Filed Pursuant to Rule 424(b)(5)

Registration No. 333-185064

Prospectus Supplement

(to Prospectus dated January 7, 2013)

2,000,000 Shares

SYNALLOY CORPORATION

Common Stock

Synalloy Corporation is offering 2,000,000 shares of our common stock pursuant to this prospectus supplement and the accompanying prospectus.

Our common stock is listed on the NASDAQ Global Market under the symbol “SYNL.” The last reported sale price of our common stock on the NASDAQ Global Market on September 24, 2013 was $15.82 per share.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page S-19 of this prospectus supplement and in the corresponding sections of the accompanying prospectus and the documents incorporated by reference into this prospectus supplement and accompanying prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share |

Total | |||||||

| Public offering price |

$ | 15.75 | $ | 31,500,000 | ||||

| Underwriting discount |

$ | 0.86625 | $ | 1,732,500 | ||||

| Proceeds, before expenses, to us |

$ | 14.88375 | $ | 29,767,500 | ||||

The underwriters may also purchase up to an additional 300,000 shares of our common stock, at the public offering price less the underwriting discount, within 30 days of the date of this prospectus supplement to cover over-allotments, if any. If the underwriters exercise the option in full, the total underwriting discount payable by us will be $1,992,375 and total proceeds to us before expenses will be $34,232,625.

The underwriters expect to deliver the common stock in book-entry form only, through the facilities of The Depository Trust Company against payment on or about September 30, 2013.

Joint Book-Running Managers

| Sterne Agee | BB&T Capital Markets | |||

Prospectus Supplement dated September 24, 2013

Prospectus Supplement

| Page | ||||

| S-ii | ||||

| S-1 | ||||

| S-7 | ||||

| Summary Unaudited Pro Forma Condensed Combined Consolidated Financial Data |

S-9 | |||

| S-16 | ||||

| S-18 | ||||

| S-19 | ||||

| S-30 | ||||

| S-31 | ||||

| S-32 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

S-33 | |||

| S-47 | ||||

| S-53 | ||||

| S-55 | ||||

| S-58 | ||||

| S-58 | ||||

| S-58 | ||||

| S-58 | ||||

Prospectus

| Page | ||||

| 1 | ||||

| 2 | ||||

| 2 | ||||

| 3 | ||||

| 4 | ||||

| 7 | ||||

| 7 | ||||

| 7 | ||||

| 7 | ||||

| 8 | ||||

| 9 | ||||

| 13 | ||||

| 14 | ||||

| 15 | ||||

| 15 | ||||

| 18 | ||||

| 18 | ||||

S-i

ABOUT THIS PROSPECTUS SUPPLEMENT

You should rely only on the information contained or incorporated by reference in this prospectus supplement, the accompanying prospectus or any related free writing prospectus. We have not, and the underwriters have not, authorized anyone to provide you with any other or different information. If anyone provides you with information that is different from, or inconsistent with, the information contained or incorporated by reference in this prospectus supplement or the accompanying prospectus, you should not rely on it. You should not assume that the information contained in this prospectus supplement, the accompanying prospectus or any related free writing prospectus is accurate as of any date other than the date on the front cover of those documents, or that the information incorporated by reference herein or therein is accurate as of any date other than the date of the relevant report or other document in which such information is contained. Our business, financial condition, results of operations and prospects may have changed since such dates.

This prospectus supplement is a supplement to the accompanying prospectus that is also a part of this document. This prospectus supplement and the accompanying prospectus are part of a registration statement that we filed with the Securities and Exchange Commission (the “SEC”) using a “shelf” registration process, which registration statement was declared effective on January 7, 2013 (File No. 333-185064). Under the shelf registration statement, we may offer and sell shares of our common stock or other securities described in the accompanying prospectus in one or more offerings. In this prospectus supplement, we provide you with specific information about the terms of this offering. Both this prospectus supplement and the accompanying prospectus include important information about us, our common stock and other information you should know before investing in our common stock. This prospectus supplement may also add, update and change information contained in the accompanying prospectus. This prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein also include important information about us and other information you should know before investing. To the extent that any statement that we make in this prospectus supplement is inconsistent with the statements made in the accompanying prospectus, the statements made in the accompanying prospectus are deemed modified or superseded by the statements made in this prospectus supplement and you should rely on such modified or superseded statements. You should read this prospectus supplement, the accompanying prospectus and any free writing prospectus, together with additional information described under the headings “Incorporation of Certain Information by Reference” and “Where You Can Find More Information” in this prospectus supplement and the accompanying prospectus before investing in our common stock.

We are offering to sell, and are seeking offers to buy, shares of our common stock only in jurisdictions where such offers and sales are permitted. The distribution of this prospectus supplement and the accompanying prospectus and the offering of the shares in certain jurisdictions or to certain persons within such jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus supplement and the accompanying prospectus must inform themselves about and observe any restrictions relating to the offering of the shares and the distribution of this prospectus supplement and the accompanying prospectus outside the United States. This prospectus supplement and the accompanying prospectus do not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement and the accompanying prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

The industry and market data and other statistical information contained in this prospectus supplement, the accompanying prospectus and the documents incorporated herein or therein are based on management’s own estimates, independent publications, government publications, reports by market research firms or other published independent sources and, in each case, are believed by management to be reasonable estimates. Although we believe these resources to be reliable, neither we nor the underwriters have independently verified the information.

Unless the context requires otherwise, in this prospectus supplement we use the terms “we,” “us,” “our,” “Synalloy” and the “company” to refer to Synalloy Corporation and its subsidiaries.

S-ii

This summary highlights selected information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus. This summary is not complete and does not contain all of the information you should consider before investing in our common stock and is qualified in its entirety by the more detailed information included or incorporated by reference in this prospectus supplement and the accompanying prospectus. We urge you to read this entire prospectus supplement, the accompanying prospectus and the documents incorporated by reference, including the “Risk Factors” section, before making an investment decision.

Synalloy Corporation

Business Overview

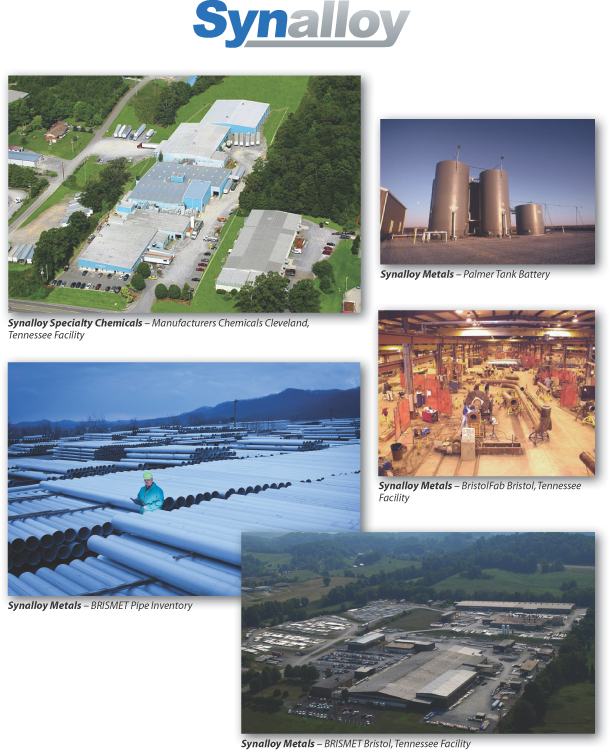

Synalloy Corporation is a growth oriented company engaging in a number of diverse industrial businesses. The company currently operates in two segments: metals and specialty chemicals. Our metals segment (“Synalloy Metals”) manufactures pipe and fabricates piping systems from stainless steel, carbon, chrome and other specialty alloys. It also manufactures fiberglass and steel liquid storage tanks and separation equipment. The principal markets for Synalloy Metals include the energy, chemical, petrochemical, mining, power generation (including nuclear), liquid natural gas (“LNG”) and liquefaction, water and waste water treatment, and pulp and paper industries. Our specialty chemicals segment (“Synalloy Specialty Chemicals”) produces specialty chemicals principally for the paper, mining, agriculture, textile, paint, petroleum, and chemical industries.

For the six month period ended June 29, 2013, we had net sales and adjusted EBITDA of $114.1 million and $9.2 million, respectively, compared to $94.3 million and $7.5 million for the six months ended June 30, 2012. This represented an increase of 21% in net sales and an increase of 23% in adjusted EBITDA. For the fiscal year ended December 29, 2012, we had net sales and adjusted EBITDA of $197.7 million and $16.0 million, respectively, compared to $170.6 million and $13.1 million, respectively, for the fiscal year ended December 31, 2011. This represented an increase of 16% in net sales and an increase of 22% in adjusted EBITDA. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Non-GAAP Financial Information” for reconciliations of adjusted EBITDA to net income.

Synalloy Metals

Synalloy Metals consists of Bristol Metals, LLC (“Bristol”), Ram-Fab LLC (“Ram-Fab”) and Palmer of Texas Tanks, Inc. (“Palmer”). Bristol’s operations include the company’s union pipe manufacturing operations (“BRISMET”) and its union piping system fabrication operations (“BristolFab”), which are located in two adjacent facilities (with approximately a combined 275,000 square feet) in Bristol, Tennessee; Ram-Fab provides piping systems fabrication services out of an approximately 133,000 square feet non-union facility in Crossett, Arkansas; and Palmer manufactures fiberglass and steel storage tanks and separation equipment, and has facilities covering approximately 110,000 square feet in Andrews, Texas.

BRISMET manufactures welded pipe from stainless steel, carbon and other specialty alloys. The pipe is produced in diameters ranging from one-half inch to 120 inches and with wall thicknesses of up to one and one-half inches. While pipe products are normally produced in standard 20-foot lengths, BRISMET’s unique capabilities enable it to produce long-length pipe without circumferential welds. Since 2008, the company has made substantial capital improvements to BRISMET, expanding and improving capabilities to service markets requiring large diameter pipe and specialty alloy pipe.

With similar capabilities, Ram-Fab and BristolFab are uniquely positioned to serve a broad range of customers, both domestic and international. Very few fabricators offer both the carbon and chrome fabrication as well as the stainless steel capabilities that are available from BristolFab and Ram-Fab. Both BristolFab and

S-1

Ram-Fab sell primarily to engineering, procurement and construction companies that manage large infrastructure projects such as KBR, Inc., Jacobs Engineering Group, Inc., E.I. DuPont de Nemours and Company, Bechtel Corporation, Georgia-Pacific LLC and Freeport-McMoRan Copper & Gold, Inc. BristolFab and Ram-Fab process a portion of the stainless pipe produced by BRISMET into piping systems, which conform to engineered drawings furnished by customers.

Palmer manufactures fiberglass and steel tanks, and separation equipment for the oil and gas, waste water treatment and municipal water industries. Additionally, Palmer stands out among its competitors by offering a full range of related services, including transportation, installation and field repairs, giving it a “one-stop shopping” advantage. Palmer’s made-to-order fiberglass tanks utilize a variety of custom mandrels and application specific materials. A large percentage of these tanks are used for oil field waste water capture and are an integral part of environmental regulatory compliance in the drilling process. Palmer’s furnished steel tanks range in size from 50 to 10,000 barrels and are used to store extracted oil.

Palmer’s operations are strategically located in the heart of the Permian Basin. This is important because the Permian Basin, where approximately 25% of the land rigs in the United States are currently operating, accounts for approximately two-thirds of the oil production in Texas and approximately 15% of the entire U.S. oil production. In 2012, the Permian Basin produced 1.25 million barrels of oil per day, and, according to Wood MacKenzie, oil production in the Permian Basin is projected to reach 1.85 million barrels per day by 2015 and 3.5 million barrels per day by 2025. We acquired Palmer in August 2012 and believe that it is well positioned to service this and other key shale regions currently being pursued by the oil and gas industry. Palmer’s customers include many of the largest exploration and production companies, including Anadarko Petroleum Corporation, EOG Resources, Inc., Energen Corporation, Chevron Corporation, BHP Billiton Group and Apache Corporation.

Synalloy Metals’ net sales and adjusted EBITDA for the six month period ended June 29, 2013 were $86.5 million and $7.5 million, respectively, compared to $70.7 million and $6.4 million, respectively, for the six months ended June 30, 2012. This represented an increase of 22% in net sales and 17% in adjusted EBITDA. For 2012, Synalloy Metals had net sales and adjusted EBITDA of $146.3 million and $13.5 million, respectively, compared to $127.7 million and $13.0 million, respectively, for 2011. This represented an increase of 15% in net sales and 4% in adjusted EBITDA.

Synalloy Specialty Chemicals

Synalloy Specialty Chemicals consists of Manufacturers Chemicals, LLC (“MC”) and CRI Tolling, LLC (“CRI”). MC is a contract manufacturer that produces over 1,100 specialty chemical formulations and intermediates for use in a wide variety of applications and industries. MC’s primary product lines focus on the areas of defoamers, surfactants and lubricating agents. These three fundamental product lines are utilized in a diverse number of industries, including paper, mining, agriculture, textiles, paint, petroleum and other chemicals. MC’s capabilities also include the sulfation of fats and oils (animal and vegetable derivatives). The products produced by this process represent renewable resources, and are alternatives to more expensive and non-renewable product derivatives. MC’s customers include some of the largest chemical companies, including Ashland, Inc., Kemira Oyj, ChemTreat, Inc. and Albemarle Corporation. MC has a manufacturing facility in Cleveland, Tennessee with approximately 118,000 square feet and a warehouse in Dalton, Georgia.

CRI, which acquired the assets of Color Resources, LLC (“Color Resources”) and the facility formerly used by Color Resources in August 2013 (the “CRI acquisition”), is located in Fountain Inn, South Carolina. CRI is a toll manufacturer that provides outside manufacturing resources to global and regional chemical companies such as BASF SE, The Dow Chemical Company, The Lubrizol Corporation and Kemira Oyj. With MC’s growth in recent years, the need to build or acquire additional production capacity was a key initiative for Synalloy Specialty Chemicals. CRI’s facility covers approximately 135,000 square feet and provides manufacturing, warehousing, laboratory and office space. Synalloy plans to invest approximately $3.5 million in this facility

S-2

over the next 18 months, adding a plant-wide hot oil system, reactor vessels and other support equipment. This will provide CRI with production capabilities similar to those currently in place at MC’s facility.

Synalloy Specialty Chemicals’ net sales and adjusted EBITDA for the six month period ended June 29, 2013 were $27.6 million and $3.2 million, respectively, compared to $23.6 million and $2.4 million, respectively, for the six months ended June 30, 2012. This represented an increase of 17% in net sales and 33% in adjusted EBITDA. For 2012, Synalloy Specialty Chemicals had net sales and adjusted EBITDA of $51.4 million and $5.3 million, respectively, compared to $42.8 million and $2.6 million, respectively, for 2011. This represented an increase of 20% in net sales and 104% in adjusted EBITDA.

Competitive Strengths

North American Market Leader in Welded Steel and Special Alloy Pipe Production

BRISMET is one of the largest domestic producers of welded stainless steel pipe. Management believes that its size enables it to achieve a favorable customer pricing structure, which makes BRISMET highly competitive with other industry participants.

Diversified Fabricator of Piping Systems Strategically Aligned with Leading Stainless Steel and Alloy Pipe Producer

BristolFab and Ram-Fab have very similar manufacturing capabilities, providing for increased flexibility in production scheduling to meet the needs of our customers. Some fabrication projects call specifically for the use of union labor, and BristolFab provides skilled union personnel to support these requirements. Integrated pipe manufacturing from BRISMET is a key selling point with many customers and provides a cost advantage particularly with large diameter non-commodity pipe. Both fabrication operations can provide logistical efficiencies to their customers by storing materials in advance of production, allowing the customer to lock-in prices.

Leading U.S. Chemical Formulator with Long Standing Customer Relationships

MC has carved out niche markets for its line of defoamers, surfactants and lubricants. Extensive testing, which lasts several months and can extend beyond a year, is required by MC’s customers before the awarding of a contract. Therefore, once the business has been obtained, it generally results in a long-term relationship. MC has many long-term customer relationships, with its top five customers having been with them for an average of more than seven years.

Strategically Located Tank Operations

Palmer’s location in the heart of the Permian Basin in West Texas, the center of the shale “revolution,” gives it a significant competitive advantage. Transporting finished tanks is expensive, and deliveries outside of 300 miles can quickly become non-competitive. From Palmer’s location in Andrews, Texas, it can also access the Eagle Ford shale region, another recently booming area for oil drilling. Palmer’s ability to produce both fiberglass and steel tanks, as well as accessories like walkways, provides customers with most of their tank battery requirements.

Conservative Debt Profile Provides Ability to Pursue Strategic Acquisitions

Synalloy has maintained a strong balance sheet with below average industry leverage. Long-term debt to capital as of June 29, 2013 was 36% and net debt to adjusted EBITDA was 2.4x for the twelve months ended June 29, 2013. This financial strength will support our ability to pursue strategic acquisitions. We intend to continue to manage our debt levels conservatively, even as we pursue strategic acquisitions.

S-3

Experienced Management Team with a Proven Track Record

Our President and Chief Executive Officer, Craig C. Bram, has been in his current position since 2011 and, with the exception of a four-month period, has been a member of the company’s board of directors since 2004. Mr. Bram has gained a deep knowledge of each of the company’s business units during this time. In addition, he has extensive experience in mergers and acquisitions. The senior management team for Synalloy Metals has an average of more than 25 years of experience in the industry, while the senior management team for Synalloy Specialty Chemicals has an average of more than 20 years of experience in the industry.

Business Strategy

Since January 2011, the company has been pursuing a strategy to accelerate growth and profitability. This strategy includes continuous improvement to the company’s current businesses as well as a disciplined approach to acquiring new businesses.

The key drivers for executing the strategy include the following:

| • | Focus on Larger, More Complex Fabrication Opportunities. Given the diverse fabrication capabilities of Bristol Fab and Ram-Fab, over the last 12 months we shifted our focus from lower margin products in the pulp and paper and waste water industries to markets requiring more complex capabilities such as the chemical, petrochemical, mining and power markets. These markets also tend to have fewer competitors in the bidding process. This shift has resulted in the backlog of Bristol Fab and Ram-Fab combined increasing from $19.3 million at December 29, 2012 to approximately $63.0 million at August 31, 2013. |

| • | Expansion of Palmer’s Capabilities and Products. Palmer is in the process of installing an automated steel tank line that will give it the ability to increase steel tank production by approximately 30% while simultaneously reducing manufacturing costs. Additionally, Palmer has applied for the appropriate certification to produce pressure vessels. This production capability will not only add a new product but will also allow Palmer to market to new oil and gas customers who want to purchase tanks and pressure vessels from a single supplier. |

| • | Expansion of Synalloy Specialty Chemicals. We are targeting growth in the sale of our defoamers and biocides to the oil and gas industry. This industry is a large user of these products for down-hole drilling applications. Additionally, we have identified the agriculture and mining markets as new markets for expansion of our products. |

| • | Integrate CRI and Cross-Sell MC’s Capabilities. The CRI acquisition and the proposed expansion of CRI’s facility are expected to nearly double the manufacturing capacity of Synalloy Specialty Chemicals and provide significant additional laboratory and research capabilities. This will allow Synalloy Specialty Chemicals to expand its business and increase the number of products in development each year. We intend to invest approximately $3.5 million in CRI to make its production capabilities similar to those at MC. Additionally, we intend to begin offering MC’s capabilities to CRI’s existing customers. |

| • | Continuous Improvements in Our Manufacturing Capabilities. We consistently seek to improve our manufacturing capabilities to generate new business and create operating efficiencies. As an example, BRISMET recently moved production of 18-inch stainless steel pipe from batch mill processing, which is very labor intensive, to continuous mill processing. As a result, BRISMET is able to produce 16,000 feet of 18-inch stainless steel pipe in two weeks, whereas previously it would have taken almost one year to produce. |

| • | Implement a Disciplined Acquisition Strategy. In 2012, we implemented a disciplined acquisition strategy to pursue potential target businesses which are complementary to our end markets and production processes. Additionally, we focus on businesses that are in niche markets, possess some |

S-4

| degree of pricing power, have stable margins and are less cyclical than our current businesses. The purchase of Palmer in August 2012 provided us with a new platform business that had a familiar production process and serves a market that we are targeting. The CRI acquisition in August 2013 extended the capabilities of Synalloy Specialty Chemicals, providing us the additional production capacity needed for future growth and adding additional customers to whom we can cross-sell our other chemical production services. |

Recent Developments

CRI Acquisition

On August 9, 2013, Synalloy acquired approximately 17 acres and 135,000 square feet of manufacturing, warehouse, laboratory and office space housing the CRI specialty chemicals business (the “CRI Facility”). The purchase price for the CRI Facility was $3.45 million. In a separate transaction on August 26, 2013, Synalloy, through CRI, acquired the assets of Color Resources used to operate its business and assumed certain operating liabilities of Color Resources for $1.1 million. Synalloy plans to use a portion of the net proceeds from this offering to invest approximately $3.5 million in the new facility to add a plant-wide hot oil system, reactor vessels and other support equipment. Once the new equipment is in place, the CRI Facility will almost double the production capacity of Synalloy Specialty Chemicals. In addition, Synalloy intends to move its corporate headquarters, currently located in Spartanburg, South Carolina, to the CRI Facility before the end of the first quarter of 2014.

In connection with the CRI acquisition, we entered into a Second Amendment to First Amended and Restated Loan Agreement with Branch Banking and Trust Company, an affiliate of BB&T Securities, LLC, pursuant to which we obtained a new ten-year term loan in the amount of $4,033,250. The interest rate on the new term loan is LIBOR plus 2%. All of the real and personal property acquired in the CRI acquisition was pledged as security for the new loan.

Impact of Foreign Imports

In the first six months of 2013, the gross profit of Synalloy Metals and the company was negatively affected by foreign imports. Stainless steel pipe received from Malaysia, Vietnam and Thailand entered the U.S. at selling prices below domestic raw material costs. These import prices forced BRISMET to lower its selling prices in order to maintain market share. As a result, BRISMET’s average selling prices in the first six months of 2013 were 16% below average selling prices in the first six months of 2012. Net sales were reduced by $8.9 million and operating profits were reduced by $2.7 million in the first six months of 2013 as compared to the first six months of 2012 as a result of the lower selling prices.

On May 16, 2013, BRISMET, along with several other domestic manufacturers of stainless steel pipe, filed an anti-dumping petition with the U.S. Department of Commerce and the U.S. International Trade Commission (the “USITC”) alleging that welded stainless steel pipe imported from Malaysia, Vietnam and Thailand were being dumped in the U.S. market. On June 28, 2013, the USITC determined there was a reasonable indication that a U.S. industry was materially injured by reason of imports from these three countries. All six commissioners of the USITC hearing the petition voted in favor of the petitioners in the affirmative. Preliminary anti-dumping duty determinations are due in October 2013 and final determinations are due by mid-2014. If there is an affirmative determination, duty deposits would be required no later than the preliminary ruling date and could be retroactive 90 days earlier if the situation is merited.

S-5

In July 2013 in advance of the anticipated determinations, Malaysia substantially increased their imports into the U.S. market. In the past, this type of behavior has resulted in the USITC opting for retroactive duties. In July and August 2013, domestic manufacturers of stainless steel pipe, including BRISMET, implemented several price increases. As of the date of this prospectus supplement, BRISMET’S price increases have been accepted by its customers.

Synalloy Corporation is a Delaware corporation. Our principal executive offices are located at 775 Spartan Boulevard, Suite 102, Spartanburg, South Carolina, and our telephone number is (864) 585-3605. Our Internet address is www.synalloy.com. We are not incorporating the information on our web site into this prospectus supplement and the accompanying prospectus, and the information on the web site is not included in, nor is it a part of, this prospectus supplement or the accompanying prospectus.

S-6

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL DATA

The following table presents summary historical consolidated financial data and other data for Synalloy as of the dates and for the periods presented. The summary historical financial data for each of the years during the three-year period ended December 29, 2012 is derived from our audited consolidated financial statements. The summary historical financial data as of and for the six-month periods ended June 29, 2013 and June 30, 2012 is derived from our unaudited consolidated financial statements. In the opinion of our management, such unaudited financial statements include all adjustments (consisting of normal recurring adjustments) necessary for a fair presentation of our financial position and results of operations for such periods. Interim results for the six months ended June 29, 2013 are not necessarily indicative of, and are not projections for, the results to be expected for the full year ending December 28, 2013 or any other period. The selected historical consolidated financial data should be read in conjunction with the information under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in (i) this prospectus supplement, (ii) our Annual Report on Form 10-K for the year ended December 29, 2012 and (iii) our Quarterly Report on Form 10-Q for the period ended June 29, 2013, and our consolidated financial statements and notes thereto included in such reports, which are incorporated by reference in this prospectus supplement and the accompanying prospectus.

| Six Months Ended (Unaudited) |

Fiscal Years Ended | |||||||||||||||||||

| June 29, 2013 |

June 30, 2012 |

December 29, 2012 |

December 31, 2011 |

January 1, 2011 |

||||||||||||||||

| (Dollars in thousands, except per share data) | ||||||||||||||||||||

| Income Statement Data: |

||||||||||||||||||||

| Net sales |

$ | 114,109 | $ | 94,250 | $ | 197,659 | $ | 170,575 | $ | 151,121 | ||||||||||

| Gross profit |

14,033 | 10,352 | 21,928 | 21,090 | 15,916 | |||||||||||||||

| Selling, general and administrative expense |

8,799 | 6,695 | 14,140 | 12,284 | 9,724 | |||||||||||||||

| Operating income |

5,234 | 3,657 | 7,788 | 8,805 | 6,192 | |||||||||||||||

| Net income |

3,378 | 2,427 | 4,235 | 5,797 | 4,034 | |||||||||||||||

| Balance Sheet Data: |

||||||||||||||||||||

| Total assets |

161,134 | 105,101 | 148,507 | 98,916 | 81,375 | |||||||||||||||

| Working capital |

73,241 | 59,869 | 66,369 | 56,344 | 43,232 | |||||||||||||||

| Long-term debt, less current portion |

41,774 | 8,864 | 37,593 | 8,650 | 219 | |||||||||||||||

| Stockholders’ equity |

75,519 | 71,257 | 71,774 | 68,619 | 63,875 | |||||||||||||||

| Financial Ratios: |

||||||||||||||||||||

| Current ratio (1) |

3.5:1 | 3.8:1 | 3.7:1 | 4.1:1 | 4.0:1 | |||||||||||||||

| Gross profit to net sales |

12 | % | 11 | % | 11 | % | 12 | % | 11 | % | ||||||||||

| Long-term debt to capital |

36 | % | 11 | % | 34 | % | 11 | % | — | |||||||||||

| Return on average assets |

2 | % | 2 | % | 3 | % | 6 | % | 5 | % | ||||||||||

| Return on average equity |

4 | % | 3 | % | 6 | % | 9 | % | 6 | % | ||||||||||

| Per Share Data (income/(loss) – diluted): |

||||||||||||||||||||

| Net income |

$ | 0.53 | $ | 0.38 | $ | 0.66 | $ | 0.91 | $ | 0.64 | ||||||||||

| Dividends declared and paid |

— | — | 0.25 | 0.25 | 0.50 | |||||||||||||||

| Book value |

11.83 | 11.23 | 11.29 | 10.85 | 10.16 | |||||||||||||||

| Other Data: |

||||||||||||||||||||

| Depreciation and amortization |

2,532 | 1,425 | 3,399 | 2,659 | 2,642 | |||||||||||||||

| Capital expenditures |

3,062 | 1,328 | 4,740 | 3,185 | 5,095 | |||||||||||||||

| Non-GAAP Financial Measures (2): |

||||||||||||||||||||

| Adjusted EBITDA |

9,205 | 7,457 | 15,982 | 13,144 | 7,816 | |||||||||||||||

| Adjusted EBITDA per share, diluted |

1.43 | 1.17 | 2.51 | 2.07 | 1.24 | |||||||||||||||

| (1) | Represents the ratio of current assets to current liabilities. |

| (2) | See “Non-GAAP Financial Measures” below. |

S-7

Non-GAAP Financial Measures

Certain of the measures set forth in the table above are not measures recognized under generally accepted accounting principles in the United States (“GAAP”). Earnings before interest, change in fair value of interest rate swap, income taxes, depreciation and amortization, excluding inventory profits and losses and acquisition costs (“adjusted EBITDA”) is a non-GAAP measure of earnings. For a reconciliation of adjusted EBITDA to net income and management’s reasons why it believes that the presentation of adjusted EBITDA provides useful information to investors regarding our results of operation, see the section appearing elsewhere in this prospectus supplement entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Non-GAAP Financial Information.”

S-8

SUMMARY UNAUDITED PRO FORMA CONDENSED COMBINED

CONSOLIDATED FINANCIAL DATA

The following summary unaudited pro forma condensed combined consolidated financial data is designed to show how the CRI acquisition might have affected our historical financial statements if the CRI acquisition had been completed at an earlier date and was prepared based on our historical financial statements and the historical financial statements of Color Resources as supplied by Color Resources. The following should be read in connection with the historical consolidated financial statements of the company and Color Resources that are incorporated by reference in this prospectus supplement and the accompanying prospectus.

The information set forth below, while helpful in illustrating the financial characteristics of the combined company under one set of assumptions, may not reflect all of the anticipated financial expenses and benefits and, accordingly, does not attempt to predict or suggest future results. It also does not necessarily reflect what the historical results of the combined company would have been had Synalloy and Color Resources been combined during the periods presented.

S-9

Synalloy Corporation and Subsidiaries

Summary Unaudited Pro Forma Condensed Combined Consolidated Balance Sheet

| Synalloy | Color Resources |

Pro Forma | ||||||||||||||

| June 29, 2013 |

June 30, 2013 |

Adjustments | Total | |||||||||||||

| Assets |

||||||||||||||||

| Current assets |

||||||||||||||||

| Cash and cash equivalents |

$ | 142,808 | $ | 31,050 | $ | (31,050 | )(1) | $ | 142,808 | |||||||

| Accounts receivable, less allowance for doubtful accounts |

36,381,202 | 546,596 | — | 36,927,798 | ||||||||||||

| Inventories, net |

57,106,370 | 347,432 | (96,704 | )(1) | 57,357,098 | |||||||||||

| Deferred income taxes |

2,944,434 | — | — | 2,944,434 | ||||||||||||

| Prepaid expenses and other current assets |

6,287,155 | 65,831 | (54,136 | )(1) | 6,298,850 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total current assets |

102,861,969 | 990,909 | (181,890 | ) | 103,670,988 | |||||||||||

| Cash value of life insurance |

2,603,219 | — | — | 2,603,219 | ||||||||||||

| (113,874 | )(1) | |||||||||||||||

| 1,562,070 | (2) | |||||||||||||||

| Property, plant & equipment, net |

29,261,908 | 844,874 | 3,450,000 | (8) | 35,004,978 | |||||||||||

| Goodwill |

18,252,678 | — | — | 18,252,678 | ||||||||||||

| Intangible asset, net |

7,695,000 | — | — | 7,695,000 | ||||||||||||

| Deferred charges, net and other non-current assets |

459,635 | 223 | (223 | )(1) | 459,635 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total assets |

$ | 161,134,409 | $ | 1,836,006 | $ | 4,716,083 | $ | 167,686,498 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Liabilities, redeemable members’ deficit and shareholders’ equity |

||||||||||||||||

| Current liabilities |

||||||||||||||||

| Current portion of long-term debt |

$ | 2,250,000 | $ | 5,842,936 | $ | (5,842,936 | )(1) | $ | 2,250,000 | |||||||

| Accounts payable |

17,470,464 | 214,712 | — | 17,685,176 | ||||||||||||

| Accrued expenses |

9,759,204 | 382,908 | (382,908 | )(1) | 9,759,204 | |||||||||||

| Other current liabilities |

140,823 | 9,316 | (9,316 | )(1) | 140,823 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total current liabilities |

29,620,491 | 6,449,872 | (6,235,160 | ) | 29,835,203 | |||||||||||

| (41,232 | )(1) | |||||||||||||||

| Long-term debt |

41,773,859 | 41,232 | 4,550,000 | (3) | 46,323,859 | |||||||||||

| Long-term contingent consideration |

5,794,031 | — | — | 5,794,031 | ||||||||||||

| Deferred income taxes |

7,645,119 | — | — | 7,645,119 | ||||||||||||

| Other long-term liabilities |

782,372 | 1,634,325 | (1,634,325 | )(1) | 782,372 | |||||||||||

| Redeemable members’ deficit |

— | (6,289,423 | ) | 6,289,423 | (9) | — | ||||||||||

| Shareholders’ equity |

||||||||||||||||

| Common stock |

8,000,000 | — | — | 8,000,000 | ||||||||||||

| Capital in excess of par value |

1,544,893 | — | — | 1,544,893 | ||||||||||||

| Retained earnings |

80,214,872 | — | 1,787,377 | (2) | 82,002,249 | |||||||||||

| Less cost of common stock in treasury |

(14,241,228 | ) | — | — | (14,241,228 | ) | ||||||||||

| Total shareholders’ equity |

75,518,537 | — | 1,787,377 | 77,305,914 | ||||||||||||

| Commitments and contingencies |

||||||||||||||||

| Total liabilities, redeemable members’ deficit, and shareholders’ equity |

$ | 161,134,409 | $ | 1,836,006 | $ | 4,716,083 | $ | 167,686,498 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

See accompanying notes to summary unaudited pro forma condensed combined consolidated financial data.

S-10

Synalloy Corporation and Subsidiaries

Summary Unaudited Pro Forma Condensed Combined Consolidated Statements of Operations

| For the Six Months Ended | ||||||||||||||||

| Synalloy | Color Resources |

|||||||||||||||

| June 29, 2013 |

June 30, 2013 |

Pro Forma Adjustments |

Pro Forma | |||||||||||||

| Net sales |

$ | 114,109,287 | $ | 2,517,958 | $ | — | $ | 116,627,245 | ||||||||

| Cost of goods sold |

100,075,791 | 2,071,283 | 123,429 | (6) | 102,270,503 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross profit |

14,033,496 | 446,675 | (123,429 | ) | 14,356,742 | |||||||||||

| Selling and administrative expense |

8,799,461 | 838,870 | — | 9,638,331 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating income (loss) |

5,234,035 | (392,195 | ) | (123,429 | ) | 4,718,411 | ||||||||||

| Other (income) and expense |

(306,897 | )(4) | ||||||||||||||

| Interest expense |

714,227 | 306,897 | 108,263 | (5) | 822,490 | |||||||||||

| Change in fair value of interest rate swap |

(633,109 | ) | — | — | (633,109 | ) | ||||||||||

| Other, net |

(194 | ) | — | — | (194 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income (loss) before income taxes |

5,153,111 | (699,092 | ) | 75,205 | 4,529,224 | |||||||||||

| Provision (benefit) for income taxes |

1,775,000 | — | (218,000 | )(7) | 1,557,000 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) |

$ | 3,378,111 | $ | (699,092 | ) | $ | 293,205 | (10) | $ | 2,972,224 | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income per common share: |

||||||||||||||||

| Basic |

$ | 0.53 | $ | 0.47 | ||||||||||||

|

|

|

|

|

|||||||||||||

| Diluted |

$ | 0.53 | $ | 0.46 | ||||||||||||

|

|

|

|

|

|||||||||||||

| Weighted average shares outstanding: |

||||||||||||||||

| Basic |

6,371,013 | 6,371,013 | ||||||||||||||

| Dilutive effect from stock options and grants |

58,872 | 58,872 | ||||||||||||||

|

|

|

|

|

|||||||||||||

| Diluted |

6,429,885 | 6,429,885 | ||||||||||||||

|

|

|

|

|

|||||||||||||

See accompanying notes to summary unaudited pro forma condensed combined consolidated financial data.

S-11

Synalloy Corporation and Subsidiaries

Summary Unaudited Pro Forma Condensed Combined Consolidated Statements of Operations

| For the Six Months Ended | ||||||||||||||||

| Synalloy | Color Resources |

|||||||||||||||

| June 30, 2012 |

June 30, 2012 |

Pro Forma Adjustments |

Pro Forma | |||||||||||||

| Net sales |

$ | 94,250,210 | $ | 4,127,209 | $ | — | $ | 98,377,419 | ||||||||

| Cost of goods sold |

83,897,819 | 2,990,357 | 140,425 | (6) | 87,028,601 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross profit |

10,352,391 | 1,136,852 | (140,425 | ) | 11,348,818 | |||||||||||

| Selling and administrative expense |

6,695,060 | 979,053 | — | 7,674,113 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating income |

3,657,331 | 157,799 | (140,425 | ) | 3,674,705 | |||||||||||

| Other (income) and expense |

(285,469 | )(4) | ||||||||||||||

| Interest expense |

92,023 | 285,469 | 108,263 | (5) | 200,286 | |||||||||||

| Other, net |

(135,148 | ) | — | — | (135,148 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income (loss) before income taxes |

3,700,456 | (127,670 | ) | 36,781 | 3,609,567 | |||||||||||

| Provision (benefit) for income taxes |

1,273,000 | — | (32,000 | )(7) | 1,241,000 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) |

$ | 2,427,456 | $ | (127,670 | ) | $ | 68,781 | (10) | $ | 2,368,567 | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income per common share: |

||||||||||||||||

| Basic |

$ | 0.38 | $ | 0.37 | ||||||||||||

|

|

|

|

|

|||||||||||||

| Diluted |

$ | 0.38 | $ | 0.37 | ||||||||||||

|

|

|

|

|

|||||||||||||

| Weighted average shares outstanding: |

||||||||||||||||

| Basic |

6,335,667 | 6,335,667 | ||||||||||||||

| Dilutive effect from stock options and grants |

51,043 | 51,043 | ||||||||||||||

|

|

|

|

|

|||||||||||||

| Diluted |

6,386,710 | 6,386,710 | ||||||||||||||

|

|

|

|

|

|||||||||||||

See accompanying notes to summary unaudited pro forma condensed combined consolidated financial data.

S-12

Synalloy Corporation and Subsidiaries

Summary Unaudited Pro Forma Condensed Combined Consolidated Statement of Operations

| For the Years Ended | ||||||||||||||||

| Synalloy | Color Resources |

|||||||||||||||

| December 29, 2012 |

December 31, 2012 |

Pro Forma Adjustments |

Pro Forma | |||||||||||||

| Net sales |

$ | 197,658,874 | $ | 7,191,887 | $ | — | $ | 204,850,761 | ||||||||

| Cost of goods sold |

175,730,511 | 5,827,306 | 266,833 | (6) | 181,824,650 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross profit |

21,928,363 | 1,364,581 | (266,833 | ) | 23,026,111 | |||||||||||

| Selling and administrative expense |

14,140,355 | 1,691,304 | — | 15,831,659 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating income (loss) |

7,788,008 | (326,723 | ) | (266,833 | ) | 7,194,452 | ||||||||||

| Other (income) and expense |

(576,404 | )(4) | ||||||||||||||

| Interest expense |

600,893 | 576,404 | 216,525 | (5) | 817,418 | |||||||||||

| Change in fair value of interest rate swap |

880,583 | — | — | 880,583 | ||||||||||||

| Acquisition related |

113,648 | — | — | 113,648 | ||||||||||||

| Non-recurring impairment of goodwill and intangibles |

— | 5,955,495 | — | 5,955,495 | ||||||||||||

| Other, net |

(148,028 | ) | — | (148,028 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income (loss) before income taxes |

6,340,912 | (6,858,622 | ) | 93,046 | (424,664 | ) | ||||||||||

| Provision (benefit) for income taxes |

2,106,000 | — | (2,250,000 | )(7) | (144,000 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) |

$ | 4,234,912 | $ | (6,858,622 | ) | $ | 2,343,046 | (10) | $ | (280,664 | ) | |||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) per common share: |

||||||||||||||||

| Basic |

$ | 0.67 | $ | (0.04 | ) | |||||||||||

|

|

|

|

|

|||||||||||||

| Diluted |

$ | 0.66 | $ | (0.04 | ) | |||||||||||

|

|

|

|

|

|||||||||||||

| Weighted average shares outstanding: |

||||||||||||||||

| Basic |

6,341,856 | 6,341,856 | ||||||||||||||

| Dilutive effect from stock options and grants |

52,488 | 52,488 | ||||||||||||||

|

|

|

|

|

|||||||||||||

| Diluted |

6,394,344 | 6,394,344 | ||||||||||||||

|

|

|

|

|

|||||||||||||

See accompanying notes to summary unaudited pro forma condensed combined consolidated financial data.

S-13

Notes to Summary Unaudited Pro Forma Condensed Combined Consolidated Financial Data

The combined purchase price for the CRI acquisition was $3,450,000 for the CRI Facility and $1,100,000 for certain assets acquired and certain operating liabilities assumed.

A summary of sources and uses of proceeds for the acquisition is as follows:

| Sources of Funds: |

||||

| Proceeds of term loan |

$ | 4,550,000 | ||

|

|

|

|||

| Total sources of funds |

$ | 4,550,000 | ||

|

|

|

|||

| Uses of Funds: |

||||

| Acquisition of certain Color Resources assets, net of assumed liabilities |

$ | 4,550,000 | ||

|

|

|

|||

| Total uses of funds |

$ | 4,550,000 | ||

|

|

|

The purchase price for the CRI acquisition was funded through a new term loan with Branch Banking and Trust Company.

The total consideration transferred is allocated to Color Resource’s net tangible and identifiable intangible assets based on their fair value as of August 26, 2013. The excess of the fair value of certain net assets acquired exceeds the consideration transferred and therefore a one-time pre-tax gain will be recorded in the third quarter of 2013. The allocation of the total consideration paid to the fair value of the assets acquired and liabilities assumed as of August 26, 2013 is as follows:

| Accounts receivable, net |

$ | 525,454 | ||

| Inventories |

232,771 | |||

| Building and land |

4,100,000 | |||

| Prepaid assets |

11,695 | |||

| Fixed assets |

1,643,070 | |||

| Other liabilities assumed |

(383,002 | ) | ||

|

|

|

|||

| Net fair value |

6,129,988 | |||

| Consideration transferred |

(4,550,000 | ) | ||

|

|

|

|||

| Excess of fair value of assets acquired |

$ | 1,579,988 | ||

|

|

|

Pro Forma Adjustments and Assumptions

| (1) | Represents adjustment to record elimination of net assets not acquired by Synalloy. |

| (2) | Represents the estimated fair value adjustment to the carrying value of Color Resource’s property, plant and equipment in purchase accounting. |

| (3) | Represents additional borrowings provided by a ten-year term note at consummation of the CRI acquisition. |

| (4) | Represents adjustment to eliminate interest expense recorded by Color Resources. |

| (5) | Represents interest expense incurred on additional borrowings provided by a term note obtained in the amount of $4,033,250 and an increase in the company’s line of credit of $516,750, based on the company’s borrowing rates at the time of the CRI acquisition. |

| (6) | Represents adjustment to Color Resource’s depreciation expense based on the fair value adjustments using estimated useful lives of property plant, and equipment following the straight-line method of depreciation for financial reporting purposes. |

| (7) | Represents adjustment of income tax expense based upon Color Resource’s addition to the consolidated Synalloy tax provision calculation. |

S-14

| (8) | Represents adjustment to record the acquisition of Color Resource’s building and property. |

| (9) | Represents elimination of Color Resource’ historical members’ equity (deficit) account balances in purchase accounting. |

| (10) | Represents impact on net income (loss) as a result of pro forma adjustments recognized. |

Reclassifications

Certain of Color Resource’s amounts for the six months ended June 30, 2013 and 2012 and for the year ended December 31, 2012 have been reclassified to conform to Synalloy’s presentation in the accompanying pro forma condensed combined consolidated statements of operations. These reclassifications had no material effect on previously reported results of operations or redeemable members’ equity (deficit).

S-15

| Common stock we are offering |

2,000,000 shares of common stock, par value $1.00 per share. |

| Common stock to be outstanding after this offering |

8,382,800 shares (8,682,800 shares if the underwriters exercise in full their option to purchase additional shares). |

| NASDAQ Global Market symbol |

SYNL |

| Use of proceeds |

We estimate that the net proceeds from this offering will be approximately $29,492,500, after deducting underwriting discounts and commissions and other estimated expenses (or approximately $33,957,625 if the underwriters exercise their over-allotment option in full). We intend to use the net proceeds from this offering to invest approximately $3,500,000 in new equipment for the CRI Facility, invest approximately $2,000,000 in new equipment for our fabrication facilities and to pay down the senior indebtedness outstanding under our line of credit that we have through the loan agreement. In the future, we may make additional borrowings under the line of credit, subject to the terms of the line of credit and the loan agreement, including the borrowing base. See “Use of Proceeds.” |

| Risk factors |

An investment in our common stock involves certain risks. You should carefully consider the risks described under “Risk Factors” beginning on page S-19 of this prospectus supplement, as well as the other information included or incorporated by reference in this prospectus supplement and the accompanying prospectus, before making an investment decision. |

| Conflict of interest |

The company has entered into a First Amended and Restated Loan Agreement, dated August 21, 2012, with Branch Banking and Trust Company, as further amended by a First Amendment to First Amended and Restated Loan Agreement, dated October 22, 2012, and as further amended by a Second Amendment to First Amended and Restated Loan Agreement, dated August 1, 2013 (collectively, the “loan agreement”). Because Branch Banking and Trust Company, an affiliate of BB&T Securities, LLC, is the lender under the loan agreement and will receive more than 5% of the net proceeds of this offering due to the repayment of borrowings under the loan agreement, such underwriter is deemed to have a conflict of interest within the meaning of Rule 5121 of the Financial Industry Regulatory Authority (“FINRA”). Accordingly, this offering will be conducted in accordance with FINRA Rule 5121, which requires, among other things, that a “qualified independent underwriter” has participated in the preparation of, and has exercised the usual standards of “due diligence” with respect to, the registration statement, this prospectus supplement and the accompanying prospectus. Sterne Agee has agreed to act as qualified independent underwriter for this offering and to undertake the legal responsibilities and liabilities of an |

S-16

| underwriter under the Securities Act of 1933, as amended (the “Securities Act”), specifically including those inherent in Section 11 of the Securities Act. Sterne Agee will not receive any additional fees for serving as qualified independent underwriter in connection with this offering. We have agreed to indemnify Sterne Agee against liabilities incurred in connection with acting as a qualified independent underwriter, including liabilities under the Securities Act. Pursuant to FINRA Rule 5121, BB&T Securities, LLC will not confirm any sales to any account over which they exercise discretionary authority without the specific written approval of the account holder. See “Use of Proceeds” and “Underwriting” for additional information. |

The number of shares of common stock to be outstanding after the offering is based on 6,382,800 shares of common stock outstanding as of August 31, 2013 and excludes (i) 300,000 shares issuable pursuant to the exercise in full of the underwriters’ over-allotment option, (ii) 170,256 shares of common stock issuable upon exercise of outstanding stock options as of August 31, 2013, with a weighted average exercise price of $11.95 per share, and (iii) 19,672 shares of common stock issuable upon vesting of outstanding restricted stock awards as of August 31, 2013.

Except as otherwise indicated, all information in this prospectus supplement assumes no exercise by the underwriters of this over-allotment option.

S-17

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

We make certain forward-looking statements in this prospectus supplement, the accompanying prospectus and in the documents incorporated by reference in this prospectus supplement that are based upon our current expectations and projections about current events. You should not rely on forward-looking statements in this prospectus supplement, the accompanying prospectus or the documents incorporated by reference. We intend these forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, and we are including this statement for purposes of these safe harbor provisions. You can identify these statements from our use of the words “may,” “will,” “should,” “could,” “would,” “plan,” “seek,” “continue,” “potential,” “estimate,” “project,” “believe,” “intend,” “anticipate,” “expect,” “target” and similar expressions. Examples of forward-looking statements include, but are not limited to, estimates with respect to the financial condition, expected or anticipated revenue, results of operations and business of the company, developments relating to our industries, customers and suppliers and market conditions and regulatory developments that are subject to various factors which could cause actual results to differ materially from these estimates. These factors include, but are not limited to: adverse economic conditions and the impact on us and our suppliers and customers; the impact of competitive products and pricing; product demand and acceptance risks; raw material and other increased costs; raw materials availability; employee relations; ability to maintain workforce by hiring trained employees; customer delays or difficulties in the production of products; new fracking regulations; a prolonged decrease or fluctuations in nickel or oil prices; unforeseen delays in completing the integration of Palmer and CRI or planned capital improvements; risks associated with mergers, acquisitions, dispositions and other expansion activities; financial stability of our customers; environmental issues; unavailability of debt financing on acceptable terms and exposure to increased market interest rate risk; inability to comply with covenants and ratios required by our debt financing arrangements; and loss of consumer or investor confidence.

You should also consider carefully the statements under “Risk Factors” and other sections of this prospectus supplement, the accompanying prospectus and the documents we incorporate by reference, which address additional facts that could cause our actual results to differ from those set forth in the forward-looking statements. We caution investors not to place significant reliance on the forward-looking statements contained in this prospectus supplement, the accompanying prospectus and the documents we incorporate by reference.

Because of these and other uncertainties, our actual future results, performance or achievements, or industry results, may be materially different from the results contemplated by these forward-looking statements. In addition, our past results of operations do not necessarily indicate our future results. Our forward-looking statements speak only as of the date they were made. We do not intend to update these forward-looking statements, even though our situation may change in the future, unless we are obligated to do so under the federal securities laws. We qualify all of our forward-looking statements by these cautionary statements.

S-18

An investment in our common stock involves certain risks. This prospectus supplement and the accompanying prospectus do not describe all of those risks. Additional risks we are not presently aware of or that we currently believe are immaterial may also impair our business operations. Our business could be harmed by any of these risks. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment. Before investing in any shares of our common stock, you should carefully consider the following risk factors, in addition to the other information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus. There may be other risks that a prospective investor should consider that are relevant to such investor’s own particular circumstances or generally.

Risks Related to Our Business

The cyclical nature of the industries in which our customers operate causes demand for our products to be cyclical, creating uncertainty regarding future profitability.

Various changes in general economic conditions affect the industries in which our customers operate. These changes include decreases in the rate of consumption or use of our customers’ products due to economic downturns. Other factors causing fluctuation in our customers’ positions are changes in market demand, capital spending, lower overall pricing due to domestic and international overcapacity, lower priced imports, currency fluctuations, and increases in use or decreases in prices of substitute materials. As a result of these factors, our profitability has been and may in the future be subject to significant fluctuation.

Domestic competition could force lower product pricing and may have an adverse effect on our revenues and profitability.

From time-to-time, intense competition and excess manufacturing capacity in the commodity stainless steel industry have resulted in reduced selling prices, excluding raw material surcharges, for many of our stainless steel products sold by Synalloy Metals. In order to maintain market share, we would have to lower our prices to match the competition. These factors have had and may have an adverse impact on our revenues, operating results and financial condition and may continue to do so in the future.

Our business, financial condition and results of operations could be adversely affected by an increased level of imported products.

Our business is susceptible to the import of products from other countries, particularly steel products. Import levels of various products are affected by, among other things, overall world-wide demand, lower cost of production in other countries, the trade practices of foreign governments, government subsidies to foreign producers and governmentally imposed trade restrictions in the United States. Although imports from certain countries have been curtailed by anti-dumping duties, imported products from other countries at significantly reduced prices have increased in the past seven months. Our average selling prices for commodity pipe of Synalloy Metals decreased by 7% and 15% for the year ended December 29, 2012 and six months ended June 29, 2013, respectively, compared to the respective prior comparable period, reducing our profitability in these periods. Increased imports of certain products, whether illegal dumping or legal imports, could reduce demand for our products in the future and adversely affect our business, financial position, results of operations or cash flows.

Raw material costs relating to Synalloy Metals are subject to volatility, and we may be unable to raise the price of our products to cover all or part of the increased cost of raw materials, which would have an adverse effect on our results of operation and profitability.

Rapid increases in raw material costs may adversely affect our results of operations, mainly for our fabrication and steel tank operations as the entire production and sales model for these operations is based upon producing to order. During the bidding process for our fabrication business, we provide a quote on the project

S-19

based upon current market prices for stainless and carbon steel plate, pipe and fittings. Although we are able to mitigate some of the adverse impact of rising raw material costs, such as passing through surcharges to customers, rapid changes in raw material costs during the period of time from when we bid on the project to when the materials were ordered would reduce our profitability on that project.

Although there historically has been ample availability of raw materials, there continues to be a significant consolidation of stainless steel suppliers throughout the world, which could have an impact on the cost and availability of stainless steel in the future. The ability to implement price increases is dependent on market conditions, economic factors, raw material costs, including surcharges on stainless steel, availability of raw materials, competitive factors, operating costs and other factors, most of which are beyond our control. To the extent that we have quoted prices to customers and accepted customer orders for products prior to purchasing necessary raw materials, or have existing contracts, we may be unable to raise the price of products to cover all or a portion of the increased cost of the raw materials.

Synalloy Specialty Chemicals uses significant quantities of a variety of specialty and commodity chemicals in its manufacturing processes, which are subject to price and availability fluctuations that may have an adverse impact our financial performance.

The raw materials we use are generally available from numerous independent suppliers. However, some of our raw material needs are met by a sole supplier or only a few suppliers. If any supplier that we rely on for raw materials ceases or limits production, we may incur significant additional costs, including capital costs, in order to find alternate, reliable raw material suppliers. We may also experience significant production delays while locating new supply sources, which could result in our failure to timely deliver products to our customers. Purchase prices and availability of these critical raw materials are subject to volatility. Some of the raw materials used by Synalloy Specialty Chemicals are derived from petrochemical-based feedstock, such as crude oil and natural gas, which have been subject to historical periods of rapid and significant movements in price. These fluctuations in price could be aggravated by factors beyond our control such as political instability, and supply and demand factors, including Organization of the Petroleum Exporting Countries (OPEC) production quotas and increased global demand for petroleum-based products. At any given time we may be unable to obtain an adequate supply of these critical raw materials on a timely basis, on price and other terms acceptable, or at all. If suppliers increase the price of critical raw materials, we may not have alternative sources of supply. We selectively pass changes in the prices of raw materials to our customers from time-to-time. However, we cannot always do so, and any limitation on our ability to pass through any price increases could have an adverse effect on our financial performance. Any significant variations in the cost and availability of our specialty and commodity materials may negatively affect our business, financial condition or results of operations, specifically for Synalloy Specialty Chemicals.

We rely on a small number of suppliers for our raw materials and any interruption in our supply chain could affect our operations.

In order to foster stronger business relationships, Synalloy Metals uses only a few raw material suppliers. During the six months ended June 29, 2013, six suppliers furnished approximately 73% of our total dollar purchases of raw materials, with two suppliers providing 23% and 20%, respectively. During the year ended December 29, 2012, four suppliers furnished approximately 79% of our total dollar purchases of raw materials, with two suppliers providing 34% and 30%, respectively. However, these raw materials are available from a number of sources, and the company anticipates no difficulties in fulfilling its raw materials requirements for Synalloy Metals. Raw materials used by Synalloy Specialty Chemicals are generally available from numerous independent suppliers and approximately 52% and 50% of total purchases were made from our top eight suppliers during the year ended December 29, 2012 and six months ended June 29, 2013, respectively. Although some raw material needs are met by a single supplier or only a few suppliers, the company anticipates no difficulties in fulfilling its raw material requirements for Synalloy Specialty Chemicals. While the company believes that raw materials for both segments are readily available from numerous sources, the loss of one or

S-20

more key suppliers in either segment, or any other material change in our current supply channels, could have an adverse effect on the company’s ability to meet the demand for its products, which could impact our operations, revenues and financial results.

A substantial portion of our overall sales is dependent upon a limited number of customers, and the loss of one or more of such customers would have a material adverse effect on our business, results of operation and profitability.

The products of Synalloy Specialty Chemicals are sold to various industries nationwide. However, that segment has one domestic customer that accounted for approximately 34% of the segment’s revenues in the first six months of 2013, 28% in 2012 and 24% in each of 2011 and 2010, respectively. This customer is a large global company, and its purchases are derived from several different business units that operate independently of each other. Even so, the loss of this customer would have a material adverse effect on the revenues of Synalloy Specialty Chemicals and the company.

Synalloy Metals has one domestic customer that accounted for approximately 11% of the segment’s revenues in the first six months of 2013. A different domestic customer accounted for 10% and 11% of the segment’s revenues in 2011 and 2010, respectively. No customer accounted for more than 10% of the segment’s revenues for 2012. The loss of these customers’ revenues would have a material adverse effect on both Synalloy Metals and the company. Palmer, which is a part of Synalloy Metals, sells much of its products to the oil and gas industry. Any change in this industry, or any change in this industry’s demand for Palmer’s products would have a material adverse effect on the profits of Synalloy Metals and the company.

Our operating results are sensitive to the availability and cost of energy and freight, which are important in the manufacture and transport of our products.

Our operating costs increase when energy or freight costs rise. During periods of increasing energy and freight costs, we might not be able to fully recover our operating cost increases through price increases without reducing demand for our products. In addition, we are dependent on third party freight carriers to transport many of our products, all of which are dependent on fuel to transport our products. The prices for and availability of electricity, natural gas, oil, diesel fuel and other energy resources are subject to volatile market conditions. These market conditions often are affected by political and economic factors beyond our control. Disruptions in the supply of energy resources could temporarily impair the ability to manufacture products for customers and may result in the decline of freight carrier capacity in our geographic markets, or make freight carriers unavailable. Further, increases in energy or freight costs that cannot be passed on to customers, or changes in costs relative to energy and freight costs paid by competitors, has adversely affected, and may continue to adversely affect, our profitability.

Oil prices are extremely volatile. A substantial or extended decline in the price of oil could adversely affect our financial condition and results of operations.

Prices for oil can fluctuate widely. Our Palmer unit’s revenues are highly dependent on our customers adding oil well drilling and pumping locations. Should oil prices decline such that drilling becomes unprofitable for our customers, such customers will likely cap many of their current wells and cease or curtail expansion. This will decrease the demand for our tanks and adversely affect the results of our operations.

Significant changes in nickel prices could have an impact on the sales by Synalloy Metals.

Synalloy Metals uses nickel in a number of its products. Nickel prices are currently at a relatively low level, which reduces our manufacturing costs for certain products. When nickel prices increase, many of our customers increase their orders in an attempt to avoid future price increases, resulting in increased sales for Synalloy Metals. Conversely, when nickel prices decrease, many of our customers wait to place orders in an attempt to

S-21

take advantage of subsequent price decreases, resulting in reduced sales for Synalloy Metals. On average, Synalloy Metals turns its inventory of commodity pipe every four months, but the nickel surcharge on sales of commodity pipe is established on a weekly basis. The difference, if any, between the price of nickel on the date of purchase of the raw material and the price, as established by the surcharge, on the date of sale has the potential to create an inventory profit or loss. If the price of nickel steadily increases over time, as it did from 2005 to 2007, Synalloy Metals is the beneficiary of the increase in nickel price in the form of inventory gains. Conversely, if the price of nickel steadily decreases over time, as it has from 2009 to 2013, Synalloy Metals suffers inventory losses. As a result of decreasing nickel prices, we incurred inventory losses of $4,645,000 and $1,389,000 for the year ended December 29, 2012 and six months ended June 29, 2013, respectively. Nickel prices were essentially flat from June 30, 2013 to August 31, 2013. We will incur additional inventory losses in the future if nickel prices decrease. Any material changes in the cost of nickel could impact our sales and result in fluctuations in the profits for Synalloy Metals.

We encounter significant competition in all areas of our businesses and may be unable to compete effectively, which could result in reduced profitability and loss of market share.

We actively compete with companies producing the same or similar products and, in some instances, with companies producing different products designed for the same uses. We encounter competition from both domestic and foreign sources in price, delivery, service, performance, product innovation and product recognition and quality, depending on the product involved. For some of our products, our competitors are larger and have greater financial resources than we do. As a result, these competitors may be better able to withstand a change in conditions within the industries in which we operate, a change in the prices of raw materials or a change in the economy as a whole. Our competitors can be expected to continue to develop and introduce new and enhanced products and more efficient production capabilities, which could cause a decline in market acceptance of our products. Current and future consolidation among our competitors and customers also may cause a loss of market share as well as put downward pressure on pricing. Our competitors could cause a reduction in the prices for some of our products as a result of intensified price competition. Competitive pressures can also result in the loss of major customers. If we cannot compete successfully, our business, financial condition and profitability could be adversely affected.

Our lengthy sales cycle for Synalloy Specialty Chemicals makes it difficult to predict quarterly revenue levels and operating results.

Purchasing the products of Synalloy Specialty Chemicals is a major commitment on the part of our customers. Before a potential customer determines to purchase products from Synalloy Specialty Chemicals, the company must produce test product material so that the potential customer is satisfied that we can manufacture a product to their specifications. The production of such test materials is a time-consuming process. Accordingly, the sales process for products in Synalloy Specialty Chemicals is a lengthy process that requires a considerable investment of time and resources on our part. As a result, the timing of our revenues is difficult to predict, and the delay of an order could cause our quarterly revenues to fall below our expectations and those of the public market analysts and investors.

A significant portion of our sales results from competitive bidding, which is a long and unpredictable process.

In both of our business segments, many of our sales efforts are based on competitive bidding situations with existing and potential customers in which we must fix a price early in the process. This is often a slow and lengthy process that requires us to spend considerable time and resources. Moreover, it is an unpredictable process and we are not always successful in our bidding. The unpredictability of the competitive bidding process makes it difficult to predict our quarterly revenues with any degree of certainty. In the event we do not accurately predict our costs on a project, we will not realize our profit expectations and may in fact incur a loss on that particular project. Many factors which are out of our control may adversely affect our profit on a project.

S-22

Our operations expose us to the risk of material environmental, health and safety liabilities and obligations, which could have a material adverse effect on our financial condition, results of operations or cash flows.

We are subject to numerous federal, state and local environmental protection and health and safety laws governing, among other things:

| • | the generation, use, storage, treatment, transportation, disposal and management of hazardous substances and wastes; |

| • | emissions or discharges of pollutants or other substances into the environment; |

| • | investigation and remediation of, and damages resulting from, releases of hazardous substances; and |

| • | the health and safety of our employees. |

Under certain environmental laws, we can be held strictly liable for hazardous substance contamination of any real property we have ever owned, operated or used as a disposal site. We are also required to maintain various environmental permits and licenses, many of which require periodic modification and renewal. Our operations entail the risk of violations of those laws and regulations, and we cannot assure you that we have been or will be at all times in compliance with all of these requirements. In addition, these requirements and their enforcement may become more stringent in the future.