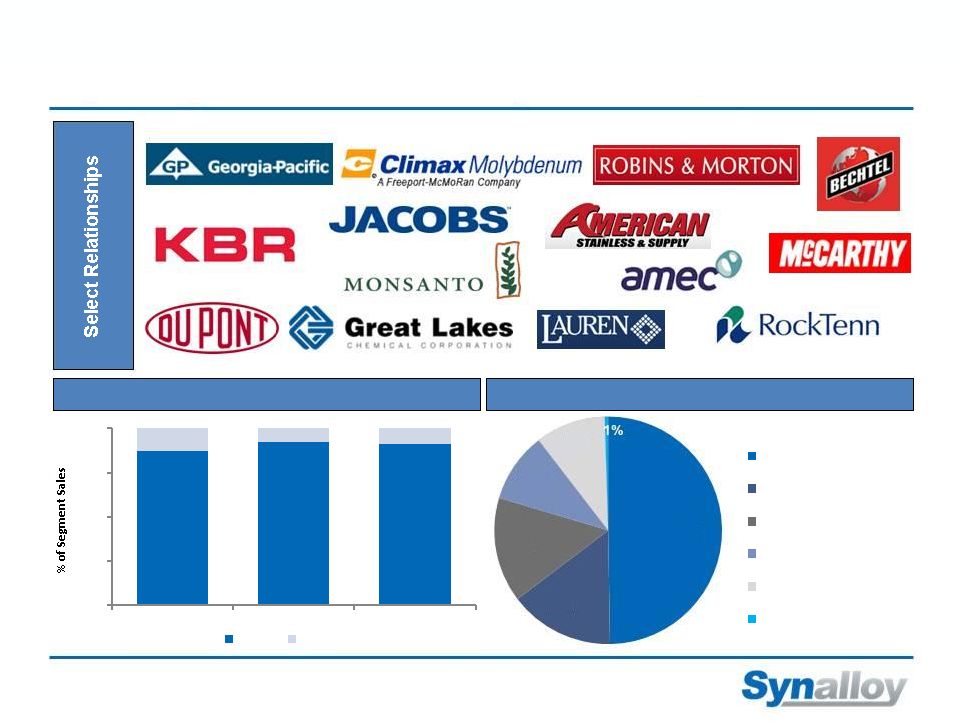

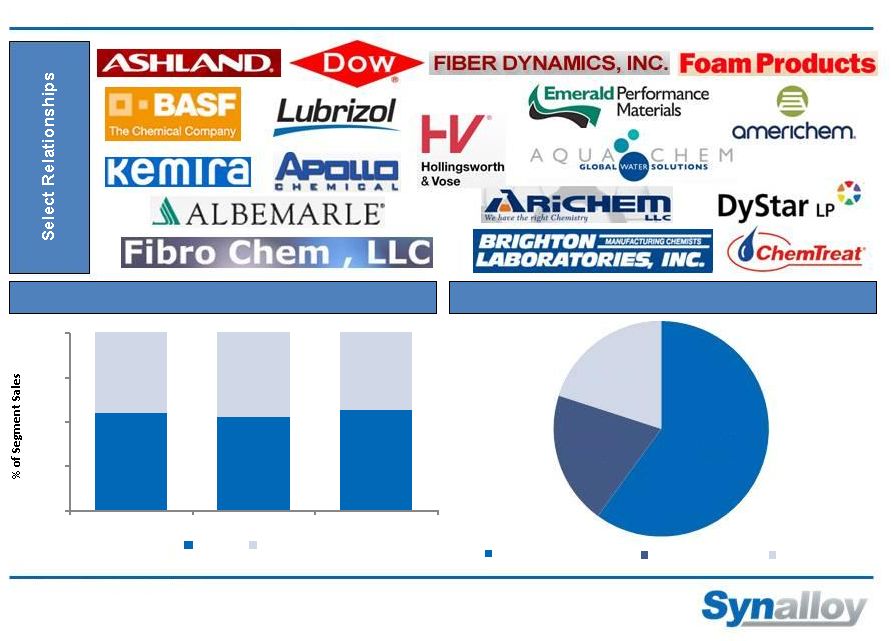

Key

Relationships 20

Contract

vs.

Non-Contract

Sales

(1)

(1)

Data as of December 31, 2012.

60%

20%

20%

Contract Manufacturing

Intermediate Sales

Direct Sales

Manufacturers Chemicals Customer Breakout

55%

53%

56%

45%

47%

44%

0%

25%

50%

75%

100%

2010

2011

2012

Top 10

Other |

Drivers of Growth

21

Represents a small percentage of total sales for the Specialty

Chemicals group, with opportunities to penetrate the market with

existing product lines

Agriculture

Mining

Heavy users of defoamers and dust inhibitors with excellent

potential to grow sales of existing products

Existing

Customers

Sale of existing products to CRI customers

Commercialization of late-stage development phase products at CRI

Oil & Gas

Substantially larger volume requirements than current customers of

the Specialty Chemicals group with higher gross margins

Product

Development |

Financial

Overview |

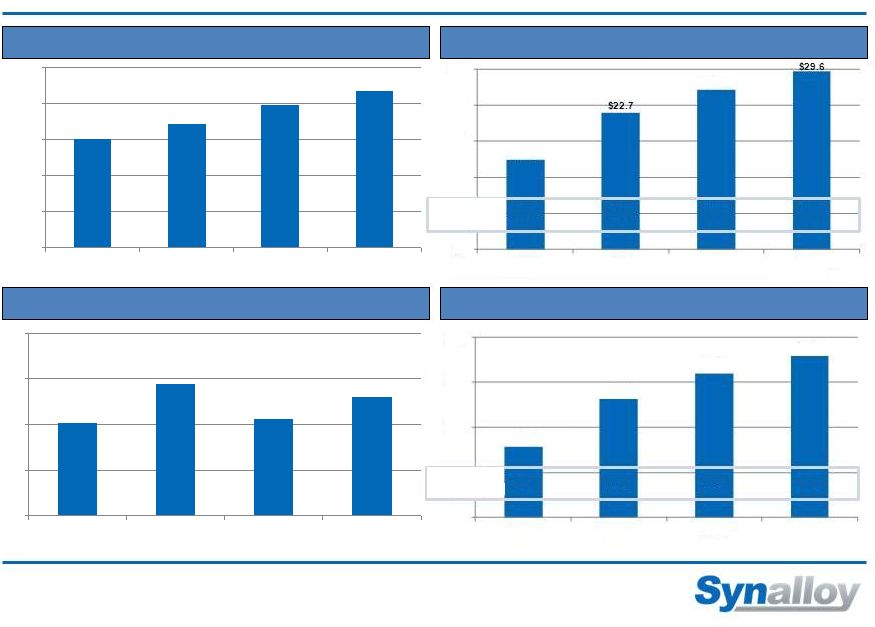

Consolidated Historical Financial Performance

23

$151.1

$170.6

$197.7

$217.5

$0

$50

$100

$150

$200

$250

2010

2011

2012

LTM

6/29/2013

Revenue

Gross

Profit

(1)

Net Income

Adjusted

EBITDA

(1)

$4.0

$5.8

$4.2

$5.2

$0

$2

$4

$6

$8

2010

2011

2012

LTM

6/29/2013

Note: Dollars in millions.

(1)

Adjusted for non-cash items and for inventory gains/losses attributable to

movement

in

nickel

prices;

Adjusted

EBITDA

is

a

non-GAAP

metric

–

see

Appendix

for

reconciliation

tables.

5.2%

7.7%

8.1%

8.2%

Adj. EBITDA

Margin

9.8%

13.3%

13.4%

13.6%

Gross Profit

Margin

$14.9

$26.6

$0

$12

$18

$24

$30

2010

2011

2012

LTM

6/29/2013

$7.8

$13.1

$16.0

$17.9

$0

$10

$15

$20

2010

2011

2012

LTM

6/29/2013 |

Summary

Balance Sheet 24

($ in 000s)

6/29/2013

12/31/2012

Cash

$143

$1,085

Current Assets

102,719

89,837

Long-term Assets

58,272

57,585

Total Assets

$161,134

$148,507

Current Liabilities

$29,620

$24,553

Other Liabilities

55,996

52,180

Total Liabilities

85,616

76,733

Shareholders' Equity

75,519

71,774

Total Liabilities and Shareholders' Equity

$161,134

$148,507 |

Pro

Forma Capitalization 25

(1)

Assumes the issuance of 1,500,000 shares of common stock at recent price of $16.02

per share, the receipt of $22.4MM of net proceeds, and the use of $3.5

million to purchase new equipment for the CRI Facility, $2.0 million to

purchase new equipment for the our fabrication facilities, and remaining

amounts to pay down our line of credit. June 29, 2013

Adjustments for

As Adjusted for

As Adjusted for CRI

($ in 000s)

Actual

CRI Acquisition

CRI Acquisition

Acquisition and Offering

(1)

Cash and cash equivalents

$143

--

$143

$143

Long term debt, including current portion:

Line of credit

$23,399

$869

$24,268

$7,335

Term loan

20,625

--

20,625

20,625

Mortgage and equipment loan

--

4,033

4,033

4,033

Total long term debt

44,024

4,902

48,926

31,993

Shareholder's Equity:

Common stock, $1.00 par value;

12,000,000 shares authorized; 8,000,000

shares issued and 6,382,800 shares

outstanding (actual) and 9,500,000 shares

issued and 7,882,800 shares outstanding

(as adjusted)

8,000

--

8,000

9,500

Capital in excess of par value

1,545

--

1,545

22,478

Retained earnings

80,215

--

80,215

80,215

Cost of common stock in treasury

(1,617,200 shares)

(14,241)

--

(14,241)

(14,241)

Total Shareholder's Equity

75,519

--

75,519

97,952

Total Capitalization

$119,543

$4,902

$124,445

$129,945 |

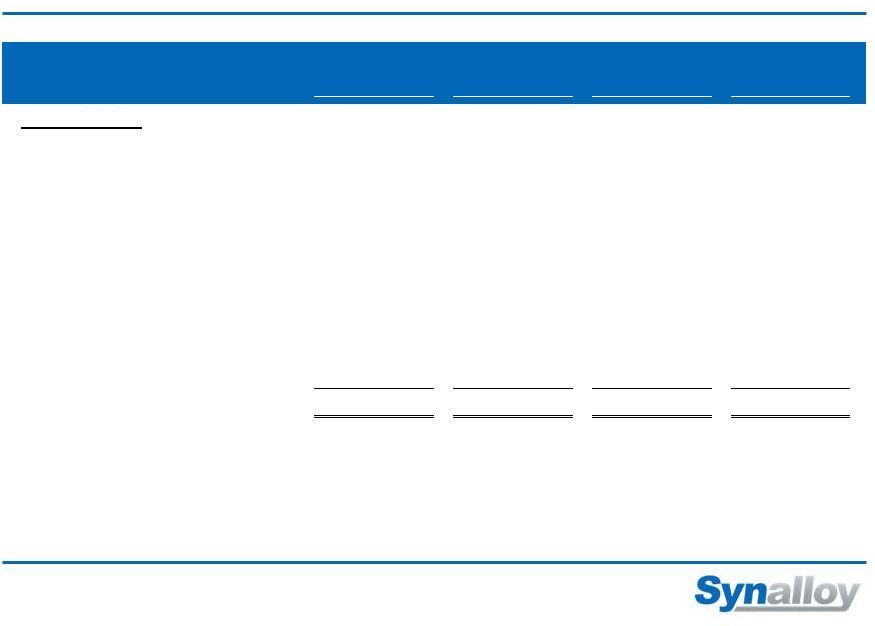

Investment Highlights

26

Fabrication business in the early stages of a major turnaround with backlog up

225% since the beginning of 2013

Poised

for

improved

pipe

manufacturing

pricing

and

profitability

following

a

favorable

anti-dumping ruling

Recently

acquired

production

capacity

in

the

Specialty

Chemicals

segment

New

Metals

segment

manufacturing

initiatives

providing

increased

throughput

and

efficiencies

Proven

M&A Capability

Disciplined M&A Strategy –

experienced at the Management and Board levels

Palmer of Texas acquired in August 2012 at approximately 5.5X trailing EBITDA,

performing in line with expectations and contributing to increasing

margins CRI acquired in August 2013, adding much needed capacity at a

significant discount to replacement value and accretive in first year

Advantageous

Macro Environment

Shale “revolution”

resulting in low natural gas prices and setting the stage for increased

infrastructure spending for the foreseeable future

Already serving the growing domestic energy market, and focused on additional

opportunities

Repositioned

for Growth

Recent expansion of sales and marketing has lead to successful penetration of new

end markets with strong growth characteristics

The shift in sales has not only provided the foundation for strong revenue growth,

it will generate the opportunity to fuel margin expansion

Growing list of blue chip customers across both segments

Conditions

Ripe to Excel |

Appendix |

Adjusted EBITDA Reconciliation

28

Consolidated

Net Income

$4.0

$5.8

$4.2

$5.2

Adjustments:

Interest Expense

0.1

0.1

0.6

1.2

Change in Fair Value

of Interest Rate Swap

-

-

0.1

(0.5)

Tax Provision

2.1

3.0

2.1

2.6

Depreciation

2.6

2.6

2.9

3.2

Amortization

-

-

0.6

1.3

Inventory Loss (Gain)

(1.0)

1.6

4.6

4.0

Acquisition Costs

-

-

0.9

0.9

Adjusted EBITDA

$7.8

$13.1

$16.0

$17.9

LTM

2010

2011

2012

6/29/2013 |

Adjusted EBITDA Reconciliation

29

Metals Segment

Net Income

$3.7

$9.3

$6.1

$7.0

Adjustments:

Interest Expense

-

-

-

-

Change in Fair Value

of Interest Rate Swap

-

-

-

-

Tax Provision

-

-

-

-

Depreciation

2.1

2.1

2.2

2.5

Amortization

-

-

0.6

1.3

Inventory Loss (Gain)

(1.0)

1.6

4.6

4.0

Acquisition Costs

-

-

-

-

Adjusted EBITDA

$4.8

$13.0

$13.5

$14.8

LTM

2010

2011

2012

6/29/2013 |

Adjusted EBITDA Reconciliation

30

Chemicals Segment

Net Income

$4.0

$2.2

$4.8

$5.5

Adjustments:

Interest Expense

-

-

-

-

Change in Fair Value

of Interest Rate Swap

-

-

-

-

Tax Provision

-

-

-

-

Depreciation

0.4

0.4

0.5

0.5

Amortization

-

-

-

-

Inventory Loss (Gain)

-

-

-

-

Acquisition Costs

-

-

-

-

Adjusted EBITDA

$4.4

$2.6

$5.3

$6.0

LTM

2010

2011

2012

6/29/2013 |

Adjusted EBITDA Reconciliation

31

Unallocated Corporate

Net Income

($3.7)

($5.7)

($6.7)

($7.3)

Adjustments:

Interest Expense

0.1

0.1

0.6

1.2

Change in Fair Value

of Interest Rate Swap

-

-

0.1

(0.5)

Tax Provision

2.1

3.0

2.1

2.6

Depreciation

0.1

0.1

0.2

0.2

Amortization

-

-

-

-

Inventory Loss (Gain)

-

-

-

-

Acquisition Costs

-

-

0.9

0.9

Adjusted EBITDA

($1.4)

($2.5)

($2.8)

($2.9)

LTM

2010

2011

2012

6/29/2013 |